- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (AMAT): Assessing Valuation After Surge in Institutional Buying and Analyst Upgrades

Reviewed by Simply Wall St

Applied Materials (AMAT) stock has been attracting attention after new filings revealed a wave of institutional buying and favorable Wall Street sentiment. This comes as investors position themselves ahead of the company’s upcoming earnings release.

See our latest analysis for Applied Materials.

This surge in institutional interest comes on the back of strong momentum in Applied Materials’ share price, which has climbed more than 10% over the past month and boasts a robust 42.5% share price return year-to-date. Despite some volatility after Q4 guidance and mixed analyst outlooks, market confidence appears steady. The company’s increasingly pivotal role in chipmaking for artificial intelligence, 5G, and EVs is fueling a remarkable 129% total shareholder return over the past three years.

If you’re watching for sector trends or new ideas, this might be the perfect moment to discover See the full list for free.

With the stock’s rapid rally, upbeat ratings, and price now near all-time highs, the key question for investors is whether Applied Materials remains undervalued or if the market has already factored in all its future growth potential.

Most Popular Narrative: 6.9% Overvalued

Applied Materials’ last close of $233.53 sits above the narrative fair value of $218.35, putting it in the spotlight for investors weighing rich pricing against future potential. This gap reflects the interplay between strong growth drivers and lingering risks shaping expectations for the business.

"Structural growth in AI and high-performance computing is reshaping semiconductor demand, driving heavy investments in advanced chip architectures such as gate-all-around (GAA) transistors, high-bandwidth memory (HBM), and advanced packaging. Applied is set to benefit from these device inflections due to its leadership in materials engineering and strong customer adoption of new process technologies, which are expected to deliver outsized revenue and market share gains as these nodes ramp from 2026 onward."

Want to know why the narrative points to a premium price? This valuation hinges on bold forecasts of future earnings, more resilient margins, and a profit multiple typically reserved for industry front-runners. The math behind this narrative could surprise you. Uncover the full story to see the assumptions that shape its fair value.

Result: Fair Value of $218.35 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent headwinds such as export license uncertainties in China and high customer concentration still threaten Applied Materials’ long-term growth narrative.

Find out about the key risks to this Applied Materials narrative.

Another View: Market Multiples Tell a Different Story

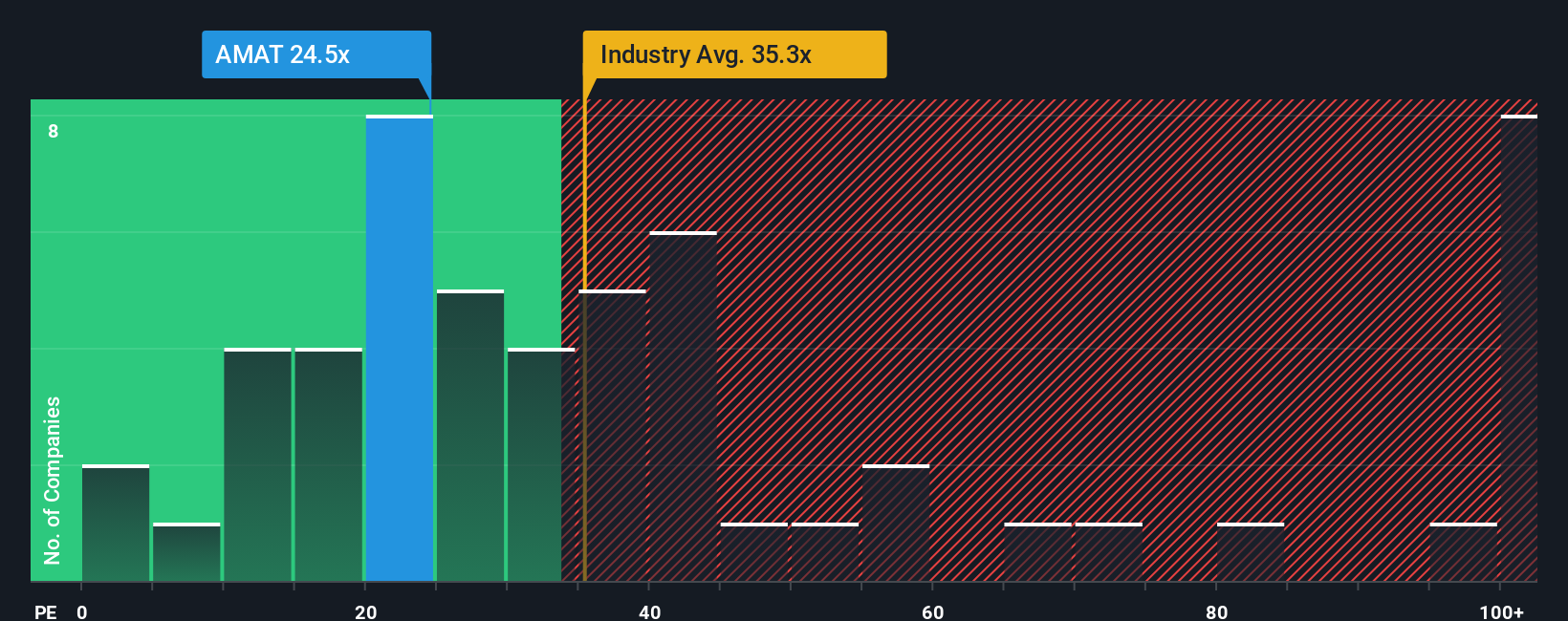

Looking through another lens, Applied Materials is currently trading at a price-to-earnings ratio of 27.2x. This is notably lower than the US Semiconductor industry average of 35.6x and also undercuts the peer average of 40.8x. The fair ratio is estimated at 33.8x, suggesting the company's shares could be viewed as relatively attractively priced compared to competitors. However, with this gap, it raises the question of whether the market is undervaluing future upside or signaling caution about risks ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Materials Narrative

If you have a different perspective or want to delve into the numbers yourself, it only takes a few minutes to develop your own angle. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Applied Materials.

Looking for More Smart Investment Opportunities?

Don't let your next great trade slip through your fingers. The Simply Wall St Screener shines a spotlight on fast-moving sectors and undervalued gems positioned for potential outperformance.

- Uncover fast-growing trends in artificial intelligence by checking out these 24 AI penny stocks to see which innovators are attracting serious attention.

- Tap into market secrets with these 860 undervalued stocks based on cash flows that financial pros are watching for untapped upside based on solid fundamentals and price value gaps.

- Catch impressive dividend payouts and steady income streams with these 17 dividend stocks with yields > 3% before others spot these high-yield opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives