- United States

- /

- Semiconductors

- /

- NasdaqGS:PDFS

PDF Solutions (PDFS): Assessing Valuation as Shares Climb 5% Despite Broader Market Weakness

Reviewed by Simply Wall St

See our latest analysis for PDF Solutions.

While PDF Solutions’ recent 5.4% share price gain over the past month points to some rebounding momentum, the bigger picture remains mixed. Despite a robust stretch in the last 90 days, with the share price jumping over 39%, the one-year total shareholder return is still down more than 20%, signaling that longer-term investors have yet to see sustained recovery.

If you’re eyeing what’s moving beyond the headlines, this could be the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

The recent movements in PDF Solutions’ stock price raise an important question: is the current value an attractive entry point for buyers, or are expectations for future growth already reflected in the share price?

Most Popular Narrative: 11.8% Undervalued

With PDF Solutions trading at $26.45, noticeably below the most popular fair value estimate of $30, narrative-driven investors are weighing the potential upside. The fair value outlook sets bold expectations for further gains, underpinned by future revenue expansion and margin growth assumptions.

Accelerated enterprise adoption of PDF's secure, cloud-based supply chain orchestration and analytics solutions, including secureWISE, Sapience Manufacturing Hub, and Exensio, positions the company to capitalize on the industry's growing need for integrated data traceability and resilient manufacturing networks. This supports robust recurring revenue growth and higher earnings stability.

Want to know the secret ingredient pushing this stock’s valuation higher? The backbone of this narrative is ambitious growth projections, and a future profit multiple usually reserved for elite tech firms. Craving the exact numbers and catalysts that drive this bullish outlook? Explore the full story to see what’s fueling this price target.

Result: Fair Value of $30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing heavy spending and heightened customer concentration could pressure margins and introduce volatility. This could potentially challenge the upbeat growth thesis for PDF Solutions.

Find out about the key risks to this PDF Solutions narrative.

Another View: Multiples Show a Premium Price

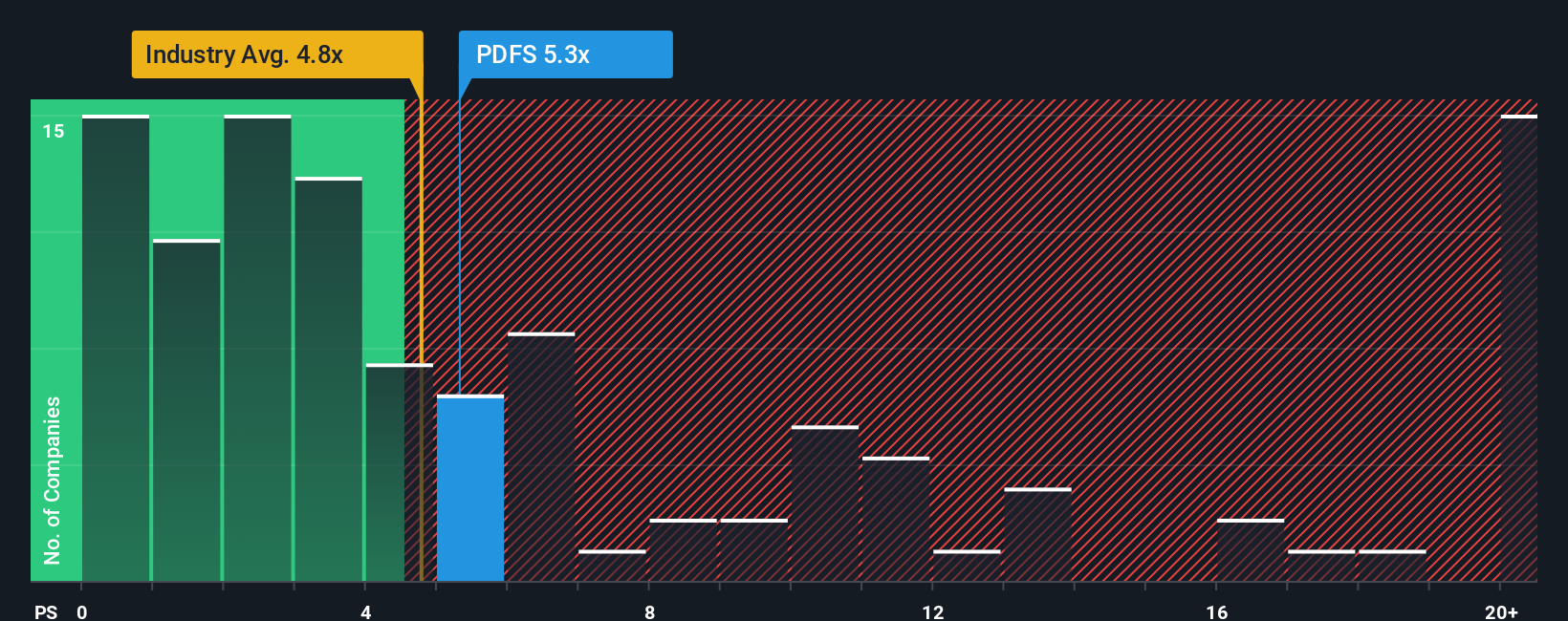

Looking at valuation from another angle, PDF Solutions is trading at a price-to-sales ratio of 5.1x. This is higher than both the US semiconductor industry average of 4.5x and the peer average of 4.4x. Even compared to its fair ratio, estimated at 6.2x, the company's current valuation signals investors are already paying up for future growth. This suggests that expectations may be running high. Does this premium carry opportunity or extra risk if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PDF Solutions Narrative

If you have a different perspective or want to dive deeper into the data, you can craft your own take in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding PDF Solutions.

Looking for more investment ideas?

Staying ahead in today’s market is all about seizing the right opportunities, and Simply Wall Street’s screener puts the smartest investment ideas right at your fingertips. Don’t miss your chance to act on strategies others overlook. Your next winning stock pick could be just a click away.

- Capture tomorrow’s biggest movers with these 3587 penny stocks with strong financials poised for breakout performance and robust financial health.

- Tap into the AI revolution by uncovering these 24 AI penny stocks powering advancements across industries and redefining what’s possible.

- Boost your portfolio’s value by targeting these 874 undervalued stocks based on cash flows primed for strong returns based on the latest cash flow metrics and market insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDFS

PDF Solutions

Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives