- United States

- /

- Semiconductors

- /

- NasdaqGS:VECO

Recent 9.7% pullback isn't enough to hurt long-term Veeco Instruments (NASDAQ:VECO) shareholders, they're still up 212% over 5 years

Veeco Instruments Inc. (NASDAQ:VECO) shareholders might be concerned after seeing the share price drop 27% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 212% higher today. We think it's more important to dwell on the long term returns than the short term returns. Of course, that doesn't necessarily mean it's cheap now.

Although Veeco Instruments has shed US$196m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Veeco Instruments

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

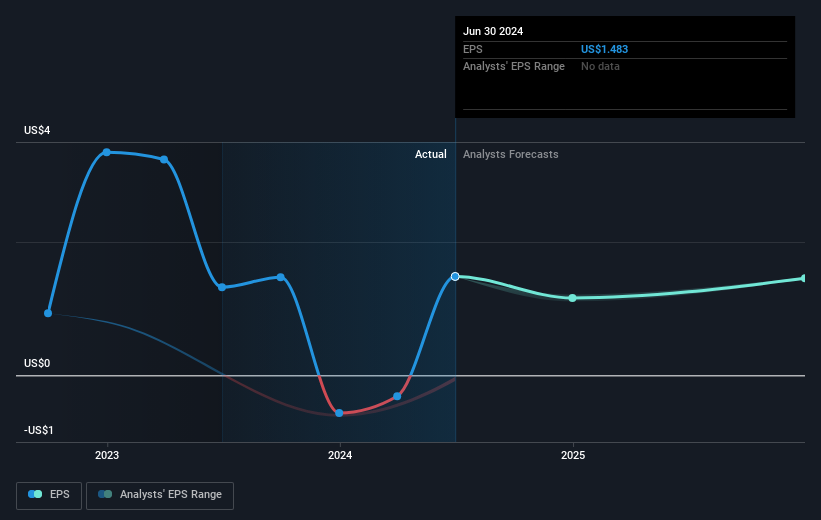

During the last half decade, Veeco Instruments became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Veeco Instruments share price is up 37% in the last three years. Meanwhile, EPS is up 97% per year. This EPS growth is higher than the 11% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Veeco Instruments has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Veeco Instruments' financial health with this free report on its balance sheet.

A Different Perspective

Veeco Instruments shareholders gained a total return of 12% during the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 26% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Veeco Instruments may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VECO

Veeco Instruments

Develops, manufactures, sells, and supports semiconductor and thin film process equipment primarily to make electronic devices in the United States, Europe, the Middle East, and Africa, China, Rest of the Asia-Pacific, and internationally.

Excellent balance sheet with proven track record.