- United States

- /

- Semiconductors

- /

- NasdaqGS:MTSI

Getting In Cheap On MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) Is Unlikely

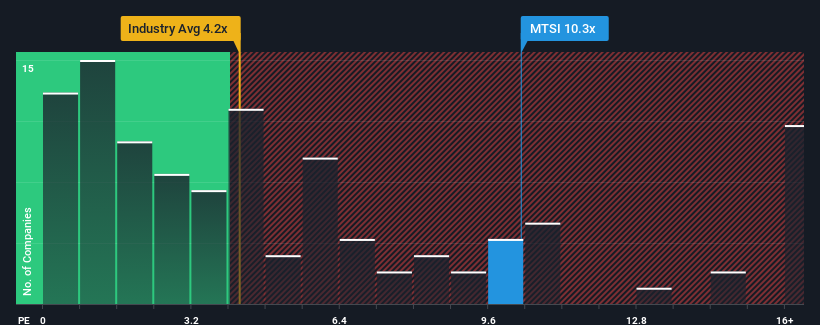

MACOM Technology Solutions Holdings, Inc.'s (NASDAQ:MTSI) price-to-sales (or "P/S") ratio of 10.3x might make it look like a strong sell right now compared to the Semiconductor industry in the United States, where around half of the companies have P/S ratios below 4.2x and even P/S below 1.6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for MACOM Technology Solutions Holdings

What Does MACOM Technology Solutions Holdings' P/S Mean For Shareholders?

MACOM Technology Solutions Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MACOM Technology Solutions Holdings.How Is MACOM Technology Solutions Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as MACOM Technology Solutions Holdings' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.9%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 22% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 9.2% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 23% each year, which is noticeably more attractive.

In light of this, it's alarming that MACOM Technology Solutions Holdings' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On MACOM Technology Solutions Holdings' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for MACOM Technology Solutions Holdings, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for MACOM Technology Solutions Holdings you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MTSI

MACOM Technology Solutions Holdings

Offers analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum.

Flawless balance sheet with high growth potential.