- United States

- /

- Retail Distributors

- /

- NasdaqGS:POOL

Assessing Pool Corp (POOL) Valuation After Recent Share Price Uptick

Reviewed by Simply Wall St

See our latest analysis for Pool.

After a tough stretch this year, Pool’s share price is showing early signs of life. Today’s uptick follows a month-long slide and a year-to-date share price return of -24%. Although its one-year total shareholder return is down over 31%, momentum could shift if sentiment improves or new growth signals emerge.

If you’re ready to look beyond Pool’s recent volatility, now’s the perfect opportunity to discover fast growing stocks with high insider ownership.

With shares sitting about 17% below their estimated intrinsic value and even further from analyst price targets, investors are left to wonder whether Pool is a bargain yet to be recognized or if the market is already factoring in its future prospects.

Most Popular Narrative: 24.4% Undervalued

Pool’s most popular narrative sees the fair value at $333, a full $81 above the last close of $252.01. The narrative points to durable expansion drivers, while suggesting the market has not yet recognized sustained trends underlying future growth potential.

*Sustained migration to high-growth Sun Belt regions like Florida and Arizona, with POOLCORP increasing local branches and franchise presence, positions the company to capture outsized revenue and market share gains as demographic shifts boost both new installations and recurring maintenance activity.*

Curious how this narrative expects Pool to outperform? The valuation is built around ambitious long-term growth assumptions and rising future profit margins. What is the forecast that could justify such a premium? Can the company hit those targets? Read the full narrative to solve the puzzle behind this bullish fair value.

Result: Fair Value of $333 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or continued weakness in the housing market could keep Pool’s growth under pressure and challenge the optimistic outlook.

Find out about the key risks to this Pool narrative.

Another View: What Do Market Ratios Say?

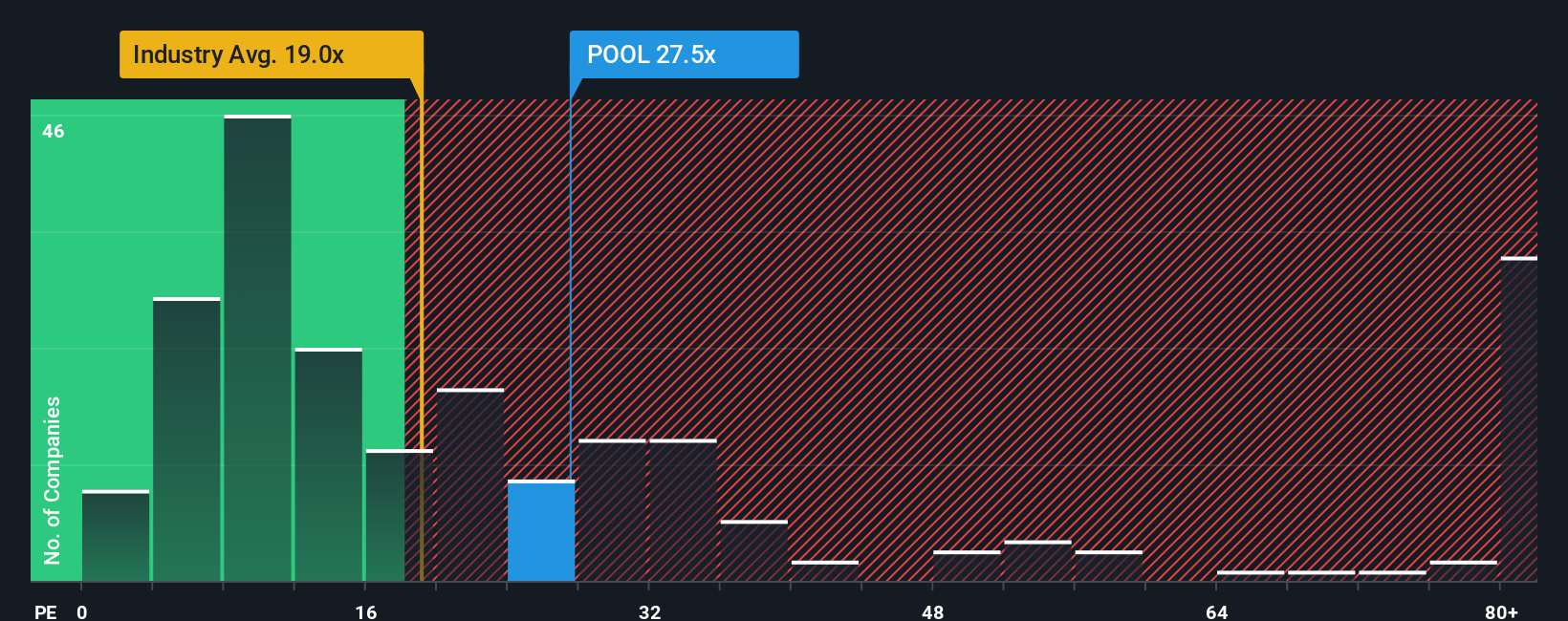

While many see Pool’s shares as undervalued, its current price-to-earnings ratio is 22.9x, higher than the global industry average of 18x and well above its fair ratio of 15.6x. This means the stock carries a valuation premium, which may signal either justified quality or extra risk if the market’s optimism fades. Are investors reaching for growth, or is this premium sustainable?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pool Narrative

If you see the story differently or want to dig into the numbers yourself, you can piece together your own perspective in just a few minutes. Do it your way.

A great starting point for your Pool research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Now is the perfect time to uncover tomorrow’s winners with Simply Wall Street’s powerful screener and broaden your investment outlook instantly.

- Capitalize on upcoming breakthroughs by scoping out these 25 AI penny stocks showing real promise in the world of artificial intelligence.

- Boost your portfolio’s income stream and stability when you check out these 16 dividend stocks with yields > 3% with attractive yields and strong fundamentals.

- Position yourself ahead of the curve in cutting-edge tech by checking these 28 quantum computing stocks forging the future of computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POOL

Pool

Distributes swimming pool supplies, equipment, related leisure, irrigation, and landscape maintenance products in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives