- United States

- /

- Specialty Stores

- /

- NYSE:GME

Evaluating GameStop (GME): Valuation Insights Following Net Income Rebound and Turnaround Developments

Reviewed by Simply Wall St

GameStop (GME) is getting attention after its latest financial report showed rising revenue and a sharp rebound in net income. This reveals progress in the company’s ongoing turnaround efforts led by CEO Ryan Cohen.

See our latest analysis for GameStop.

GameStop’s latest rebound in net income has caught some attention, but the share price hasn’t yet reflected lasting optimism, with a year-to-date price return of -30.04%. Despite buzz around leadership and new directions like collectibles, long-term holders are still in the green. Over five years, total shareholder return stands at a remarkable 646%, a testament to how quickly momentum can build even when sentiment is mixed.

If you’re watching for what else is gaining traction, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With signs of a turnaround underway and recent returns still muted, investors have to ask whether GameStop is undervalued given its progress, or if the market is already pricing in the company’s next phase of growth.

Most Popular Narrative: 82.1% Undervalued

GameStop’s most followed valuation view puts fair value far above today’s close, suggesting the market may be missing a key transformation story. Here is a quote that captures what sets this perspective apart.

GameStop’s Q1 2025 financials, combined with an amazing shareholder community, just showed its takes-money-to-buy-whiskey strategy at work. This demonstrates its status as a compelling investment as the retail investors have been saying for years while fighting a corrupt legacy media, bots, social media manipulation, and hedge funds. Gamestop delivered a stellar adjusted EPS of $0.17, beating estimates by 325 percent, and achieved a $44.8 million net profit, reversing last year’s $32 million loss.

Is this jaw-dropping fair value built on wild earnings leaps, bold Bitcoin bets, or a future profit engine not seen in specialty retail? The narrative unlocks the specific levers driving this sky-high price target, exposing the numbers traditional models leave out. Want to see which eye-watering forecast gives this story its punch?

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, execution missteps or a downturn in Bitcoin prices could undermine GameStop’s bullish thesis and delay any expected transformation.

Find out about the key risks to this GameStop narrative.

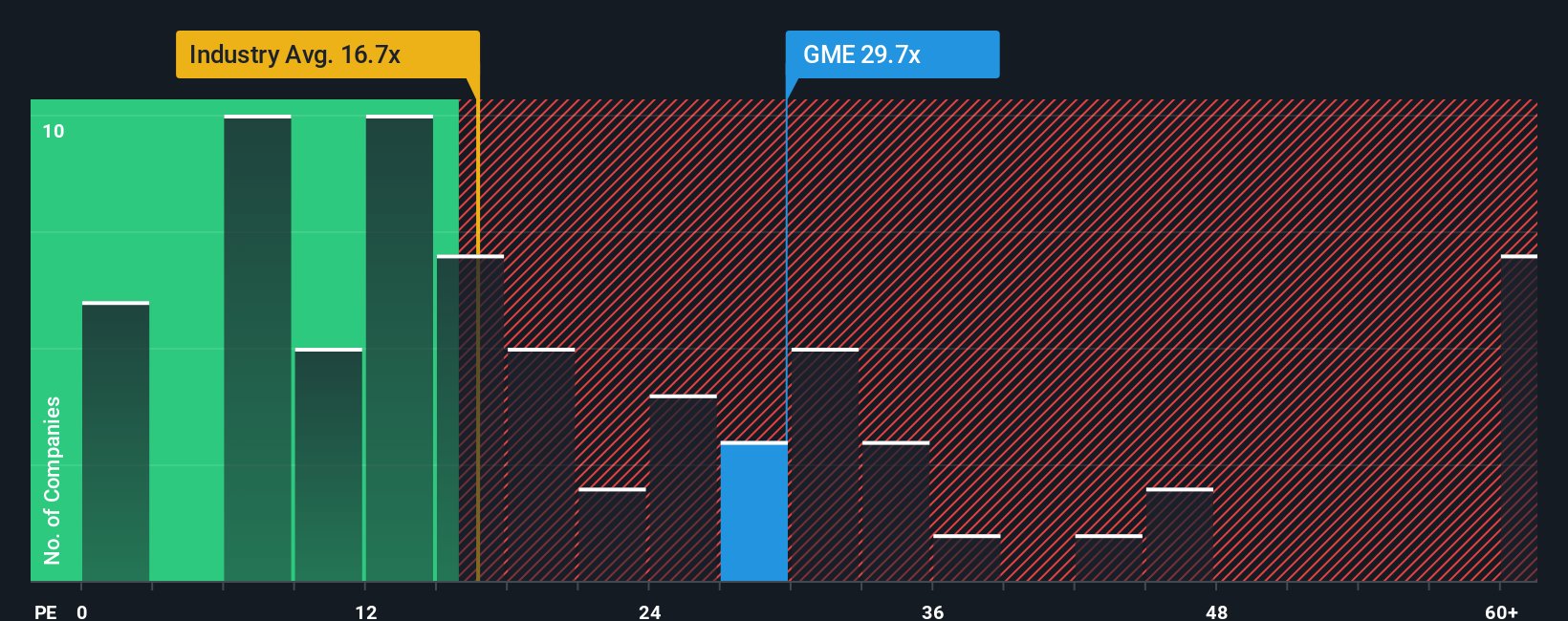

Another View: Price-to-Earnings Raises Questions

Looking at GameStop’s price-to-earnings ratio, a different story emerges. Shares are trading at 26.5 times earnings, which is noticeably higher than both the US specialty retail industry average and GameStop’s peer group, both at 18.3 times. This signals the stock could be expensive compared to its sector.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GameStop Narrative

If you have a different take or want to see the numbers firsthand, you can craft your own story for GameStop in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for More Investment Ideas?

Don’t settle for a single stock story when there are outstanding opportunities all around you. Act now and go after tomorrow’s potential market winners.

- Capitalize on surging artificial intelligence breakthroughs by seizing the momentum in companies powering innovation through these 26 AI penny stocks.

- Catch the rising wave of market bargains and snap up potential winners trading below their true worth via these 872 undervalued stocks based on cash flows.

- Turn rapidly emerging medical technology trends into long-term gains by targeting pioneers advancing healthcare through these 32 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives