- United States

- /

- Semiconductors

- /

- NasdaqGS:MKSI

Assessing MKS Instruments (MKSI) Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

MKS (MKSI) has drawn attention from investors in recent weeks, thanks to its strong stock performance. Over the past month, shares have jumped 16%, and the past 3 months show a 49% return. This momentum raises questions about what is fueling the company’s growth and whether it can sustain this pace.

See our latest analysis for MKS.

Momentum for MKS has clearly accelerated, with the share price return over the past year driven by both robust quarterly numbers and renewed buying interest among investors. The stock’s strong 1-year total shareholder return of 39.4% and surging short-term price gains suggest optimism is building around its growth prospects.

If you’re watching this rally and wondering what other standouts could be next, broaden your search and discover fast growing stocks with high insider ownership

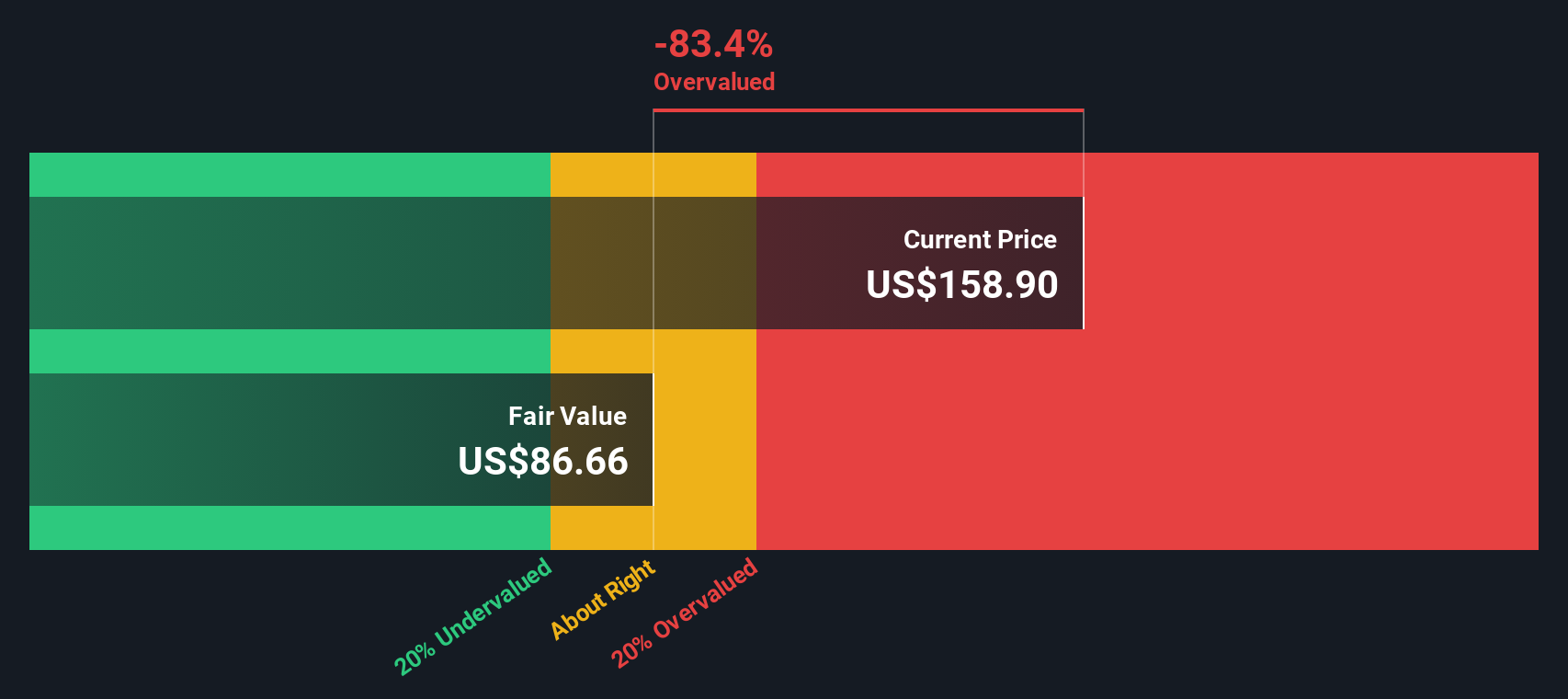

With the stock posting sharp gains, the question is whether MKS remains undervalued based on its fundamentals or if the recent rally means the market has already priced in future growth. Could there still be a buying opportunity here?

Most Popular Narrative: 1.4% Overvalued

With MKS closing at $141.40, the most followed narrative values it at $139.38, just below the market price. This tight gap brings the company’s forward-looking story into sharp focus.

The company's deepening integration of advanced materials and chemistry equipment (including Atotech) positions MKS as a unique provider of both tools and consumables required for the shift to multilayer, high-density AI-related applications. This is enabling cross-selling, leading to superior revenue growth and structural improvements in gross and operating margins.

What’s behind this slight premium in value? There is a bold bet riding on margin expansion and a strategic foothold in next-gen chip manufacturing. The full narrative breaks down which business segments and future profit assumptions are fueling the high expectations. Don’t miss the details that could shape MKS’s next move.

Result: Fair Value of $139.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the outlook is not without risks, such as potential slowdowns in key segments or the possibility that industry growth may fall short of current high expectations.

Find out about the key risks to this MKS narrative.

Another View: Discounted Cash Flow Questions the Upside

While valuation by market multiples suggests MKS might be priced high, our DCF model projects a different story. According to our SWS DCF, MKS trades well above its estimated fair value of $76.96. This could mean investors are taking on significant downside risk if growth expectations are not met. Will market optimism continue, or does this gap signal caution?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MKS Narrative

If you see the story differently or want to dig into the details yourself, it’s quick and easy to craft your own narrative in just minutes. So why not Do it your way?

A great starting point for your MKS research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

There’s no reason to get left behind when other investors are already putting these unique opportunities on their radar. Take action now and set yourself up for smarter moves with curated picks built for today’s market.

- Spot high yields for your portfolio and scan through these 21 dividend stocks with yields > 3% with strong, reliable income potential.

- Capitalize on emerging artificial intelligence by reviewing these 26 AI penny stocks poised to benefit from the next wave of AI breakthroughs and real-world adoption.

- Catch powerful earnings trends early by tracking these 848 undervalued stocks based on cash flows that show major upside based on robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKSI

MKS

Provides foundational technology solutions to semiconductor manufacturing, electronics and packaging, and specialty industrial applications in the United States, China, South Korea, Japan, Taiwan, Singapore, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives