- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Analog Devices (ADI): Evaluating Valuation After a Stable Month and Strong Multi-Year Returns

Reviewed by Kshitija Bhandaru

See our latest analysis for Analog Devices.

The steady share price for Analog Devices over the past month follows a much stronger showing earlier this year, with the stock now up 14.3% year-to-date. While recent movement has been quiet, long-term momentum remains solid as total shareholder returns have climbed an impressive 79% over three years and 112% over five.

If you’re interested in finding more tech stocks showing strong growth and resilience, it’s a great time to explore See the full list for free.

The question now is whether Analog Devices is undervalued given its strong fundamentals, or if the current price already reflects all the growth ahead. Is there a hidden buying opportunity, or is the market fully up to speed?

Most Popular Narrative: 9.7% Undervalued

Comparing the consensus fair value of $267.47 to Analog Devices' last close at $241.61, the most widely followed narrative suggests room for price growth as analyst targets exceed the current market level.

Disciplined capital allocation, with a focus on R&D, strategic partnerships (such as with NVIDIA and Teradyne), and shareholder returns, positions ADI to drive sustainable EPS growth and further enhance financial resilience as secular growth drivers unfold across its diversified end-markets.

Curious what future growth rates, margin gains, and bold strategic bets power this upbeat valuation? The linchpin of this narrative rests on ambitious earnings and revenue projections. Are you ready to peek under the hood and discover what supports that price target?

Result: Fair Value of $267.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from lower-cost rivals and unpredictable global trade policies could quickly challenge these bullish assumptions for Analog Devices.

Find out about the key risks to this Analog Devices narrative.

Another View: Valuation Gaps in Focus

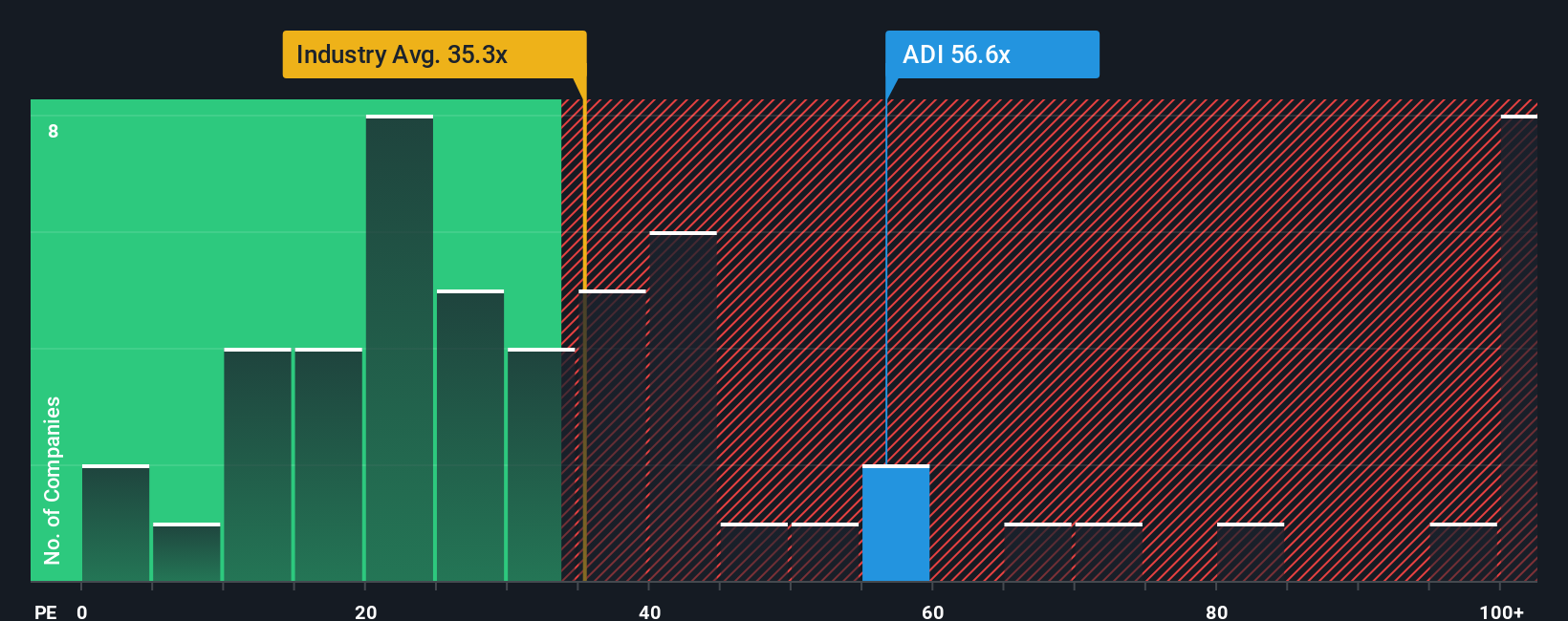

Looking through the lens of price-to-earnings ratios, Analog Devices trades at 60.7x earnings, much higher than both the US Semiconductor industry average of 35.6x and its fair ratio of 40.8x. This premium suggests that investors may be pricing in more optimism here than in peers or the broader sector. Is this confidence justified or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Analog Devices Narrative

If you're looking to dig deeper or challenge these perspectives, you can analyze the numbers and shape your own story in just minutes with Do it your way.

A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities in the market rarely wait around. Give yourself an edge and uncover innovative sectors and companies you might be missing with these handpicked ideas:

- Fuel your search for future leaders by checking out these 868 undervalued stocks based on cash flows, which offers attractive prices based on their underlying cash flows and potential for growth.

- Capture the excitement in artificial intelligence and position yourself for what is next by reviewing these 24 AI penny stocks developed by pioneers at the forefront of machine learning.

- Strengthen your portfolio with steady income streams when you compare these 20 dividend stocks with yields > 3%, which features reliable yields well above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives