Stock Analysis

- United States

- /

- Software

- /

- NYSE:DV

Exploring Grid Dynamics Holdings And Two High Growth Tech Stocks

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 1.4%, but it is up 21% over the past year with earnings forecast to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks such as Grid Dynamics Holdings can be crucial for investors looking to capitalize on robust earnings potential and market resilience.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Super Micro Computer | 20.62% | 27.13% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

| Ascendis Pharma | 39.87% | 68.71% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 248 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Grid Dynamics Holdings (NasdaqCM:GDYN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grid Dynamics Holdings, Inc. provides technology consulting, platform and product engineering, and analytics services globally and has a market cap of approximately $1.03 billion.

Operations: Grid Dynamics Holdings, Inc. generates revenue primarily from its computer services segment, which accounted for $318.34 million. The company's operations span North America, Europe, and other international markets.

Grid Dynamics Holdings has demonstrated significant growth potential, with a forecasted annual revenue increase of 14%, surpassing the US market's average. Their innovative AI-powered Data Observability Starter Kit enhances data quality across diverse platforms, crucial for data-driven decision-making. Despite a net loss of $0.82 million in Q2 2024, their R&D expenses contribute to long-term growth, with earnings expected to grow 105.85% annually. The company’s forward-looking strategy includes robust product offerings and seamless integration capabilities, supporting enterprise-scale clients effectively.

- Click here to discover the nuances of Grid Dynamics Holdings with our detailed analytical health report.

Explore historical data to track Grid Dynamics Holdings' performance over time in our Past section.

Savara (NasdaqGS:SVRA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Savara Inc. is a clinical-stage biopharmaceutical company specializing in rare respiratory diseases with a market cap of $692.97 million.

Operations: Savara Inc. focuses on developing therapies for rare respiratory diseases. The company is currently in the clinical stage and does not yet generate revenue from product sales.

Savara's revenue is forecasted to grow at an impressive 66.5% per year, significantly outpacing the US market's average of 8.7%. Despite reporting a net loss of $22.24 million in Q2 2024, the company's earnings are expected to increase by 55.67% annually, with profitability anticipated within three years. Their recent Phase 3 IMPALA-2 clinical trial results for molgramostim showed statistically significant improvements and durability of effect, bolstering future growth prospects in the biotech sector.

- Dive into the specifics of Savara here with our thorough health report.

Gain insights into Savara's historical performance by reviewing our past performance report.

DoubleVerify Holdings (NYSE:DV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DoubleVerify Holdings, Inc. offers a software platform for digital media measurement and data analytics in the United States and internationally, with a market cap of $3.29 billion.

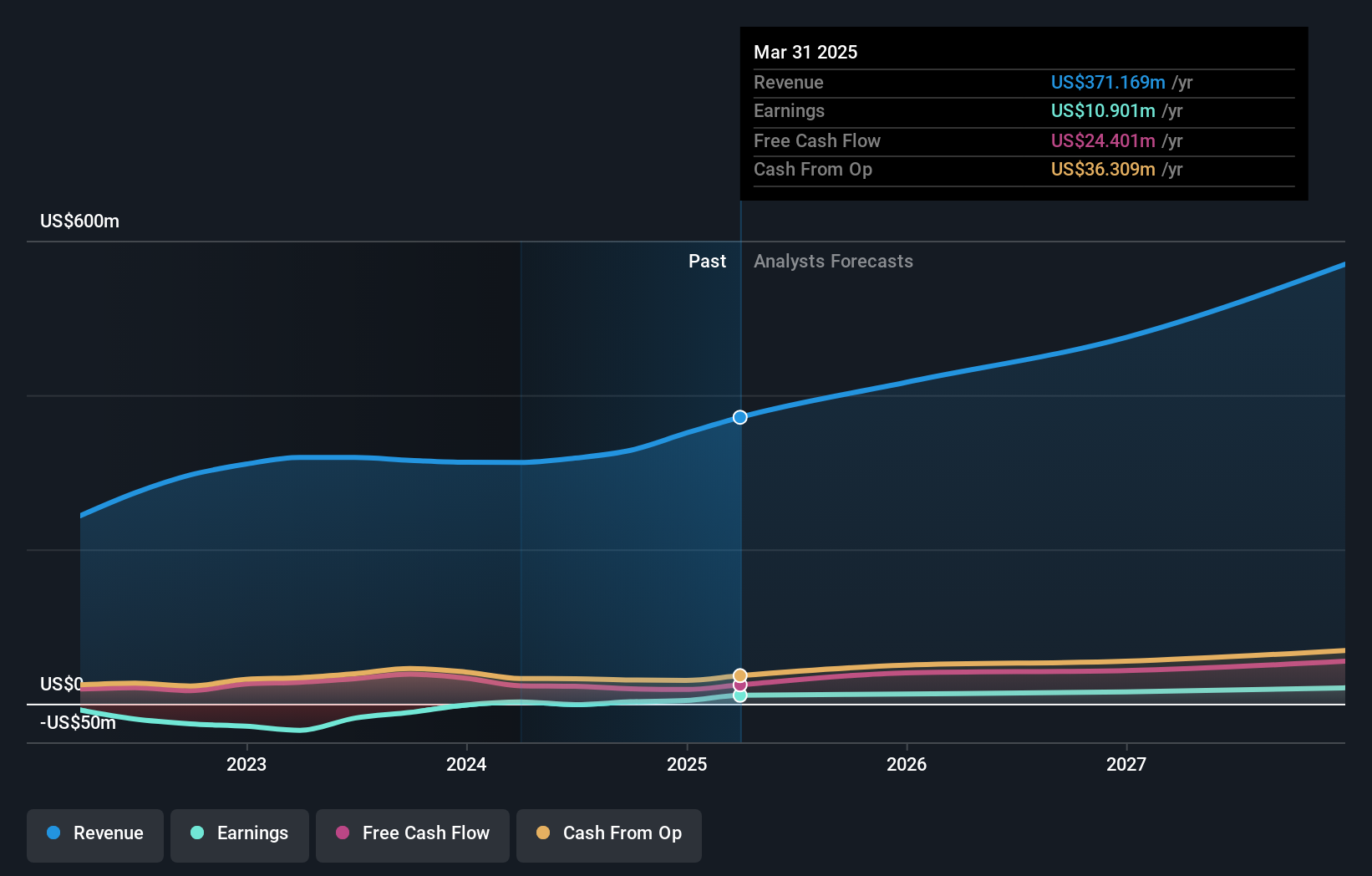

Operations: DoubleVerify Holdings generates revenue primarily from its data processing services, amounting to $612.88 million. The company focuses on providing digital media measurement and analytics solutions across various markets.

DoubleVerify Holdings’ earnings are expected to grow at 23.5% annually, outpacing the US market's average of 15%. The company's revenue is forecasted to increase by 15.3% per year, with recent Q2 sales reaching $155.89 million, up from $133.74 million a year ago. Notably, DoubleVerify has invested significantly in R&D to enhance its AI-driven ad verification solutions, with expenses contributing to their innovative offerings like DV Authentic Marketplace and partnerships with firms like Taboola and Pinterest for brand safety measures.

Taking Advantage

- Navigate through the entire inventory of 248 US High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides a software platform for digital media measurement, and data analytics in the United States and internationally.