- United States

- /

- Semiconductors

- /

- NasdaqGS:ALGM

Allegro MicroSystems (ALGM): Evaluating Valuation After Strong Earnings, Upbeat Guidance, and Product Innovation

Allegro MicroSystems (ALGM) captured attention after releasing quarterly results that showed a return to profitability, 14% year-over-year revenue growth, and fresh guidance that topped what most on Wall Street were expecting.

See our latest analysis for Allegro MicroSystems.

Allegro’s shares have captured fresh momentum this year, driven by strong e-Mobility and industrial demand, product launches, and solid earnings outperformance. With a year-to-date share price return of 31% and a robust 41.8% total shareholder return over 12 months, both short-term and long-term performance signal growing optimism about its growth runway and operational discipline.

If Allegro’s upswing has you wondering what else is gaining traction, now is a great chance to broaden your investing horizons and discover See the full list for free.

With shares climbing after a string of earnings beats and upbeat guidance, the key question for investors now is clear: Is Allegro MicroSystems trading below its fair value, or is future growth already fully priced in?

Most Popular Narrative: 18.6% Undervalued

According to the most widely followed narrative, Allegro MicroSystems appears attractively priced compared to its fair value estimate of $36.75, with shares last closing at $29.92. This perspective sets up a debate on the pace and durability of its earnings surge.

Ongoing investments and recent improvements in proprietary manufacturing and test yield (notably in TMR sensor ICs) are translating to cost reductions and enhanced gross margins. This is expected to continue as product differentiation and scale improve, which would positively impact net margins.

Want to know why the math points higher? This valuation relies on Allegro’s ability to supercharge profits and margins far beyond today’s baseline. The secret ingredients include bold revenue bets, significant margin assumptions, and a future multiple that rivals industry titans. Discover what is fueling the fair value calculation in the full narrative.

Result: Fair Value of $36.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in China and Allegro’s reliance on automotive demand could create challenges for the company’s growth assumptions and may put pressure on future margins.

Find out about the key risks to this Allegro MicroSystems narrative.

Another View: Market Ratios Raise a Red Flag

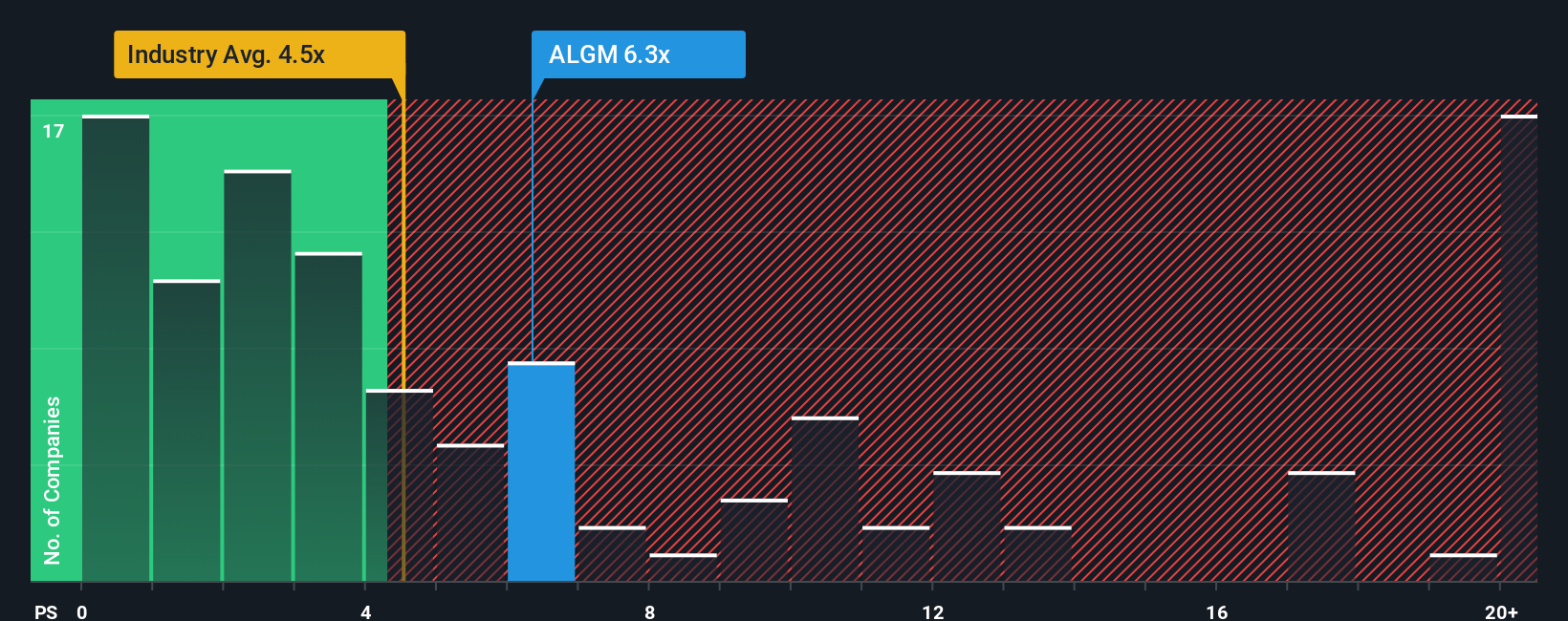

Looking at Allegro MicroSystems through the lens of its sales ratio reveals a different picture. The company's ratio sits at 7x, noticeably higher than the US Semiconductor industry average of 5.3x and its peer average of 12.3x. While this premium could highlight optimism about growth, it also introduces valuation risk if future performance disappoints. Is the current price justified, or might the market eventually expect this ratio to shift closer to the fair ratio of 5.2x?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allegro MicroSystems Narrative

If these views don't fit your take or you like to crunch numbers personally, dive into the data and develop your own perspective with just a few clicks. Do it your way

A great starting point for your Allegro MicroSystems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity favors the bold. Uncover powerful trends and stay ahead of the crowd by taking action with these handpicked stock ideas:

- Unlock growth potential by checking out these 28 quantum computing stocks. These are transforming tech with quantum innovation.

- Boost your portfolio's income with these 22 dividend stocks with yields > 3%. These offer yields above 3% and reliable cash returns.

- Get early access to promising companies through these 3590 penny stocks with strong financials with exceptional financial strength before they hit the spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGM

Allegro MicroSystems

Designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific power ICs for motion control and energy-efficient systems.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

BSX after Penumbra ?

Procter & Gamble - A Fundamental and Historical Valuation

Investing in the future with RGYAS as fair value hits 228.23

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!