- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

How Investors May Respond To Texas Instruments (TXN) Q3 Results and Share Buyback Completion

Reviewed by Sasha Jovanovic

- Texas Instruments recently reported its third quarter 2025 results, showing sales of US$4.74 billion and net income of US$1.36 billion, along with earnings guidance for the fourth quarter in a range of US$4.22 billion to US$4.58 billion in revenue and earnings per share between US$1.13 and US$1.39.

- An interesting insight is that the company also completed a tranche of its longstanding share buyback program, repurchasing 659,384 shares for US$121.56 million during the quarter, which may influence capital allocation moving forward.

- With earnings growth and new guidance announced, we will assess how this impacts Texas Instruments’ investment narrative and future outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Texas Instruments Investment Narrative Recap

Being a Texas Instruments shareholder is about believing in steady semiconductor growth driven by industrial automation and automotive demand, and disciplined capital deployment. The latest quarterly earnings and renewed buyback activity, while positive, do not materially shift the primary near-term catalyst, an eventual automotive recovery, nor do they alter the key risk of underutilized new manufacturing capacity if market growth slows.

The company’s third quarter 2025 results, US$4.74 billion in sales and net income of US$1.36 billion, stand out, especially when paired with consistent share repurchases totaling over 50 million shares since 2018. This continuing capital return, though encouraging, occurs against the backdrop of ongoing competitive and pricing pressures in analog and embedded markets that could still limit near-term upside.

However, investors should keep in mind that if new wafer fabs ramp up just as end-market demand weakens, the risk of underutilization and financial strain grows...

Read the full narrative on Texas Instruments (it's free!)

Texas Instruments is forecast to reach $22.3 billion in revenue and $7.9 billion in earnings by 2028. This outlook assumes a 10.1% annual revenue growth rate and a $2.9 billion increase in earnings from the current $5.0 billion.

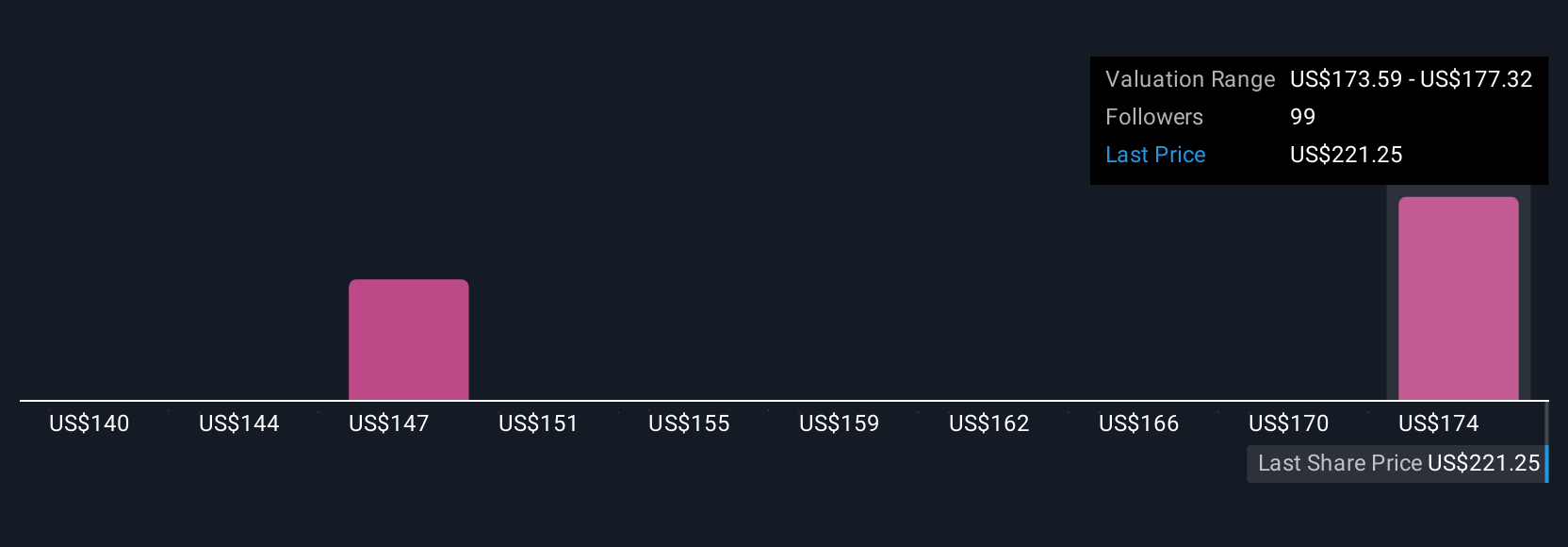

Uncover how Texas Instruments' forecasts yield a $190.31 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Some analysts were forecasting Texas Instruments’ revenue to reach US$27,900 million and earnings to hit US$11,700 million by 2028, banking on explosive AI and auto chip demand. That view is much more optimistic than the consensus, highlighting how opinions range widely. As new data comes out, you may want to explore how these narratives could evolve for yourself.

Explore 6 other fair value estimates on Texas Instruments - why the stock might be worth as much as 18% more than the current price!

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives