- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (AMAT): Assessing Valuation as Workforce Cuts Signal Strategic Shift in Semiconductor Industry

Reviewed by Simply Wall St

Applied Materials (AMAT) is making headlines after announcing it will cut about 4% of its global workforce, or roughly 1,400 jobs. The move comes as the company adapts to shifts in automation and digitalization across the semiconductor industry.

See our latest analysis for Applied Materials.

Despite the news of workforce reductions, Applied Materials has maintained strong momentum, with a year-to-date share price return of nearly 39% and a three-year total shareholder return topping 160%. Continued AI-driven demand, better-than-expected results, and strategic investments have supported optimism and signaled that growth potential remains, even as the company navigates market headwinds and changing industry dynamics.

If automation and industry shifts interest you, consider uncovering new possibilities by exploring See the full list for free.

With the stock’s strong recent gains and analysts still divided on near-term expectations, the key question for investors is whether Applied Materials remains undervalued or if the market has already priced in its future growth potential.

Most Popular Narrative: 5.8% Overvalued

Applied Materials' most popular narrative currently estimates a fair value just below the recent share price. This sets up a debate about what exactly is driving analysts to a more cautious stance as momentum remains strong.

Structural growth in AI and high-performance computing is reshaping semiconductor demand, driving heavy investments in advanced chip architectures such as gate-all-around (GAA) transistors, high-bandwidth memory (HBM), and advanced packaging. Applied is set to benefit from these device inflections due to its leadership in materials engineering and strong customer adoption of new process technologies, which are expected to deliver outsized revenue and market share gains as these nodes ramp from 2026 onward.

Want to know the backbone behind this elevated share price? The narrative’s calculation leans heavily on aggressive profit expansion and long-term margin growth. Discover which financial drivers power these projections and how they could shift the valuation landscape for Applied Materials.

Result: Fair Value of $215 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, export restrictions in China and intense global competition could create headwinds. These factors may potentially challenge the bullish outlook for Applied Materials.

Find out about the key risks to this Applied Materials narrative.

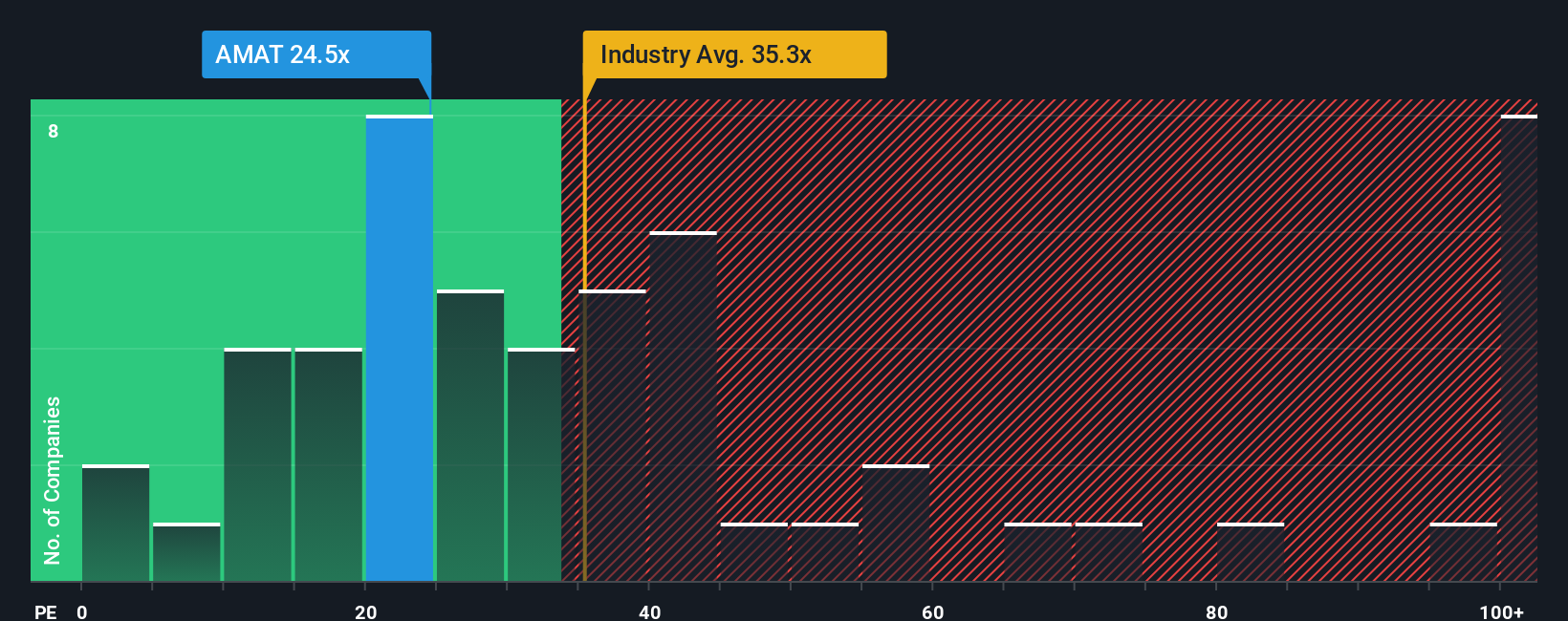

Another View: Multiples Suggest Relative Value

From a market multiple perspective, Applied Materials trades at a price-to-earnings ratio of 26.5 times, which is well below the industry average of 39.8 times and also undercuts its peer group’s 36.9 times. The fair ratio sits higher at 32.4 times. This sizable gap may indicate a valuation opportunity, but it could also reflect caution around potential risks the market sees ahead. With these divergent signals, is the stock poised for further upside or are there warning flags investors should heed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Materials Narrative

If you have a different perspective or want to conduct your own analysis, you can easily build a personalized narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Applied Materials.

Looking for more investment ideas?

Unlock even greater opportunities. Use the Simply Wall St Screener to spot standout stocks that match your strategy, so you never miss a potential winner.

- Capture untapped value by checking out these 866 undervalued stocks based on cash flows and see which companies the market has overlooked but the numbers say have room to run.

- Grow your passive income stream. Start with these 21 dividend stocks with yields > 3% to find solid businesses offering reliable yields over 3%.

- Tap into innovation at the frontier by browsing these 28 quantum computing stocks. These stocks are spearheading game-changing advancements in quantum technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives