- United States

- /

- Semiconductors

- /

- NYSE:Q

Qnity Electronics (NYSE:Q): Assessing Valuation Following Unexplained Share Price Uptick

Reviewed by Simply Wall St

Qnity Electronics (NYSE:Q) shares edged higher by nearly 5% in the last session. Investors are chatting about the move, especially as it comes without an immediately apparent event or announcement from the company.

See our latest analysis for Qnity Electronics.

With the share price up 4.65% in a single day, Qnity Electronics has caught fresh attention even as its year-to-date share price return is a more modest 1.36%. This increase in momentum hints at renewed optimism, although the broader trend suggests investors are watching for something more long-lasting from the company.

If you're weighing what's next for your portfolio, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With Qnity Electronics delivering mixed growth metrics and shares rebounding suddenly, the real question for investors is whether the current price reflects untapped value or if the market has already accounted for all future prospects.

Price-to-Earnings of 25.5x: Is it justified?

Qnity Electronics' price-to-earnings (P/E) ratio stands at 25.5x, which is notably below both its peer average of 46.7x and the broader US Semiconductor industry average of 35.4x. At a last close price of $96.6, this multiple suggests the market is pricing Qnity Electronics’ earnings at a relative discount to competitors.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. In the semiconductor space, where growth prospects and profitability can vary widely, the P/E is a key signal of perceived future performance and risk.

Qnity Electronics’ lower P/E hints that the market may not be fully crediting its recent earnings growth or improved profit margins. The company saw earnings rise by an impressive 32.3% over the last year, significantly outperforming the sector’s 3.3% average. Still, the subdued multiple could reflect market skepticism about whether such growth is sustainable given expectations for declining profits ahead.

Compared to the US Semiconductor industry’s average P/E of 35.4x, Qnity Electronics trades at a substantial discount. This gap could potentially narrow if the company continues to deliver high-quality earnings and improve margins, or it could persist if future growth concerns remain in focus.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 25.5x (UNDERVALUED)

However, declining net income and market skepticism about future growth could quickly dampen the optimism surrounding Qnity Electronics' recent share price rally.

Find out about the key risks to this Qnity Electronics narrative.

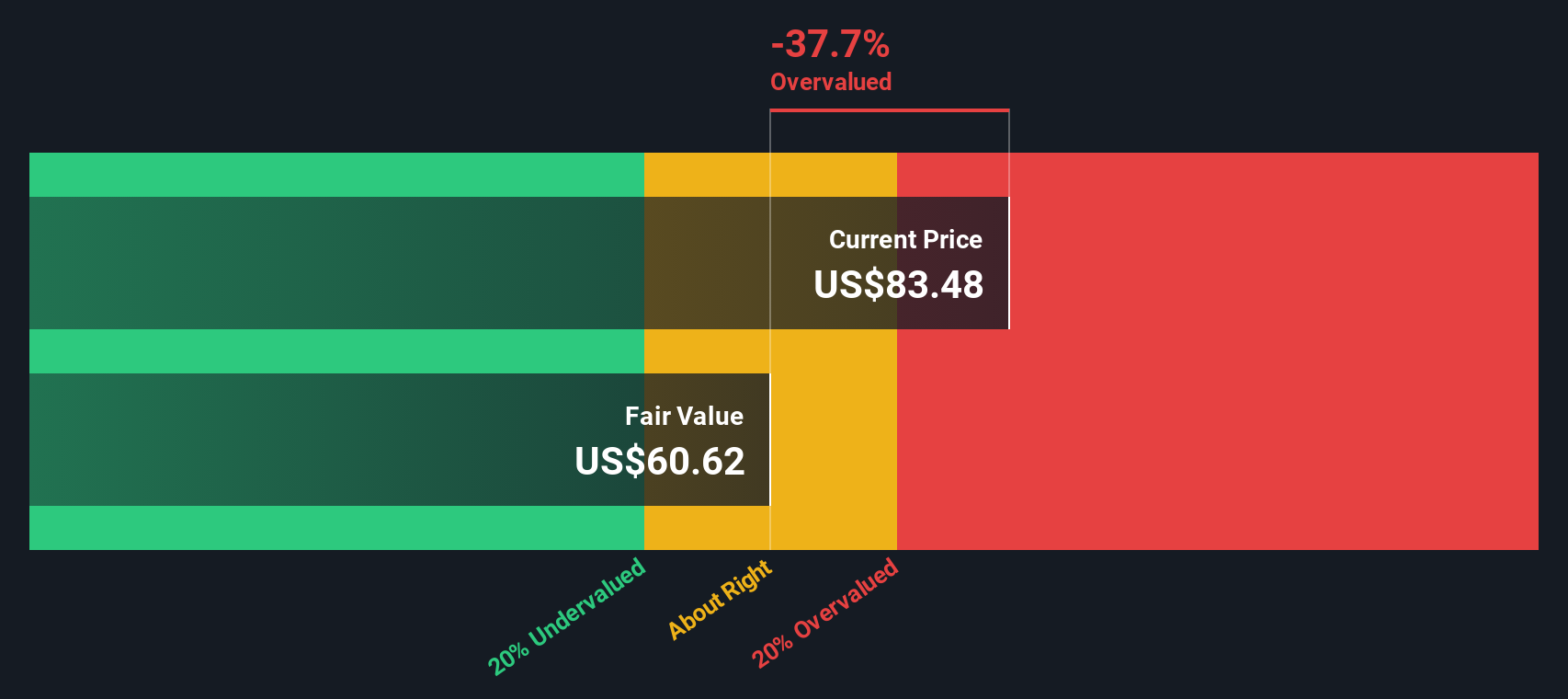

Another View: SWS DCF Model Points to Overvaluation

While Qnity Electronics looks attractively valued on P/E, our SWS DCF model offers a different perspective. According to this discounted cash flow approach, the stock’s current price of $96.6 sits well above the estimated fair value of $60.69, suggesting shares may actually be overvalued right now. Could the market be too optimistic, or is something else driving the premium?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Qnity Electronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Qnity Electronics Narrative

If you see the story differently or would rather dive into the numbers yourself, you have the tools to create your own perspective in just a couple of minutes. Do it your way

A great starting point for your Qnity Electronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a single opportunity slip past you when there are so many other ways to grow your wealth and stay ahead in the market.

- Tap into tech’s explosive potential by checking out these 24 AI penny stocks, which could help define tomorrow’s digital landscape.

- Capture steady income streams and strengthen your portfolio with these 16 dividend stocks with yields > 3%, which offers attractive yields above 3%.

- Ride the wave of innovation by investigating these 82 cryptocurrency and blockchain stocks, which is driving breakthroughs in blockchain and decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qnity Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:Q

Qnity Electronics

Provides materials and solutions to the semiconductor and electronics industries worldwide.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives