- United States

- /

- IT

- /

- NasdaqGS:KC

Kingsoft Cloud (NasdaqGS:KC): Assessing Valuation Following Rising AI and E-Commerce Momentum

Reviewed by Simply Wall St

Kingsoft Cloud Holdings (NasdaqGS:KC) is catching the eye of investors after recent discussion around its strong revenue growth and important foothold in areas like artificial intelligence, e-commerce, and intelligent mobility. This spotlight comes as the company continues to face profitability hurdles.

See our latest analysis for Kingsoft Cloud Holdings.

Kingsoft Cloud’s share price has pulled back sharply over the past month, but zooming out, the momentum is still undeniable. Despite short-term volatility, it delivered a staggering 385% total shareholder return over the past year and remains well ahead of its levels from just a few years ago. This signals that investors are increasingly optimistic about its role in high-growth tech sectors.

If you’re keen to see which other innovative tech names could follow in Kingsoft Cloud’s footsteps, check out the latest movers with our See the full list for free.

Yet with a soaring one-year return and analysts still seeing nearly 50% upside, the question remains: is Kingsoft Cloud trading at a discount to its true potential, or is the market already pricing in its next chapter of growth?

Most Popular Narrative: 29.5% Undervalued

Compared to the most widely followed narrative, Kingsoft Cloud's last close of $12.61 sits noticeably below the narrative's fair value of $17.88. This gap reflects bold expectations for transformative AI-driven growth and improved recurring revenue streams.

Ongoing advances in AI and generative AI adoption across multiple sectors are rapidly increasing demand for intelligent computing and scalable cloud services, driving strong revenue growth, evidenced by AI-related gross billings up 120%+ YoY and forming 45% of public cloud revenue, indicating the addressable market and future top-line expansion remain underappreciated.

The narrative points to massive AI adoption, ecosystem partnerships, and the promise of much fatter profit margins ahead. Want to find out which financial assumptions power this sky-high valuation? Don’t miss the numbers and tensions setting up the story. Read the full narrative.

Result: Fair Value of $17.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures from rising infrastructure costs or the loss of a major ecosystem client could quickly undermine the bullish narrative laid out by analysts.

Find out about the key risks to this Kingsoft Cloud Holdings narrative.

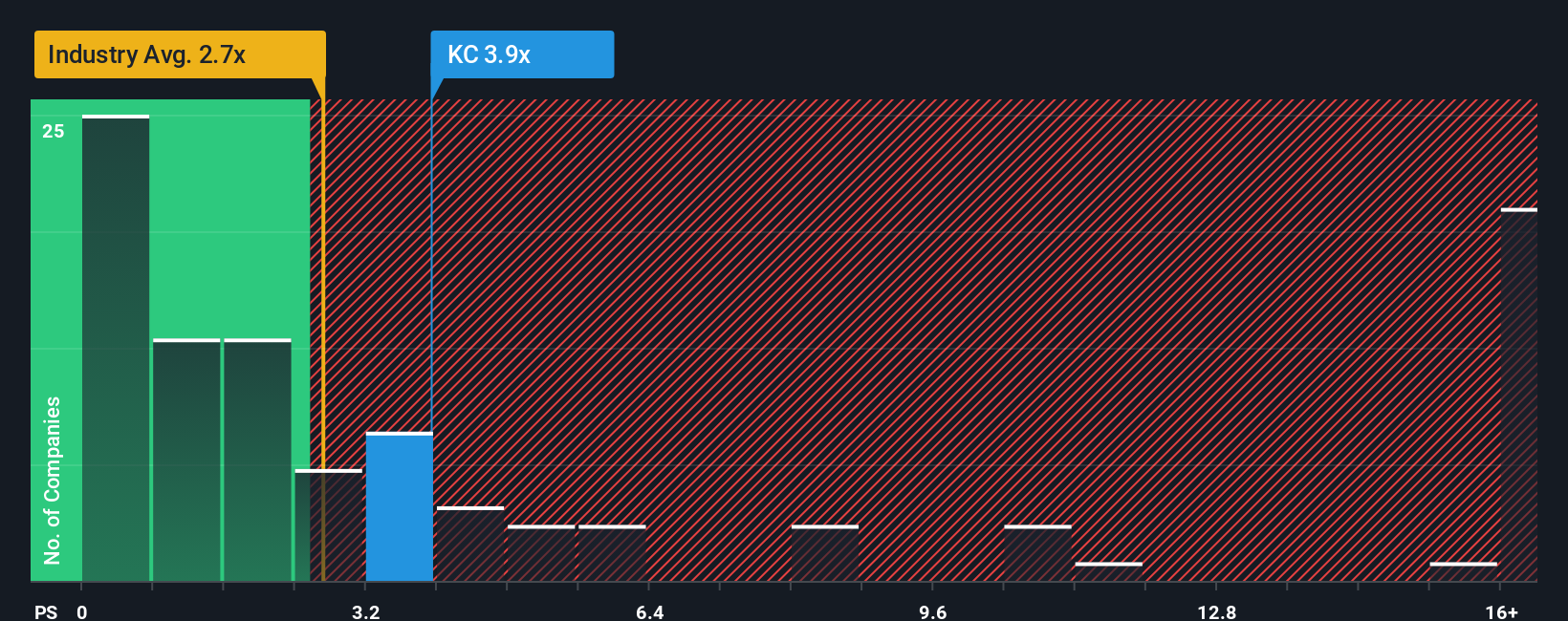

Another View: Sizing Up with Sales Ratios

Looking at Kingsoft Cloud Holdings through the lens of its sales ratio presents a distinct perspective. The company’s ratio stands at 3.2x, which is above both the US IT industry average of 2.8x and its fair ratio of 2.9x. This suggests the market might be pricing in considerable future growth, or perhaps overestimating potential. Could this mean risk is lurking for value-focused investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kingsoft Cloud Holdings Narrative

Feel empowered to dig into the data yourself and present your own take. Building a personalized outlook on Kingsoft Cloud can take just a few minutes, and you’re always free to do it your way with Do it your way.

A great starting point for your Kingsoft Cloud Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why stop at just one opportunity? Step ahead of the crowd and pinpoint your next winning stock by checking out these hand-picked lists, built for smart decision makers.

- Get in early on the digital revolution and capitalize on fresh market trends by reviewing these 80 cryptocurrency and blockchain stocks, which is powering advancements in blockchain and payment innovation.

- Unlock steady income and build a portfolio designed for resilience by targeting these 17 dividend stocks with yields > 3%, offering attractive yields above 3%.

- Seize potential in emerging market leaders with these 27 AI penny stocks, a selection featuring companies at the forefront of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft Cloud Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KC

Kingsoft Cloud Holdings

Provides cloud services to businesses and organizations primarily in China.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives