Stock Analysis

- United States

- /

- Software

- /

- NasdaqCM:MARA

The 5.5% return this week takes Marathon Digital Holdings' (NASDAQ:MARA) shareholders five-year gains to 651%

The last three months have been tough on Marathon Digital Holdings, Inc. (NASDAQ:MARA) shareholders, who have seen the share price decline a rather worrying 34%. But that doesn't undermine the fantastic longer term performance (measured over five years). In that time, the share price has soared some 651% higher! So it might be that some shareholders are taking profits after good performance. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 54% decline over the last three years: that's a long time to wait for profits. Anyone who held for that rewarding ride would probably be keen to talk about it.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Marathon Digital Holdings

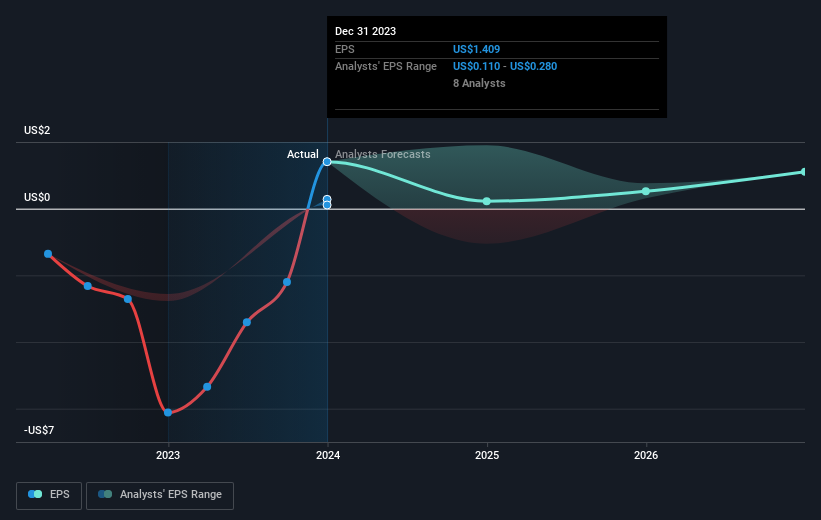

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Marathon Digital Holdings moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Marathon Digital Holdings' earnings, revenue and cash flow.

A Different Perspective

It's good to see that Marathon Digital Holdings has rewarded shareholders with a total shareholder return of 183% in the last twelve months. That gain is better than the annual TSR over five years, which is 50%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Marathon Digital Holdings has 4 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Marathon Digital Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MARA

Marathon Digital Holdings

Marathon Digital Holdings, Inc. operates as a digital asset technology company that mines digital assets with a focus on the bitcoin ecosystem in United States.

Excellent balance sheet and good value.