- United States

- /

- IT

- /

- NasdaqGM:GDS

Will Analyst Optimism on GDS Holdings’ (GDS) Expansion Shift Perceptions of Its Long-Term Strategy?

Reviewed by Sasha Jovanovic

- GDS Holdings Limited has announced it will release its third quarter 2025 unaudited financial results on November 19, 2025, after the Hong Kong market closes and before the U.S. market opens, with management hosting an earnings call that same day to discuss performance and strategy.

- Recent analyst upgrades and optimistic outlooks reflect increasing confidence in GDS Holdings’ growth prospects as it expands its data center operations in China and Southeast Asia.

- With new analyst coverage highlighting optimism about GDS Holdings’ regional expansion, we'll assess how this shapes the company’s investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

GDS Holdings Investment Narrative Recap

To be a shareholder in GDS Holdings, you need to believe in the company’s ability to leverage its scale and landbank in China, capitalize on AI and cloud demand, and manage aggressive expansion into Southeast Asia, all while handling high debt and capital requirements. The latest earnings date confirmation is unlikely to materially impact the main short-term catalyst, which remains the normalization of demand and fulfillment of large AI-driven orders, or the ongoing risk of margin pressure from falling average service revenue per square meter.

Among recent developments, the coverage initiated by Macquarie with an “Outperform” rating stands out as directly relevant. This has reinforced positive sentiment as GDS continues to grow its data center footprint in China and Southeast Asia. New analyst attention in this context underscores how critical regional expansion could be for supporting top-line growth, especially as management prepares to discuss strategy on the upcoming call.

By contrast, investors should not overlook the continued risk surrounding customer concentration and what could happen if major clients...

Read the full narrative on GDS Holdings (it's free!)

GDS Holdings' outlook anticipates CN¥16.2 billion in revenue and CN¥734.2 million in earnings by 2028. This is based on 14.1% annual revenue growth and an increase in earnings of approximately CN¥457 million from the current CN¥277.2 million.

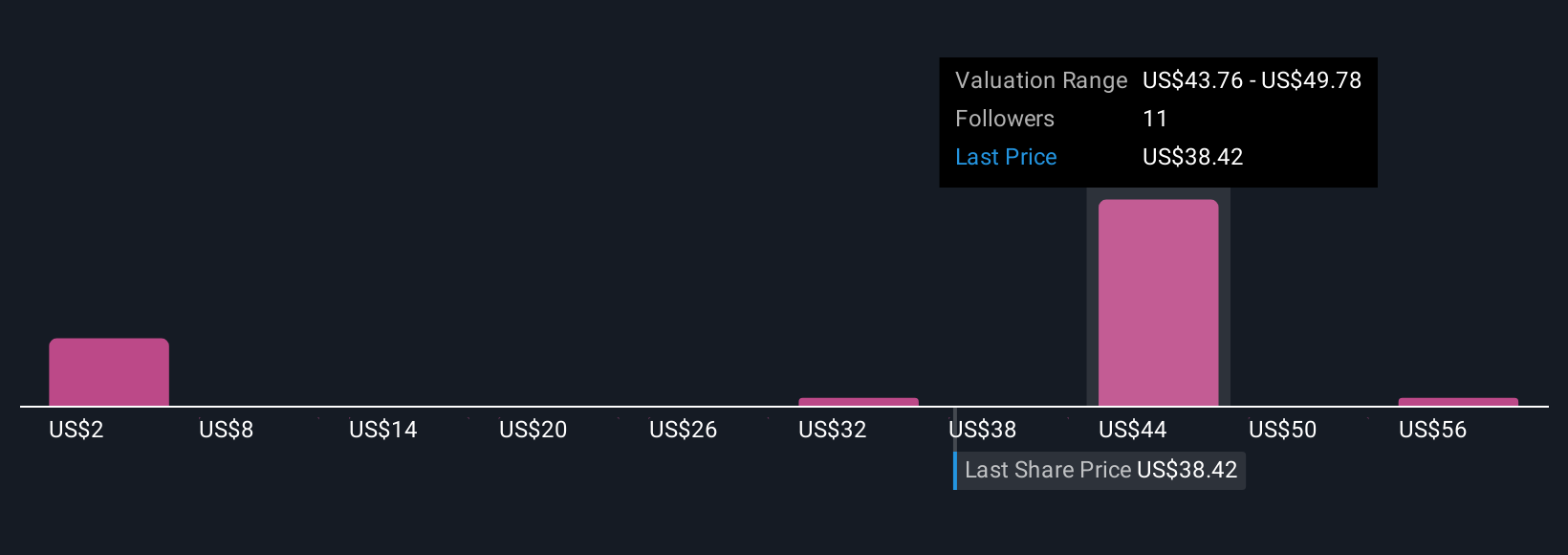

Uncover how GDS Holdings' forecasts yield a $47.44 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from CN¥5.80 to CN¥61.83 per share, revealing wide variation in outlooks. Keep in mind, persistent declines in average service revenue per square meter could put pressure on both revenue and margins, which may influence long-term performance across these different projections.

Explore 4 other fair value estimates on GDS Holdings - why the stock might be worth as much as 88% more than the current price!

Build Your Own GDS Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GDS Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GDS Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GDS Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GDS

GDS Holdings

Develops and operates data centers in the People's Republic of China.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives