- United States

- /

- Semiconductors

- /

- NasdaqCM:DVLT

Datavault AI (DVLT): Evaluating Valuation After Recent Volatility and Growth Momentum

Reviewed by Simply Wall St

Datavault AI (DVLT) has caught the attention of market watchers recently, as investors note the company’s swing in performance over the past quarter. Shares have fluctuated, which has prompted a closer look at valuation and recent growth trends.

See our latest analysis for Datavault AI.

Although Datavault AI’s share price has cooled off recently, dropping 24.2% over the past month and 29.4% year-to-date, it’s hard to ignore the staggering 229.3% share price return over the last 90 days. However, when viewed over the long term, total shareholder return tells a cautionary tale, with a 1-year decline of 22.6% and near-total losses spanning three and five years. The recent swings suggest that momentum has been building in the short run. Still, investors remain mindful of the rollercoaster ride this stock has delivered over time and the risks that continue to weigh on its valuation.

If short-term moves like these have you thinking bigger, now is the perfect opportunity to see which other fast-moving, high-potential stocks insiders are backing using our fast growing stocks with high insider ownership.

Yet even with huge swings and impressive short-term gains, the central question remains: is Datavault AI truly undervalued at these levels, or is the recent optimism already reflected in the stock price?

Most Popular Narrative: 52% Undervalued

Compared to its last close of $1.44, the most widely followed narrative values Datavault AI at $3.00. This implies there is dramatic upside potential if the optimistic scenario plays out. This narrative presents a notable contrast with recent share price turbulence, and relies on an ambitious plan of rapid sales expansion, new market launches, and large-scale partnerships.

The announcement of multiple proprietary data exchange platforms (International Elements Exchange, NIL Exchange, Political Exchange) launching on compliant, AI-powered infrastructure positions Datavault AI to capitalize on accelerating digital transformation across sectors. This suggests significant future revenue growth as these exchanges monetize new verticals. The company's deepened alliance with IBM, including Platinum Partner status and integration of Watsonx.ai, provides Datavault with scalable AI capabilities and best-in-class cybersecurity. This supports enterprise-grade adoption and efficient scaling, which could drive higher net margins by improving operational leverage and reducing per-unit delivery costs.

Want to know what propels this company’s value far above its current price? Hint: this narrative hinges on ambitious revenue growth assumptions and industry-leading profit margins, all underpinned by transformative partnerships. Discover which bold financial leaps drive this eye-catching target in the full deep-dive.

Result: Fair Value of $3.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, large unrecognized revenues and Datavault AI’s reliance on major partnerships introduce uncertainty, which could quickly challenge even the most optimistic forecasts.

Find out about the key risks to this Datavault AI narrative.

Another View: Multiples Tell a More Cautious Story

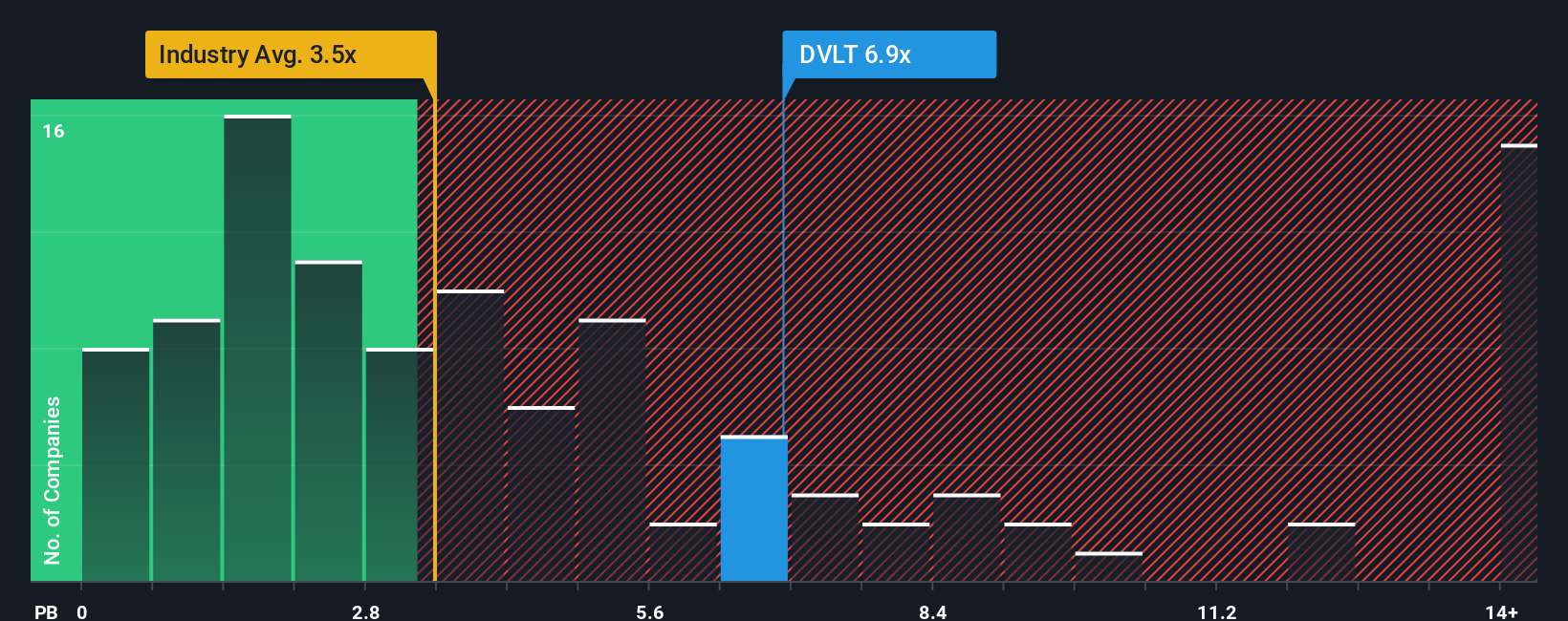

Looking at valuation through the lens of price-to-book, Datavault AI trades at 5.4x, which is notably higher than the US semiconductor industry average of 3.4x. While it is cheaper than its peer average of 10.5x, this elevated ratio signals investors are already pricing in significant future gains, despite limited current revenue and ongoing losses. This premium could suggest hidden upside or increased risk if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datavault AI Narrative

If you want to dig deeper and form your own perspective, you can examine the underlying numbers and craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Datavault AI research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want an edge in today’s fast-changing markets? Don’t settle for ordinary picks; you can uncover stocks with serious potential using these tailored screeners:

- Uncover fresh opportunities poised for future breakthroughs by checking out these 27 quantum computing stocks that are redefining what’s possible in computing.

- Boost your income strategy and seek reliable returns with these 15 dividend stocks with yields > 3% offering consistent, attractive yields above 3%.

- Supercharge your watchlist by zeroing in on these 858 undervalued stocks based on cash flows that experts believe may be trading for less than their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DVLT

Datavault AI

A data sciences technology company, owns and operates data management platforms by supercomputing capabilities in the North America, Asia Pacific, Europe, and internationally.

Moderate risk with limited growth.

Similar Companies

Market Insights

Community Narratives