- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Is Penguin Solutions’ (PENG) AI Infrastructure Expansion Shifting Its Long-Term Growth Outlook?

Reviewed by Sasha Jovanovic

- Penguin Solutions, Inc. recently announced its participation at Supercomputing 25 (SC25) in St. Louis, where it will showcase breakthrough AI infrastructure technologies and highlight its partnership with SK Telecom supporting a major AI factory in South Korea.

- In addition, Penguin Solutions announced general availability of Oracle Linux on its Stratus ztC Endurance platforms, enabling highly reliable operation of critical enterprise applications with extremely low downtime.

- We will explore how Penguin Solutions’ expanded support for essential enterprise infrastructure may influence its broader investment outlook and growth story.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Penguin Solutions Investment Narrative Recap

The key to being a shareholder in Penguin Solutions lies in believing in the accelerating need for scalable AI and high-performance computing infrastructure, underpinned by growing industry partnerships and continued product innovation. While the company's participation at SC25 and strengthened alliances may reinforce medium-term growth prospects, near-term revenue lumpiness and unpredictable project timing in the Advanced Computing segment remain the biggest risk and are not directly addressed by this news event.

The recent announcement of Oracle Linux support on the Stratus ztC Endurance platforms stands out, letting customers run mission-critical Oracle Database applications with extremely high reliability on a single, fault-tolerant system. This is highly relevant to Penguin’s efforts to boost recurring solution sales and improve the reliability and appeal of its enterprise offerings, aligning with key near-term growth catalysts.

However, in contrast, investors should also keep in mind how ongoing customer concentration and revenue timing risks could still create...

Read the full narrative on Penguin Solutions (it's free!)

Penguin Solutions' outlook anticipates $1.8 billion in revenue and $316.1 million in earnings by 2028. This scenario depends on 10.4% annual revenue growth and a $331 million increase in earnings from the current $-14.9 million.

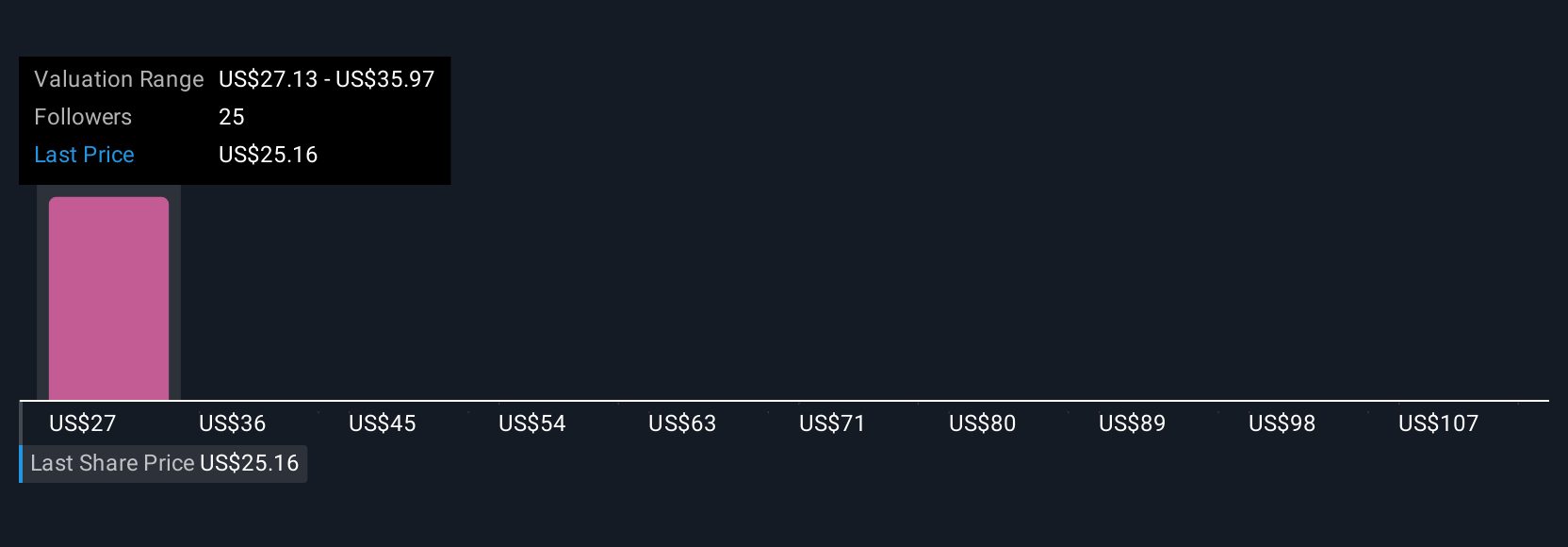

Uncover how Penguin Solutions' forecasts yield a $28.25 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered six fair value estimates for Penguin Solutions, ranging from US$25.80 to US$156.06 per share. With such wide-ranging views, it is important to consider ongoing revenue volatility in the Advanced Computing business when weighing the company’s outlook.

Explore 6 other fair value estimates on Penguin Solutions - why the stock might be worth over 6x more than the current price!

Build Your Own Penguin Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Penguin Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Penguin Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Penguin Solutions' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENG

Penguin Solutions

Designs, builds, deploys and manages enterprise solutions worldwide.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives