- United States

- /

- Specialty Stores

- /

- NYSE:AEO

A Look at American Eagle Outfitters's Valuation After a 19.5% 30-Day Share Price Rally

Reviewed by Simply Wall St

American Eagle Outfitters (AEO) has been drawing attention with its recent stock movement. Over the past month, shares have climbed nearly 20%, reflecting shifting sentiment among investors in the retail apparel space.

See our latest analysis for American Eagle Outfitters.

After months of subdued trading, American Eagle Outfitters' 19.5% share price rally over the past 30 days has definitely turned heads. This strong momentum builds on a solid 90-day move and comes despite a slightly negative year-to-date result. Its three- and five-year total shareholder returns of 50% and 30% respectively hint at resilience and long-term value for patient investors.

If this strength in retail sparks your curiosity, consider expanding your search and discover fast growing stocks with high insider ownership.

At current prices, does American Eagle Outfitters represent an overlooked bargain, or are investors already factoring in its potential turnaround and future growth into the stock’s valuation?

Most Popular Narrative: 7% Overvalued

American Eagle Outfitters closed at $17.10, which is higher than the most popular narrative’s fair value of $15.94. This sets up a tension between recent optimism boosting the stock and more cautious long-term projections from analysts.

The analysts have a consensus price target of $15.167 for American Eagle Outfitters based on their expectations of its future earnings growth, profit margins, and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.5 and the most bearish reporting a price target of just $10.0.

Want to know why this valuation came in below today’s price? The model’s bold assumptions about profit growth, margin expansion, and future multiples are driving the story. Curious which of these expectations truly matter and why analyst consensus splits so sharply? Dive into the narrative to see what really supports this fair value estimate.

Result: Fair Value of $15.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing consumer uncertainty and the threat of higher operating costs could quickly change the outlook for American Eagle Outfitters.

Find out about the key risks to this American Eagle Outfitters narrative.

Another View: Market Multiple Tells a Different Story

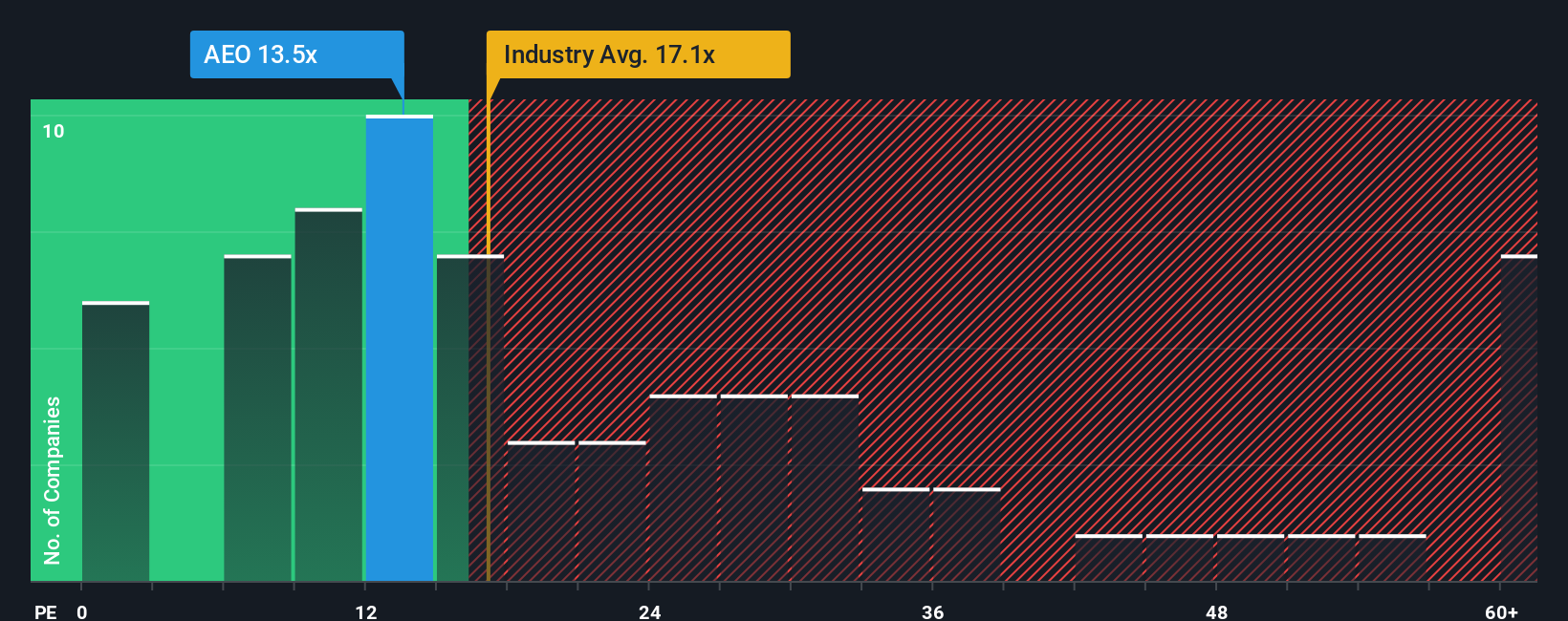

While the analyst fair value estimate sees American Eagle Outfitters as overvalued, the price-to-earnings ratio offers another perspective. At 14.7x, it is below both the industry average of 18.4x and the peer average of 16.7x, and also below a fair ratio of 22.2x. This suggests the market is less optimistic about the company’s future profits compared to its competitors. Could this signal an overlooked value opportunity, or are there risks the market sees ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Eagle Outfitters Narrative

If you see things differently or want to dig into the details on your own, you can easily craft your own perspective in just a few minutes with Do it your way.

A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let high-potential stocks pass you by. Expand your watchlist with innovative opportunities that could shape your portfolio’s future, all on Simply Wall Street’s free screener.

- Capitalize on tomorrow’s tech leaders by tapping into these 25 AI penny stocks, which could benefit most from advances in artificial intelligence and automation.

- Boost your income stream and stability as you scan for yield with these 16 dividend stocks with yields > 3%, offering over 3% in annual returns.

- Ride the next wave of digital disruption by seeking out these 82 cryptocurrency and blockchain stocks, at the forefront of blockchain and crypto market innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives