Stock Analysis

- United States

- /

- Software

- /

- NasdaqCM:BTBT

Strong week for Bit Digital (NASDAQ:BTBT) shareholders doesn't alleviate pain of three-year loss

It's nice to see the Bit Digital, Inc. (NASDAQ:BTBT) share price up 16% in a week. But that is meagre solace in the face of the shocking decline over three years. In that time the share price has melted like a snowball in the desert, down 83%. So it sure is nice to see a bit of an improvement. Of course the real question is whether the business can sustain a turnaround. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the last three years has been tough for Bit Digital shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Bit Digital

Bit Digital wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Bit Digital's revenue dropped 24% per year. That's definitely a weaker result than most pre-profit companies report. And as you might expect the share price has been weak too, dropping at a rate of 22% per year. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

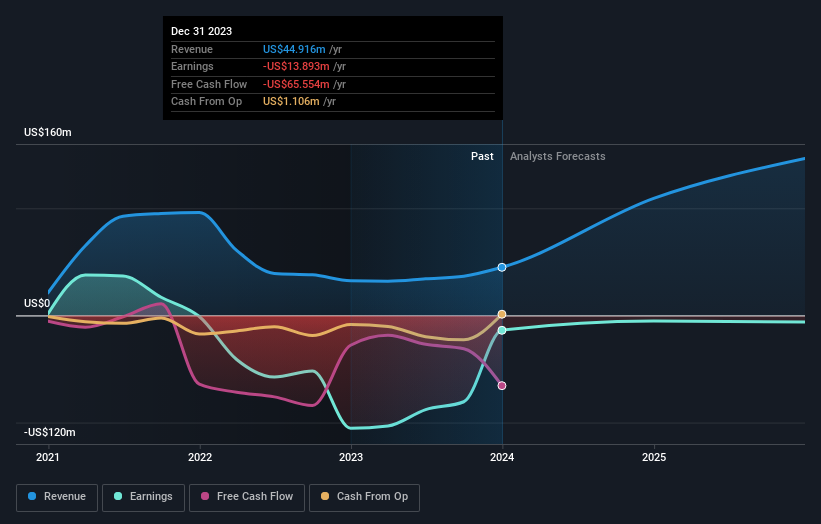

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Bit Digital's financial health with this free report on its balance sheet.

A Different Perspective

Bit Digital provided a TSR of 17% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 11% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Bit Digital (of which 1 is potentially serious!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Bit Digital is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BTBT

Bit Digital

Bit Digital, Inc., together with its subsidiaries, engages in the bitcoin mining business.

Adequate balance sheet and fair value.