- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research (ACMR): Margin Gains Reinforce Bullish Outlook as Valuation Discount Narrows

Reviewed by Simply Wall St

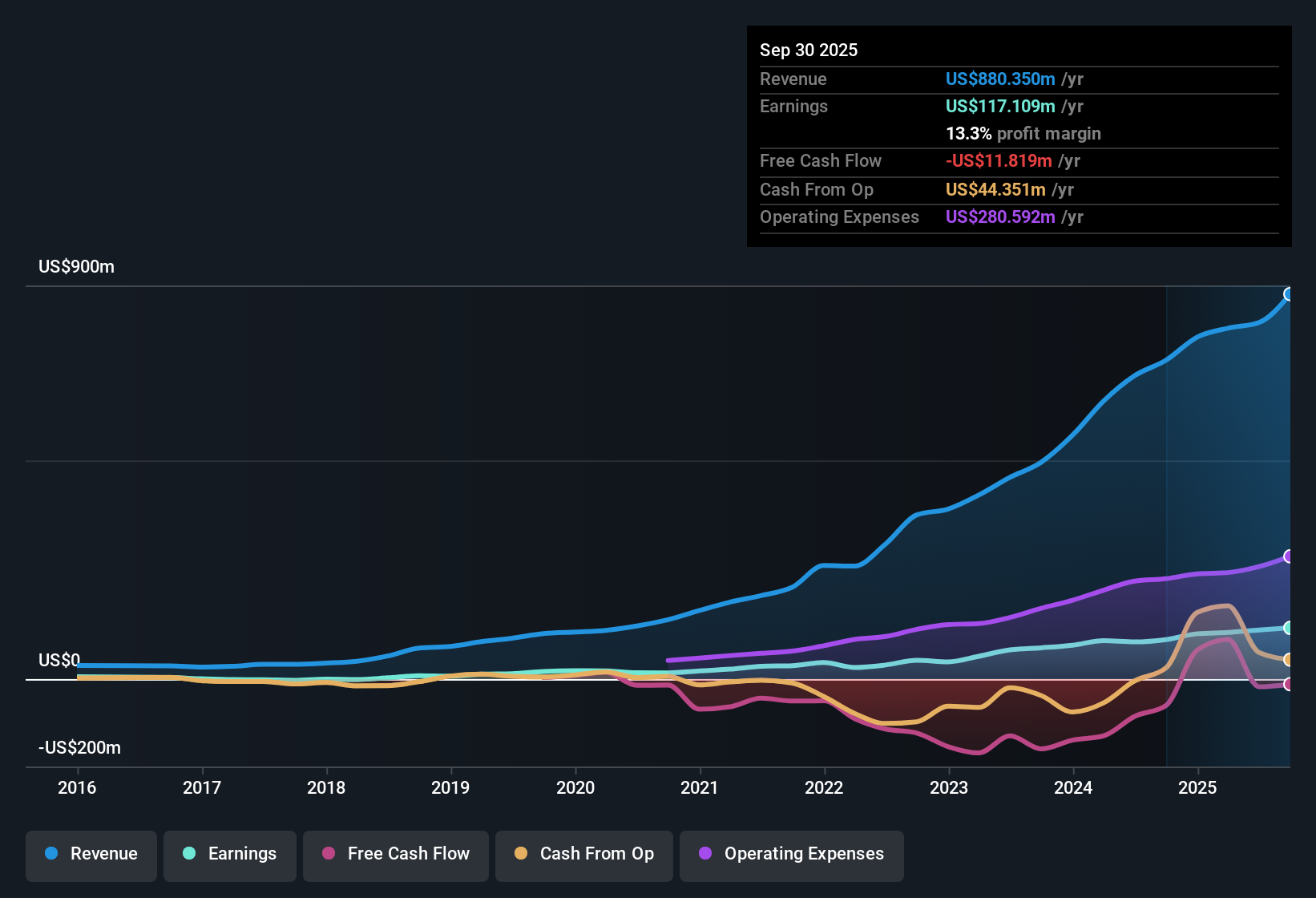

ACM Research (ACMR) is on track for robust growth, with revenue forecast to climb 15% per year, well ahead of the broader US market’s 10.5% annual growth. EPS is set to expand by 14.3% annually, net profit margins have increased to 13.8% from 12.3% last year, and earnings have averaged a 37% annual increase over the past five years. Investors may take notice as strong margin improvement and premium revenue growth continue to support a positive outlook, even as recent share price stability remains a minor concern.

See our full analysis for ACM Research.Now, let’s see how these figures stand up to the most widely discussed narratives. Some perspectives might hold up, while others could be put to the test.

See what the community is saying about ACM Research

Margin Expansion Anchors Profit Outlook

- Net profit margins jumped to 13.8% from 12.3% last year, extending ACM Research’s track record of profitability improvement even as the US semiconductor industry faces margin pressure.

- Analysts' consensus view sees margin strength fueling further growth:

- This level is expected to persist for the next three years amid ambitious expansion across China and new international markets.

- Recent investments in manufacturing and R&D are designed to scale higher-margin offerings and cushion against rising operating costs and global competition.

- Curious why ACM’s margins remain resilient while competitors stumble? Dive deeper in the full Consensus Narrative. 📊 Read the full ACM Research Consensus Narrative.

Peer Discount May Understate Value

- ACMR trades at a price-to-earnings ratio of 17.8x, which stands well below its peer average of 48.8x and the US semiconductor industry average of 35.8x. This suggests the market is attaching a lower valuation to its earnings power.

- Analysts' consensus view highlights this discount as a key upside lever:

- Despite robust revenue and strong quality earnings, the current share price of $31.14 trails the only allowed analyst price target of $41.66, a gap of over 33%.

- Continued revenue leadership and premium margin performance could help rerate the multiple closer to sector norms if international growth materializes and margin resilience persists.

Exposure to China Drives Both Growth and Risk

- ACMR’s aggressive revenue targets rely heavily on the Chinese semiconductor market, which remains supported by policy but is also vulnerable to export restrictions and demand swings.

- Analysts' consensus narrative flags this dependence as a double-edged sword:

- On one hand, close ties and local expansion have pushed management's China revenue goal to $2.5 billion and overall targets to $4 billion, well above industry growth rates.

- On the other, any new export controls or weakening Chinese demand could challenge both top-line gains and margin durability, leaving future growth exposed to geopolitical headwinds and customer concentration risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ACM Research on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think there’s another story in these numbers? Share your own perspective and start crafting your narrative in just minutes. Do it your way

A great starting point for your ACM Research research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While ACM Research’s growth outlook is strong, its heavy reliance on the Chinese market creates ongoing exposure to geopolitical headwinds and unpredictable demand swings.

If you want to minimize your portfolio’s sensitivity to these risks, focus on steadier performers by using our stable growth stocks screener (2074 results) who deliver consistent results regardless of market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells capital equipment worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives