Stock Analysis

- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Enphase Energy (NASDAQ:ENPH) delivers shareholders fantastic 50% CAGR over 5 years, surging 4.8% in the last week alone

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. Don't believe it? Then look at the Enphase Energy, Inc. (NASDAQ:ENPH) share price. It's 650% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. It's even up 4.8% in the last week. But this could be related to the buoyant market which is up about 2.7% in a week. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the stock has added US$690m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Enphase Energy

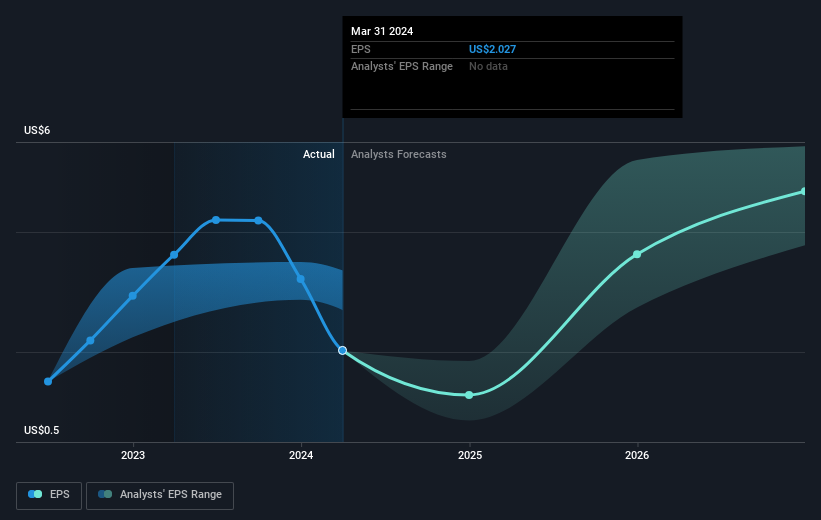

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Enphase Energy moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. In fact, the Enphase Energy stock price is 3.0% lower in the last three years. During the same period, EPS grew by 39% each year. So there seems to be a mismatch between the positive EPS growth and the change in the share price, which is down -1.0% per year.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Enphase Energy shareholders are down 31% for the year, but the market itself is up 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 50%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Enphase Energy better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Enphase Energy .

Enphase Energy is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Enphase Energy is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Flawless balance sheet with high growth potential.