- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

KLA (KLAC): How Barclays’ Upgrade and Earnings Beat Shape the Latest Valuation Debate

Reviewed by Simply Wall St

Barclays recently upgraded KLA (KLAC) after the company posted stronger than expected quarterly earnings, with both revenue and earnings per share coming in ahead of estimates. This resilience continues to boost investor confidence.

See our latest analysis for KLA.

KLA’s momentum has been truly impressive this year, with a 30-day share price return of 21.4% and an 87.5% year-to-date gain. This reflects strong buying interest since its recent earnings beat and a string of positive company updates. Over the longer term, the 1-year total shareholder return stands at 80.9%, showing that KLA has delivered for its investors as growth expectations have accelerated.

If you’re intrigued by the strength behind KLA’s run, this could be an ideal time to broaden your search and discover fast growing stocks with high insider ownership

Given the stock’s exceptional run and analyst upgrades, investors are now left to ponder whether KLA is still undervalued at current levels or if the market has fully priced in its future growth prospects.

Most Popular Narrative: 6.2% Undervalued

With KLA last closing at $1,193.37 and the narrative fair value pegged at $1,271.88, analysts see untapped upside from current levels. This gap is driven by a bullish combination of future market trends and operational momentum.

KLA is seeing continued and rising demand for its process control and metrology solutions due to accelerated AI, high-performance compute, and diverse design proliferation at advanced nodes, which is driving a structurally higher process control intensity across both logic and memory fabs; this supports above-industry-average revenue growth and margin expansion as process complexity increases.

Want to know what’s powering that price target? The most popular narrative leans on an aggressive growth outlook, bold margin expansion, and a future profit multiple not seen in many industrial names. Which key analyst assumptions unlock this upside? Read the full story to discover what’s driving the valuation and if you agree with their bet.

Result: Fair Value of $1,271.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in China and potential geopolitical changes could quickly shift market sentiment and pose real risks to this bullish narrative.

Find out about the key risks to this KLA narrative.

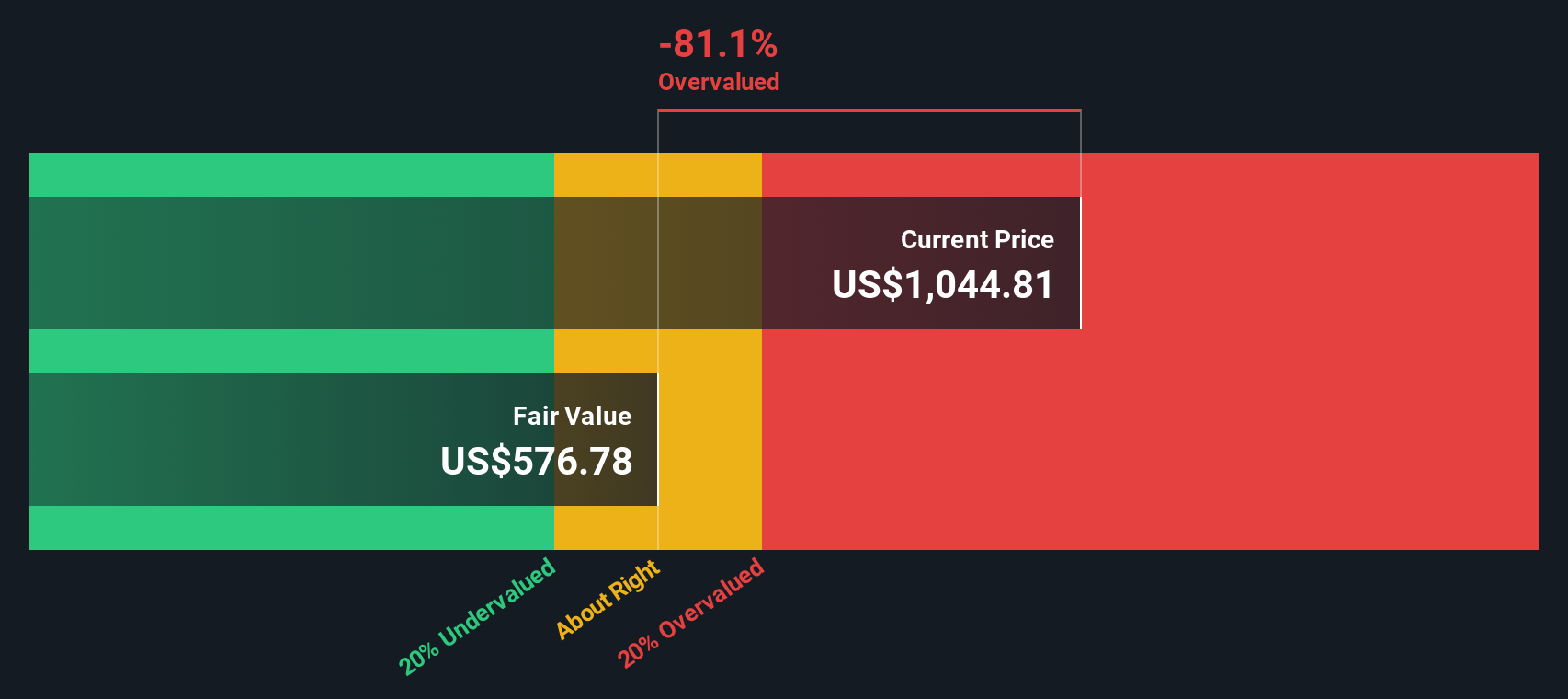

Another View: Our SWS DCF Model Points to Overvaluation

While analysts see KLA as undervalued, our SWS DCF model arrives at a very different conclusion. According to its calculations, KLA is trading well above its estimated fair value of $647.23. This suggests the stock could be overvalued if cash flow assumptions prove to be too optimistic. Where do you land on these competing narratives?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KLA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KLA Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly shape your own view and narrative in just a few minutes with Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KLA.

Looking for more investment ideas?

Skip the wait and check out opportunities catching investors’ attention right now, from future-shaping tech to steady income or the best value picks in the market.

- Target higher returns by handpicking these 872 undervalued stocks based on cash flows that are trading well below their fair value and could be ready for a potential rebound.

- Grow your portfolio’s passive income by adding these 16 dividend stocks with yields > 3% that pay strong, reliable yields above the market average.

- Accelerate your edge in tomorrow's technologies by backing these 28 quantum computing stocks that are harnessing breakthroughs in quantum computing for the next era of innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives