- United States

- /

- Specialty Stores

- /

- NYSE:BOOT

Boot Barn Holdings (BOOT): Assessing Valuation Following Upbeat Guidance and Strong Quarterly Results

Reviewed by Simply Wall St

Boot Barn Holdings (NYSE:BOOT) just rolled out new earnings guidance pointing to double-digit sales and profit growth for the coming year, along with quarterly figures that showed strong year-over-year gains in both revenue and net income.

See our latest analysis for Boot Barn Holdings.

Shares of Boot Barn Holdings have reflected growing optimism around the company’s updated earnings guidance and recent strong results, with a 13.95% share price return over the past month and a 22.32% gain year-to-date. Over the past year, total shareholder return hit an impressive 38.14%, and the five-year total return stands at a striking 379.77%. Momentum appears to be building on the back of its robust fundamentals, supported by buybacks and a positive retail environment.

If Boot Barn’s momentum makes you curious about what else is thriving, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares soaring and Wall Street analysts boosting their price targets, the question now is whether Boot Barn Holdings is trading below its true value, or if investors have already priced in every bit of the company’s future growth potential.

Most Popular Narrative: 15.5% Undervalued

Boot Barn Holdings' most widely followed narrative assigns a higher fair value of $220.92 per share versus the last close at $186.68, suggesting the stock trades below projected future worth. The narrative's case for upside hinges on a mix of aggressive growth catalysts and evolving industry fundamentals.

Robust store expansion into underpenetrated markets, particularly in population-growing regions, is driving higher-than-expected new store performance, strong customer acquisition, and increased sales productivity. This expansion provides an ongoing tailwind for revenue and positions Boot Barn to benefit from broader demographic shifts, supporting long-term top-line growth.

Curious what sets Boot Barn’s valuation apart from its specialty retail peers? The real secret behind this number is a daring set of growth targets and assumptions. Future earnings and margin projections that only a handful of retail companies even attempt are at the core. See which forward-looking metrics power this price target and why analysts believe the market could be missing the upside.

Result: Fair Value of $220.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on aggressive store expansion and shifts in consumer shopping habits could present challenges for Boot Barn’s growth narrative in the years ahead.

Find out about the key risks to this Boot Barn Holdings narrative.

Another View: Market Ratios Raise Caution

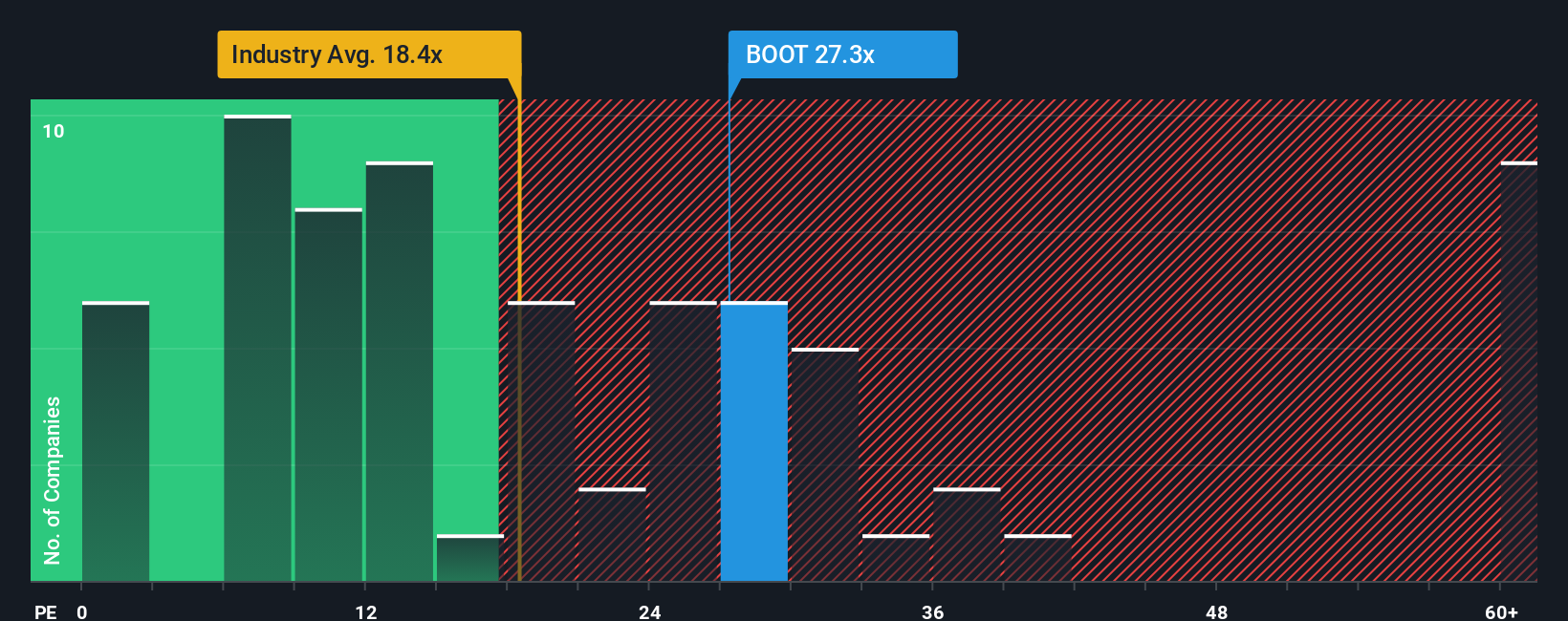

While analyst models point to upside, the company’s current price-to-earnings ratio of 27.3x is well above both the peer group average of 10.7x and the industry average of 18.4x. In comparison to a fair ratio of 18.5x, Boot Barn also trades at a premium. Does this reflect a risk investors are willing to accept, or a warning that expectations might be too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boot Barn Holdings Narrative

If you have a different perspective or prefer diving into the numbers yourself, you can shape your own Boot Barn Holdings story in just a few minutes: Do it your way

A great starting point for your Boot Barn Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means spotting new opportunities before the crowd. Uncover high-potential trends and sectors others might overlook by using these hand-picked investing angles.

- Boost your dividend income by searching for these 16 dividend stocks with yields > 3% with steady yields above 3%, which may offer the potential for stronger and more consistent returns.

- Tap into the explosive potential of artificial intelligence by reviewing these 25 AI penny stocks that are innovating in areas ranging from automation to data analytics.

- Build your watchlist with these 876 undervalued stocks based on cash flows that are priced attractively based on real cash flows, allowing you to act before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOOT

Boot Barn Holdings

Operates specialty retail stores in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives