- United States

- /

- Specialty Stores

- /

- NYSE:VSCO

Victoria's Secret (VSCO): Assessing Valuation After a 28% Share Price Surge

Reviewed by Simply Wall St

Victoria's Secret (VSCO) shares have seen significant swings over the past month, climbing nearly 28% even as retail stocks face mixed sentiment. Investors are weighing recent performance trends against the company's evolving positioning in the competitive apparel market.

See our latest analysis for Victoria's Secret.

The recent surge in Victoria's Secret's share price, especially the impressive 28% jump over the past month, stands out after a tough start to the year. While the 1-year total shareholder return is just about positive, shorter-term momentum has picked up sharply and signals renewed optimism around the company’s future moves.

If this kind of momentum has you watching for the next big opportunity, now is the perfect moment to expand your search and check out fast growing stocks with high insider ownership

With such a sharp rebound, the key question for investors becomes whether Victoria's Secret is now trading below its true value, or if recent gains mean the market is already anticipating all the good news ahead. Is there still room to buy in, or are expectations already reflected in the stock price?

Most Popular Narrative: 25% Overvalued

The most widely followed narrative places Victoria's Secret's fair value at $29, while the last close price stands notably higher at $36.32. This sets the stage for a debate over whether the brand’s ambitious transformation can justify its current market premium.

The ongoing transformation of Victoria's Secret toward inclusivity, body positivity, and enhanced storytelling continues to resonate with younger customers and drive new customer acquisition, especially among the 18-44 demographic. This supports sustained revenue and market share growth.

Want to unpack why this premium valuation exists? The heart of this narrative is a bold bet on lasting appeal to new customer segments. Can management’s vision really shift the long-term growth curve? Dive into the full narrative for the key financial forecasts that anchor this high-stakes valuation.

Result: Fair Value of $29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and reliance on physical stores may slow progress and challenge Victoria's Secret in sustaining long-term earnings growth.

Find out about the key risks to this Victoria's Secret narrative.

Another View: What Does the SWS DCF Model Say?

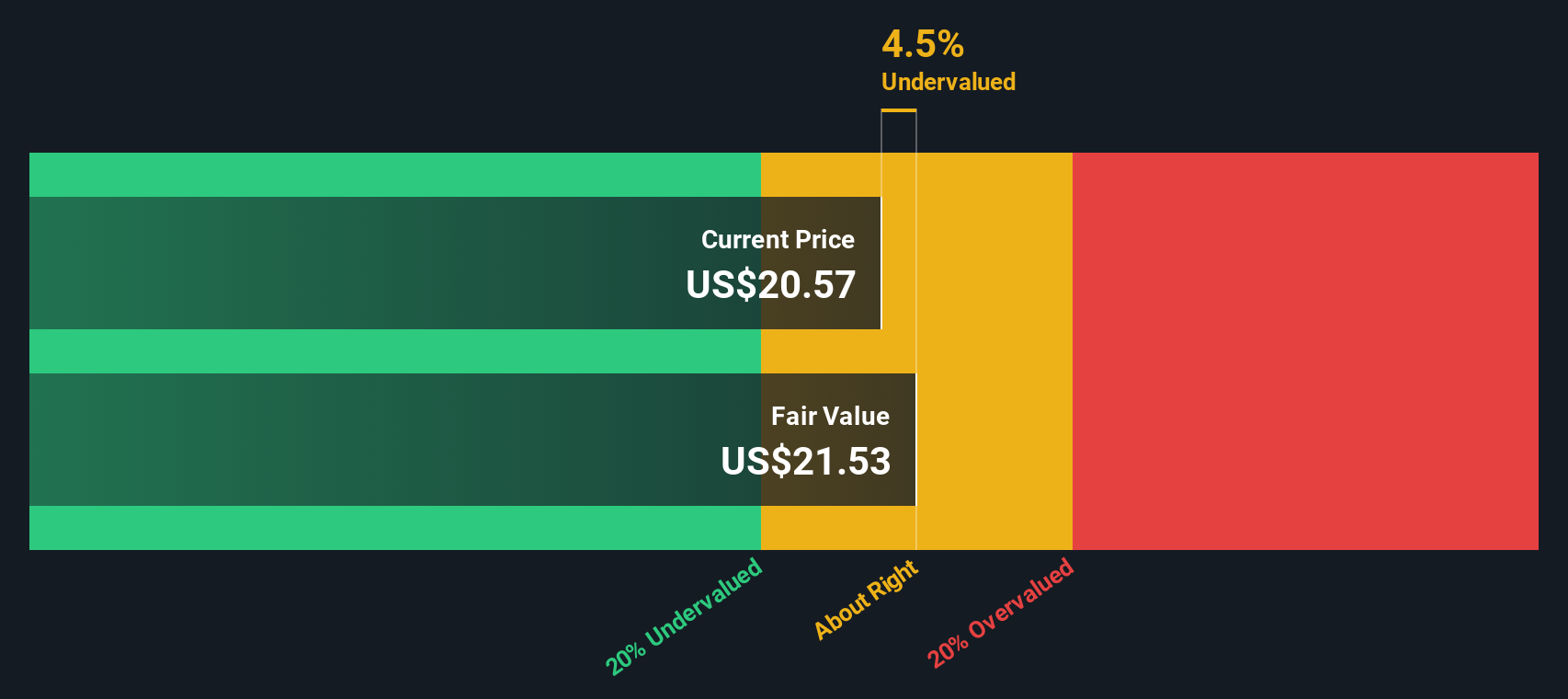

While many see Victoria's Secret as overvalued based on analyst targets, our SWS DCF model tells a different story. According to this approach, the shares trade about 21% below their estimated fair value. This suggests upside potential, but which method will prove more accurate as the company evolves?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Victoria's Secret for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Victoria's Secret Narrative

If you'd rather see the numbers firsthand or wish to craft your own viewpoint, you can put together a unique narrative in just a few minutes. Do it your way

A great starting point for your Victoria's Secret research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let a single opportunity slip past you. You can discover remarkable stocks poised for future growth using the Simply Wall Street Screener.

- Tap into untapped value by checking out these 861 undervalued stocks based on cash flows which is trusted by investors seeking sizable upside based on real cash flow strength.

- Capitalize on next-generation medical breakthroughs through these 32 healthcare AI stocks. This brings together firms revolutionizing healthcare with artificial intelligence.

- Unlock steady income streams by reviewing these 17 dividend stocks with yields > 3%, featuring companies offering attractive dividend yields above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSCO

Victoria's Secret

Operates as a specialty retailer of women’s intimate, and other apparel and beauty products worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives