- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Why Texas Instruments (TXN) Is Down 5.8% After Weak Outlook and Restructuring Plans

Reviewed by Sasha Jovanovic

- Earlier this month, Texas Instruments reported third-quarter revenue of US$4.74 billion and net income of US$1.36 billion, but issued a fourth-quarter outlook targeting revenue between US$4.22 billion and US$4.58 billion and earnings per share of US$1.13 to US$1.39, both below analyst expectations and reflecting anticipated near-term weakness.

- Alongside the cautious outlook, Texas Instruments announced further layoffs and manufacturing restructuring, attributing these steps to the retirement of older wafer production lines in a bid to enhance long-term efficiency.

- We will explore how Texas Instruments' ongoing operational restructuring and cautious guidance may impact its longer-term earnings narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Texas Instruments Investment Narrative Recap

To be a shareholder in Texas Instruments, you need to believe in the enduring demand for industrial and automotive semiconductors, powered by ongoing automation and electrification. The recent cautious fourth-quarter guidance suggests near-term softness in key end markets, tempering optimism for a quick rebound, while persistent risks around underutilized manufacturing capacity remain central to the story. For now, the impact to longer-term drivers appears minimal, but short-term sentiment will likely hinge on upcoming trading updates.

The announcement of further layoffs and wafer production line retirements is significant, reflecting Texas Instruments’ commitment to improving manufacturing efficiency. This ongoing operational restructuring aligns closely with the company’s focus on maintaining margins amid uncertain demand, and will be closely watched as TI deploys capital-intensive investments to position for future growth.

In contrast, investors should be aware of lingering risks around capacity investments if demand projections...

Read the full narrative on Texas Instruments (it's free!)

Texas Instruments' outlook anticipates $22.3 billion in revenue and $7.9 billion in earnings by 2028. This implies annual revenue growth of 10.1% and an earnings increase of $2.9 billion from the current $5.0 billion in earnings.

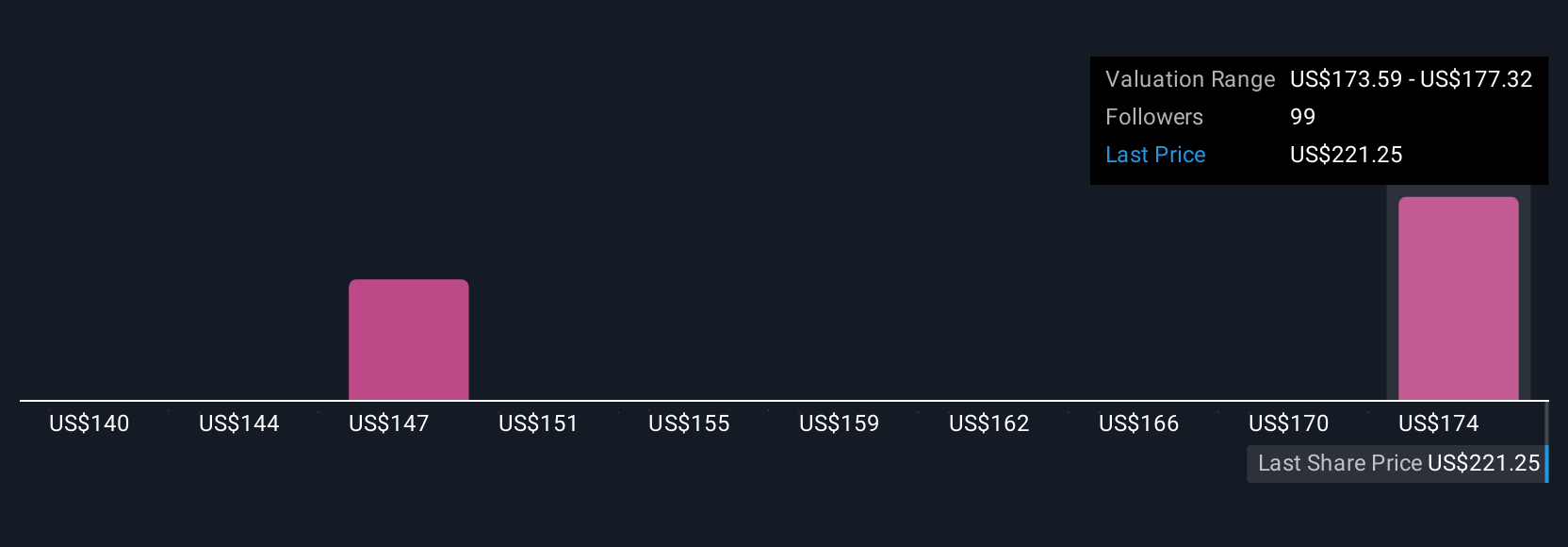

Uncover how Texas Instruments' forecasts yield a $203.06 fair value, a 20% upside to its current price.

Exploring Other Perspectives

While consensus analysts expect steady, moderate growth, some of the most optimistic forecasts prior to this news event projected Texas Instruments’ revenues could reach US$27.9 billion and earnings US$11.7 billion by 2028, underscoring how differing views on industrial and AI-driven demand could reshape expectations going forward. Be open to alternative perspectives as analyst opinions can vary significantly, especially after new developments like these.

Explore 6 other fair value estimates on Texas Instruments - why the stock might be worth as much as 20% more than the current price!

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives