- United States

- /

- IT

- /

- NasdaqGS:SHOP

Shopify (SHOP): Evaluating Valuation After Q3 Growth and New Estee Lauder Partnership

Reviewed by Simply Wall St

Shopify (SHOP) is drawing attention after delivering strong third-quarter results, with revenue up sharply year-over-year. The company also provided guidance for continued double-digit growth in the upcoming quarter, reinforcing optimism among investors.

See our latest analysis for Shopify.

Shopify's share price has been on a wild ride, rallying over 41% year-to-date and boasting a 1-year total shareholder return of nearly 75% as momentum builds from robust revenue growth and new enterprise partnerships such as the recent alliance with The Estee Lauder Companies. The latest pullback, though sharp in the past week, comes after a period of substantial gains and does not overshadow Shopify's impressive long-term track record, including a stunning 286% total return over three years.

If you're curious to see what other high-potential tech names are making moves, you can check out the full list with our curated See the full list for free..

With so much momentum in revenue, new partnerships, and an impressive long-term return, the key question becomes whether Shopify is undervalued at current levels or if markets have already priced in the company's future growth potential.

Most Popular Narrative: 8.1% Undervalued

Shopify’s latest fair value is pegged at $165.87, which is $13.46 above the last close of $152.41. This highlights a narrative-driven optimism backed by robust operational catalysts and high forward expectations.

Shopify is expanding rapidly in international markets, with 42% YoY GMV growth internationally (especially in Europe, but also in Asia Pacific). As digital commerce adoption increases globally, this drives a larger addressable market and will support outperformance in revenue growth and GMV.

How does a tech name justify such a premium? The factors underpinning this valuation are bold growth projections and an earnings path that only industry disruptors typically enjoy. Think profit multiples suitable for a select few. Ready to explore the assumptions powering this aggressive stance? The answers lie in the numbers behind the fair value.

Result: Fair Value of $165.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from e-commerce giants and rising regulatory scrutiny could challenge Shopify's growth trajectory and test its ability to sustain high margins.

Find out about the key risks to this Shopify narrative.

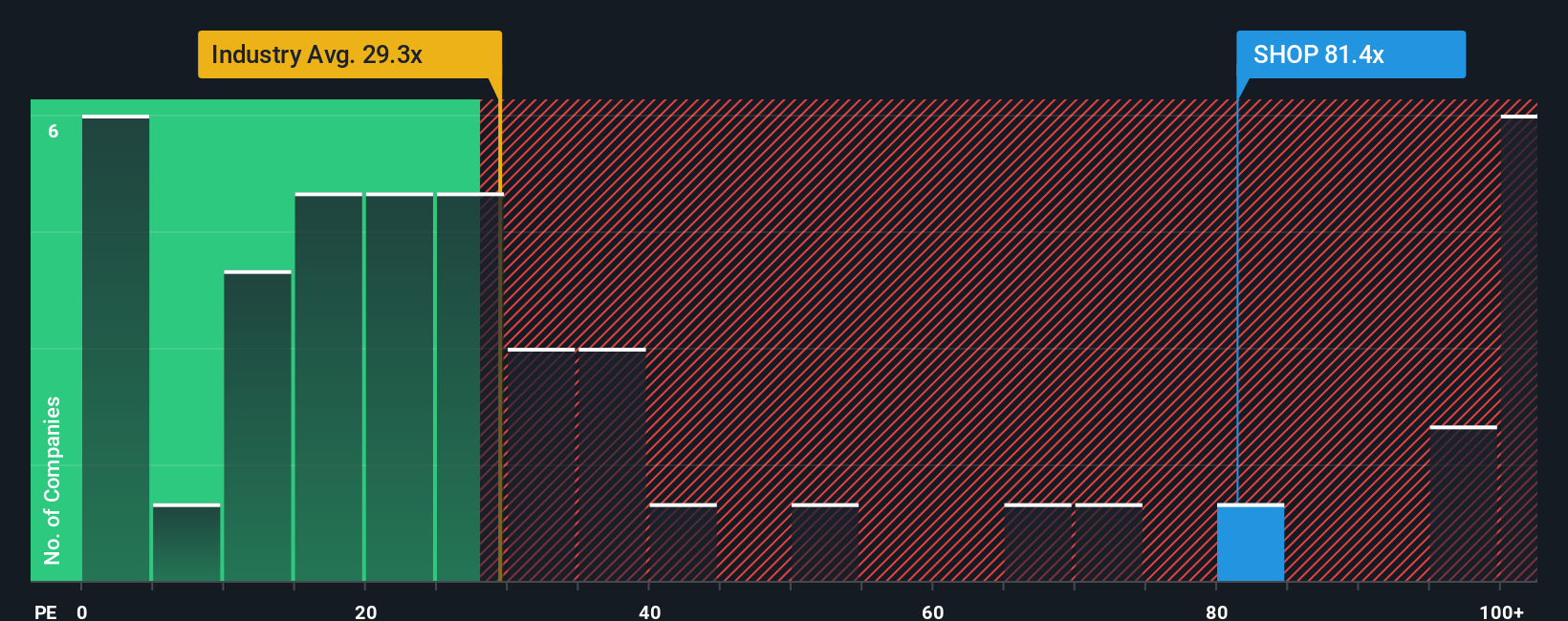

Another View: What Multiples Say

While the narrative-driven and analyst consensus view points to Shopify being undervalued, the picture changes when you look at valuation multiples. Shopify trades at a price-to-earnings ratio of 111.4x, which is much higher than the US IT industry average of 31.1x, the peer average of 40.6x, and nearly double the fair ratio of 52.2x. This sizable gap means investors are paying a significant premium for growth, leaving less margin for error if expectations slip. Does this premium represent justified optimism, or is it a risk that investors should watch carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shopify Narrative

If you'd rather rely on your own insight or dig deeper into the figures, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your financial future and unlock new opportunities today. Jump on these specialized stock searches before the next big story breaks.

- Spot dividend opportunities with yields above 3% by scanning these 16 dividend stocks with yields > 3%, helping you build a portfolio that works harder for you.

- Uncover the future of medicine, where AI meets healthcare progress, through these 32 healthcare AI stocks for unique growth prospects.

- Break into rapidly growing niches by checking out these 3589 penny stocks with strong financials and find hidden gems flying under most investors’ radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives