- United States

- /

- Semiconductors

- /

- NasdaqGS:LAES

Will SEALSQ’s (LAES) Expanding Quantum Security Partnerships Reshape Its Competitive Edge Across Industries?

Reviewed by Sasha Jovanovic

- SEALSQ Corp. and its affiliates recently announced a series of partnerships and initiatives, including advancing secure quantum-resilient communications with the Swiss Armed Forces, forming an alliance with BWT Alpine Formula One Team, expanding automotive cybersecurity through subsidiary IC'Alps, and signing a strategic MoU with South Korea's INNOSPACE for secure satellite deployment.

- These collaborations position SEALSQ as an innovator in post-quantum cryptography and secure connectivity, addressing critical cybersecurity needs across space, automotive, and military sectors.

- We'll explore how SEALSQ’s focus on post-quantum security across diverse industries supports its evolving investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is SEALSQ's Investment Narrative?

For anyone considering SEALSQ stock, the bull case has always hinged on the company's ability to lead in post-quantum cryptography and secure connectivity, driven by a string of partnerships and ongoing product rollout. The latest news, especially the expanded collaboration with the Swiss Armed Forces, the Alpine F1 announcement, and the MoU with INNOSPACE, gives further real-world validation of SEALSQ’s relevance in fields like defense, automotive, and satellites. These headline deals could act as catalysts, potentially attracting enterprise customers and fortifying SEALSQ’s pipeline, but it’s still early to call the financial impact material in the short term. Risks remain prominent: the company is unprofitable, recent leadership and board turnover raise execution questions, and the share price has been highly volatile despite impressive returns over the past year. For now, while the news strengthens SEALSQ’s technology story, weathering ongoing losses and market swings remains the biggest test. Yet, as impressive as the story is, the company’s high share price volatility is a risk investors should watch.

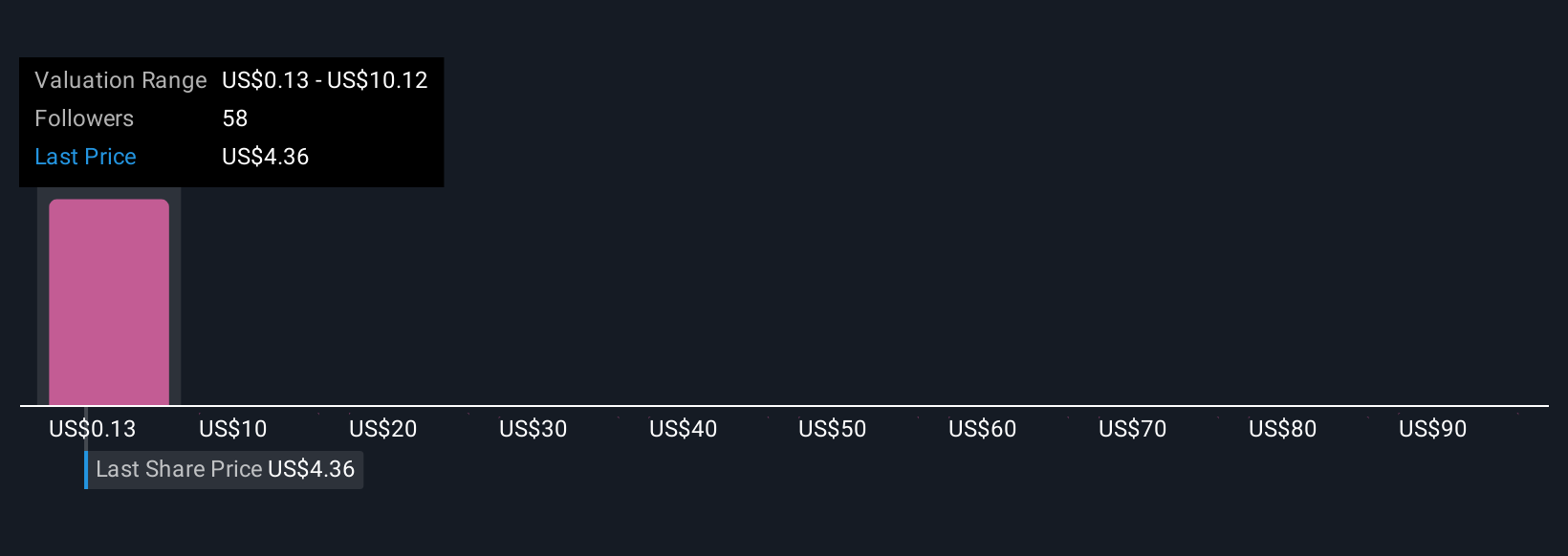

Our comprehensive valuation report raises the possibility that SEALSQ is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 23 other fair value estimates on SEALSQ - why the stock might be a potential multi-bagger!

Build Your Own SEALSQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SEALSQ research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free SEALSQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SEALSQ's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAES

SEALSQ

Designs, develops, and markets semiconductors in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives