- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

Is KLA-Tencor Corporation's (NASDAQ:KLAC) CEO Salary Justified?

Rick Wallace has been the CEO of KLA-Tencor Corporation (NASDAQ:KLAC) since 2006. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at other big companies. After that, we will consider the growth in the business. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for KLA-Tencor

How Does Rick Wallace's Compensation Compare With Similar Sized Companies?

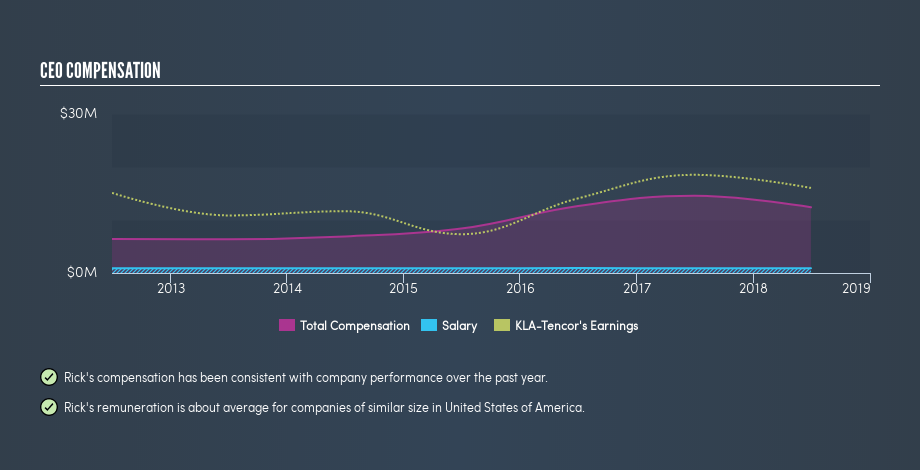

Our data indicates that KLA-Tencor Corporation is worth US$20b, and total annual CEO compensation is US$12m. (This is based on the year to June 2018). We think total compensation is more important but we note that the CEO salary is lower, at US$900k. When we examined a group of companies with market caps over US$8.0b, we found that their median CEO total compensation was US$11m. Once you start looking at very large companies, you need to take a broader range, because there simply aren't that many of them.

So Rick Wallace is paid around the average of the companies we looked at. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance.

You can see, below, how CEO compensation at KLA-Tencor has changed over time.

Is KLA-Tencor Corporation Growing?

Over the last three years KLA-Tencor Corporation has grown its earnings per share (EPS) by an average of 18% per year (using a line of best fit). In the last year, its revenue is up 13%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of growth in a single year. That suggests a healthy and growing business. Shareholders might be interested in this free visualization of analyst forecasts.

Has KLA-Tencor Corporation Been A Good Investment?

I think that the total shareholder return of 77%, over three years, would leave most KLA-Tencor Corporation shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Rick Wallace is paid around the same as most CEOs of large companies.

Few would be critical of the leadership, since returns have been juicy and earnings per share are moving in the right direction. Indeed, many might consider the pay rather modest, given the solid company performance! So you may want to check if insiders are buying KLA-Tencor shares with their own money (free access).

Important note: KLA-Tencor may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:KLAC

KLA

Engages in the design, manufacture, and marketing of process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Undervalued with adequate balance sheet and pays a dividend.