- United States

- /

- IT

- /

- NasdaqGM:MDB

How Investors May Respond To MongoDB (MDB) Naming Chirantan Desai CEO and Raising Revenue Guidance

Reviewed by Sasha Jovanovic

- MongoDB announced the appointment of Chirantan "CJ" Desai as President and CEO, effective November 10, 2025, succeeding longtime leader Dev Ittycheria, who will remain on the Board and serve as an advisor during the transition.

- Alongside this leadership change, MongoDB raised its third quarter fiscal 2026 revenue and earnings guidance, highlighting ongoing momentum in its Atlas cloud platform.

- We'll now examine how this executive transition and revenue guidance upgrade could reshape MongoDB's investment narrative, especially given Desai's cloud expertise.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MongoDB Investment Narrative Recap

To be a MongoDB shareholder, you need confidence in the company's ability to outpace competitors in the cloud database market, especially through continued Atlas adoption. The appointment of CJ Desai as CEO and strong preliminary Q3 results are positive indications, yet the main near-term catalyst remains Atlas’s growth, while intensifying competition from cloud-native rivals continues to pose a significant risk. As of now, the leadership change is not expected to materially shift these immediate drivers or headwinds.

The raised Q3 fiscal 2026 revenue and earnings guidance stands out as most relevant, reinforcing the importance of Atlas to MongoDB’s near-term outlook. Higher-than-expected Atlas-driven results bolster the growth narrative, but do not mitigate competitive pricing and margin pressure, which remain key investor concerns.

However, investors should be aware that as Atlas grows, competitive pressures from lower-cost cloud-native alternatives could raise new profitability concerns...

Read the full narrative on MongoDB (it's free!)

MongoDB's outlook projects $3.5 billion in revenue and $5.0 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 16.8% and an earnings improvement of $83.6 million from current earnings of $-78.6 million.

Uncover how MongoDB's forecasts yield a $353.37 fair value, in line with its current price.

Exploring Other Perspectives

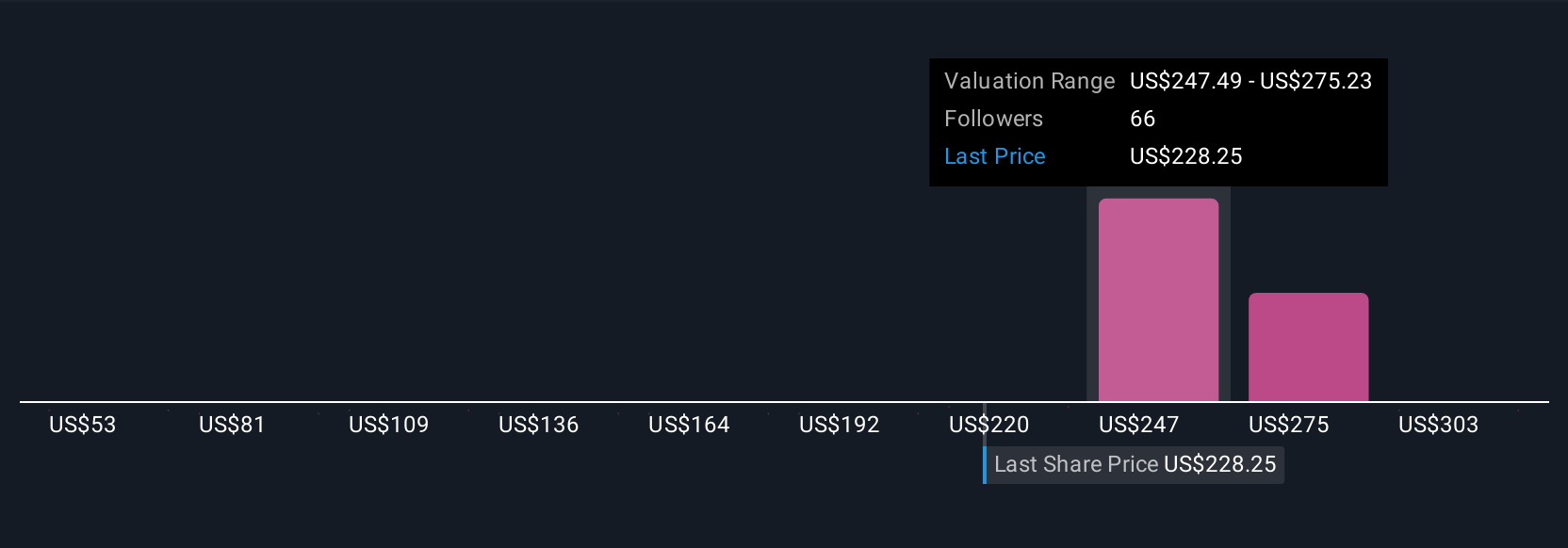

Simply Wall St Community members provided 11 fair value estimates for MongoDB, ranging from US$130.20 to US$394.78 per share. As investors weigh these diverse viewpoints, margin pressure from cloud-native competition remains crucial for performance and warrants closer attention.

Explore 11 other fair value estimates on MongoDB - why the stock might be worth as much as 9% more than the current price!

Build Your Own MongoDB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MongoDB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MongoDB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MongoDB's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives