- United States

- /

- IT

- /

- NasdaqGS:AKAM

Akamai (AKAM) Surges 11.5% After Launching Edge AI Platform With NVIDIA Inference Cloud Partnership

Reviewed by Sasha Jovanovic

- Akamai Technologies recently reported strong third-quarter 2025 results, highlighting robust growth in cloud infrastructure, security products, and the launch of Akamai Inference Cloud in partnership with NVIDIA, which enables real-time edge AI processing.

- The introduction of Akamai Inference Cloud signals a move toward bringing AI inference closer to users and devices and reflects accelerating customer demand for distributed, low-latency AI solutions across multiple industries.

- We’ll look at how the rollout of Akamai Inference Cloud could reshape the company’s investment narrative around AI-driven edge computing.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Akamai Technologies Investment Narrative Recap

To invest in Akamai Technologies, you need to believe the company’s future is tied to surging demand for secure, scalable edge computing and AI-driven cloud services. The Q3 2025 earnings beat, robust cloud infrastructure revenue, and raised full-year guidance reinforce the view that cloud and security growth are now the most important short-term catalysts. However, the continued drag from the declining delivery (CDN) business and potential for margin pressures due to high capital requirements remain key risks, with the recent results not fully mitigating these concerns.

The most relevant announcement is the launch of Akamai Inference Cloud, which expands the company’s AI capabilities to the network edge by leveraging NVIDIA technology. This showcases Akamai’s ambition to address low-latency AI demand, supporting the narrative that ramping edge and AI-driven workloads are a core catalyst, even as traditional content delivery segments slow.

But risks remain, especially if large new compute contracts do not scale as expected, and investors should be aware that...

Read the full narrative on Akamai Technologies (it's free!)

Akamai Technologies is projected to reach $4.9 billion in revenue and $765.1 million in earnings by 2028. This outlook implies a 6.1% annual revenue growth rate and a $340.5 million increase in earnings from the current level of $424.6 million.

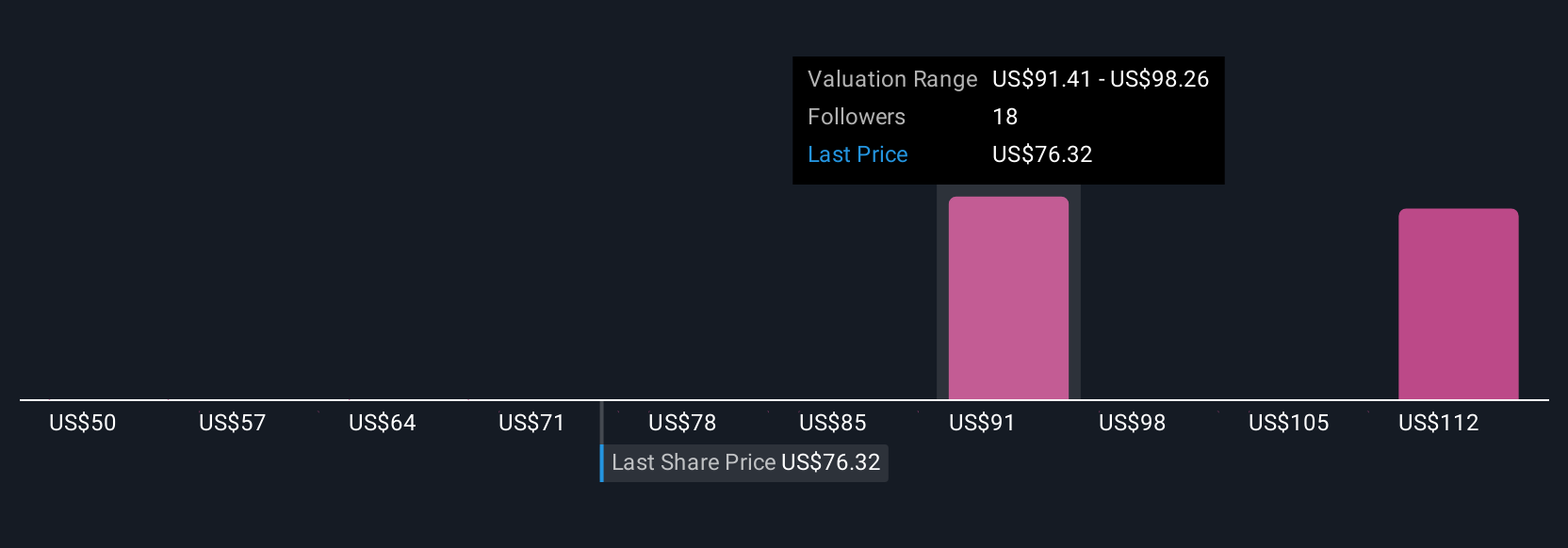

Uncover how Akamai Technologies' forecasts yield a $95.20 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Six individual fair value estimates from the Simply Wall St Community span from US$66 to over US$131, highlighting wide divergence in outlooks. Opinions differ just as sharply on Akamai’s reliance on a handful of large compute contracts, which could have an outsized effect on future earnings volatility.

Explore 6 other fair value estimates on Akamai Technologies - why the stock might be worth 21% less than the current price!

Build Your Own Akamai Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Akamai Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Akamai Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Akamai Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AKAM

Akamai Technologies

Engages in the provision of security, delivery, and cloud computing solutions in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives