- United States

- /

- Specialty Stores

- /

- NYSE:GME

Is There Still Opportunity in GameStop After a 29.9% Slide in 2025?

Reviewed by Bailey Pemberton

- Curious if GameStop is a hidden gem or just another volatile stock? You’re not alone, as many investors are hungry to know if there’s still any real value after all the headline hype.

- GameStop’s price has been on the move lately, sliding 3.5% over the past week and 29.9% year-to-date. Despite these declines, it is still up a staggering 690.3% over the past five years.

- Much of the recent buzz has been fueled by renewed interest from retail investors and social media chatter, pushing the stock to new highs followed by sharp reversals. After surging on online forums and in the news, GameStop remains a hotly debated name both for its cult following and for how drastically sentiment can shift based on the latest headline.

- On our standard valuation checks, GameStop scores a 2 out of 6 for being undervalued, so there is a lot more to unpack. We will break down what those different valuation approaches really say, so keep reading for a perspective you are not likely to find anywhere else.

GameStop scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: GameStop Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method for valuing a company by projecting its expected future cash flows and then discounting those amounts back to today's value. This helps estimate what the company is really worth based on how much money it is expected to generate in the future.

For GameStop, the current Free Cash Flow stands at $474.48 million, providing a snapshot of its ability to generate cash right now. According to projections, GameStop's annual Free Cash Flow is expected to climb over the next decade and reach approximately $1.38 billion by 2035. While analysts typically provide estimates for up to five years, the projections beyond 2029 are extrapolated to maintain a consistent outlook.

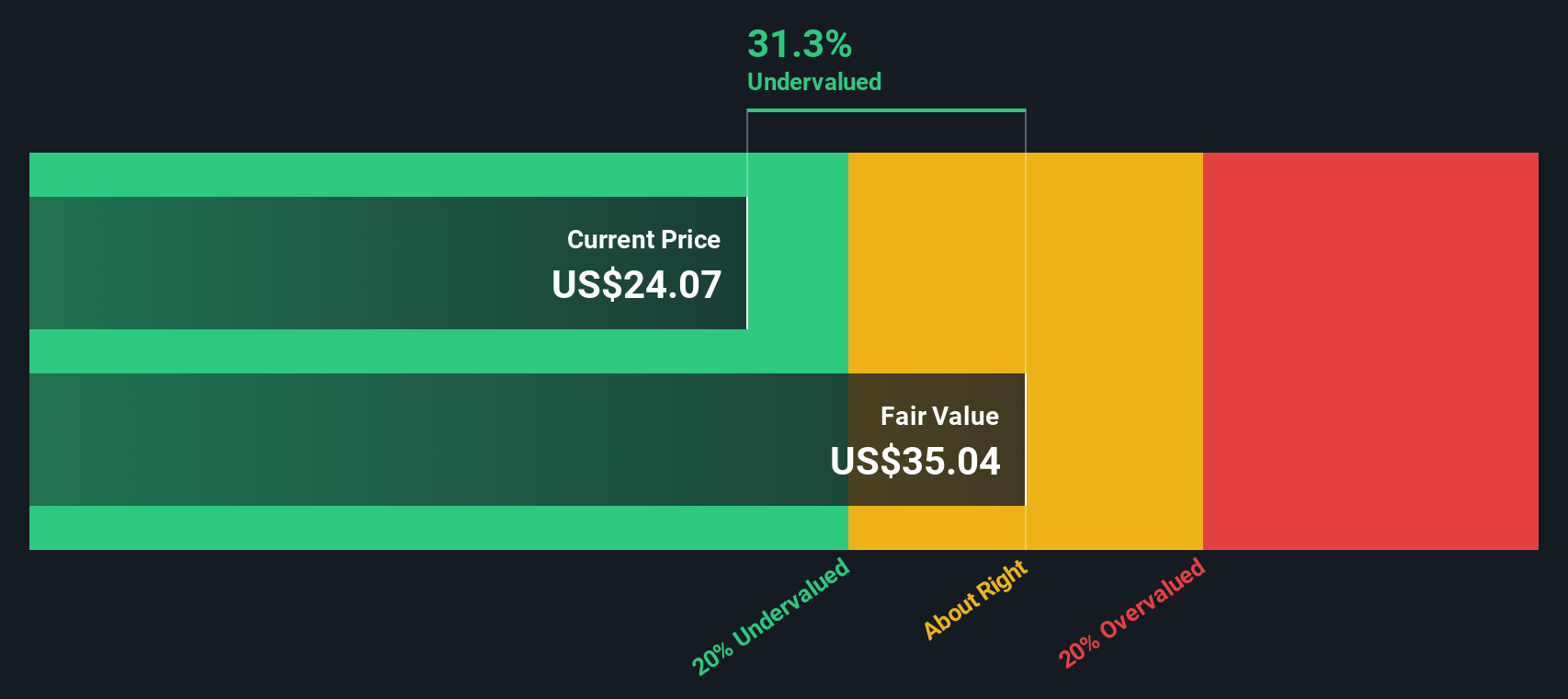

Based on the DCF model, GameStop's intrinsic value per share is calculated at $35.22. Since this model suggests the stock is trading at a 39.0% discount to its intrinsic value, it indicates the shares are notably undervalued at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GameStop is undervalued by 39.0%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

Approach 2: GameStop Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a popular metric for evaluating profitable companies because it connects a company’s current share price to its earnings. Investors often look to the PE ratio as a quick gauge of whether a stock is expensive or cheap relative to how much profit the business produces.

But not all PE ratios are created equal. Factors such as a company’s expected earnings growth and the risks it faces play a significant role in determining what a “normal” or “fair” PE should be. Fast-growing, lower-risk companies can often justify a higher PE ratio, while slower-growing or riskier companies usually trade at lower multiples.

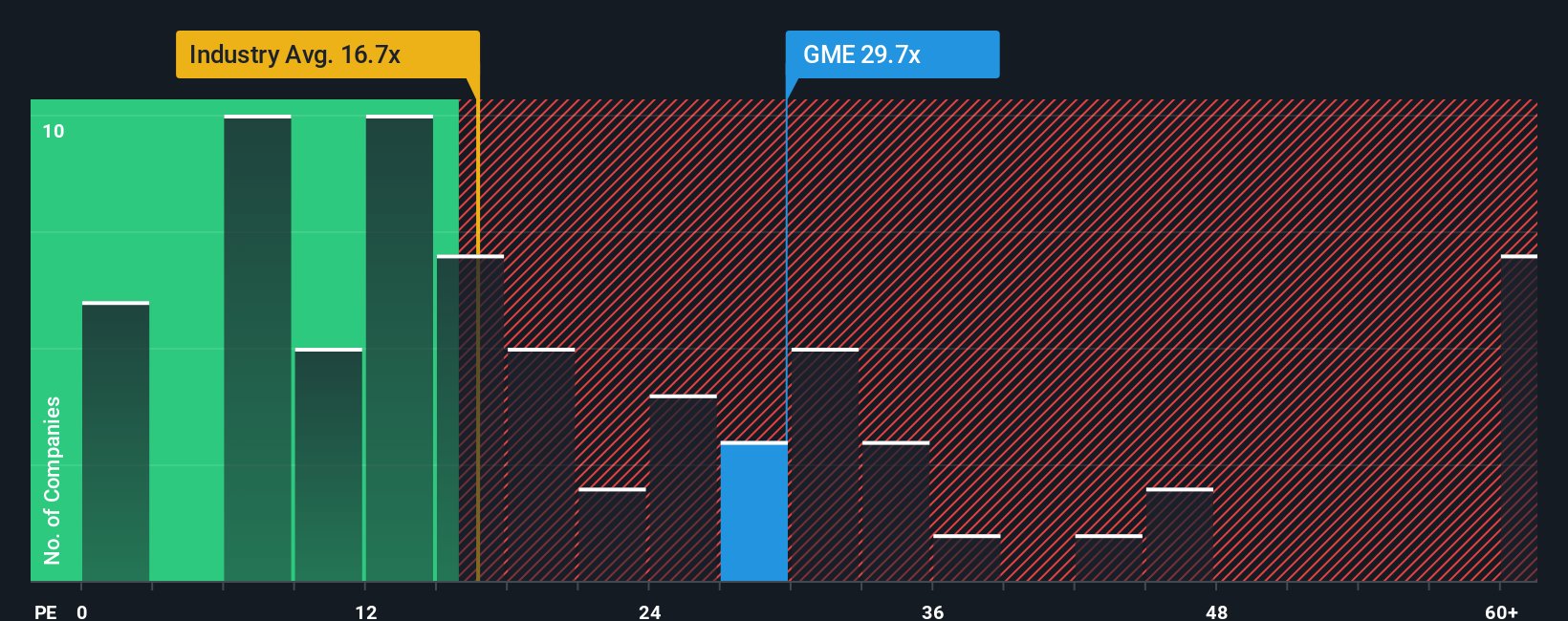

Currently, GameStop is trading at a PE ratio of 26.6x. This is noticeably higher than its industry average of 18.4x and the peer average of 18.0x. On the surface, this suggests the stock may be priced at a premium compared to many of its industry peers.

This is where Simply Wall St's Fair Ratio comes into play. The Fair Ratio is designed to reflect what a suitable multiple should be for GameStop specifically, based on its earnings growth, profit margins, market cap, industry, and company-specific risks. Rather than simply comparing with industry averages, this tailored metric offers a clearer and more justified benchmark for valuation.

If GameStop’s PE ratio is close to its Fair Ratio, then the share price can be considered reasonable given its exact circumstances. If it is much higher or lower, it could signal overvaluation or undervaluation.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GameStop Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story about a company. It is your view on where the business is headed and what it might be worth, built right into the numbers. With Narratives, you connect your outlook and assumptions about GameStop’s future revenue, profit margins, and risks to a financial forecast, which then calculates a Fair Value tailored to your unique perspective.

Simply Wall St makes creating and sharing Narratives easy on its Community page, where millions of investors access and update their views. Narratives let you track why you believe a stock like GameStop is a buy, hold, or sell, as you can instantly see when Fair Value changes versus the current price, empowering more confident decisions as new news or earnings emerge.

Since Narratives are updated dynamically whenever fresh information comes in, you are never stuck with an outdated thesis. Your Narrative evolves alongside the company. For example, one investor’s Narrative values GameStop at $120 based on strong crypto holdings and loyal shareholders, while another puts Fair Value near $12 by factoring in industry challenges and low expected growth.

For GameStop, we’ll make it straightforward for you with previews of two leading GameStop Narratives:

- 🐂 GameStop Bull Case

Fair Value: $120.00

Current price is 82% below narrative fair value.

Revenue Growth Rate: 0%

- Highlights GameStop’s exceptional Q1 2025 financial turnaround, with adjusted EPS of $0.17, net profit of $44.8 million, and $6.4 billion in cash with no long-term debt. These factors signal strong operational health and flexibility.

- Emphasizes strategic moves including holding $516.6 million in Bitcoin, an active Direct Registration System (DRS) base securing almost 25% of shares, and aggressive store closures and cost cuts that have boosted margins.

- Attributes potential for substantial future growth to loyal retail investors, board leadership (notably Ryan Cohen), crypto investments, and resilience to market speculation due to community cohesion and high insider ownership.

- 🐻 GameStop Bear Case

Fair Value: $11.91

Current price is 81% above narrative fair value.

Revenue Growth Rate: 0%

- Notes that while GameStop has made operational improvements and posted a Q3 2024 profit, overall revenues are falling (down 20%), and the traditional retail model continues to face severe pressure from digital competitors and industry changes.

- Discusses new digital initiatives (such as BNPL partnerships and crypto investment plans) as creative but high-risk moves that add uncertainty and may or may not succeed in reversing the underlying business challenges.

- Warns that meme-stock speculation, extreme volatility fueled by social media, and influential personalities drive price movements often unmoored from fundamentals, making long-term investment riskier than it might initially appear.

Do you think there's more to the story for GameStop? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives