- United States

- /

- Specialty Stores

- /

- NasdaqGS:EYE

National Vision (EYE): Losses Worsen, Path to Profitability Challenges Investor Optimism

Reviewed by Simply Wall St

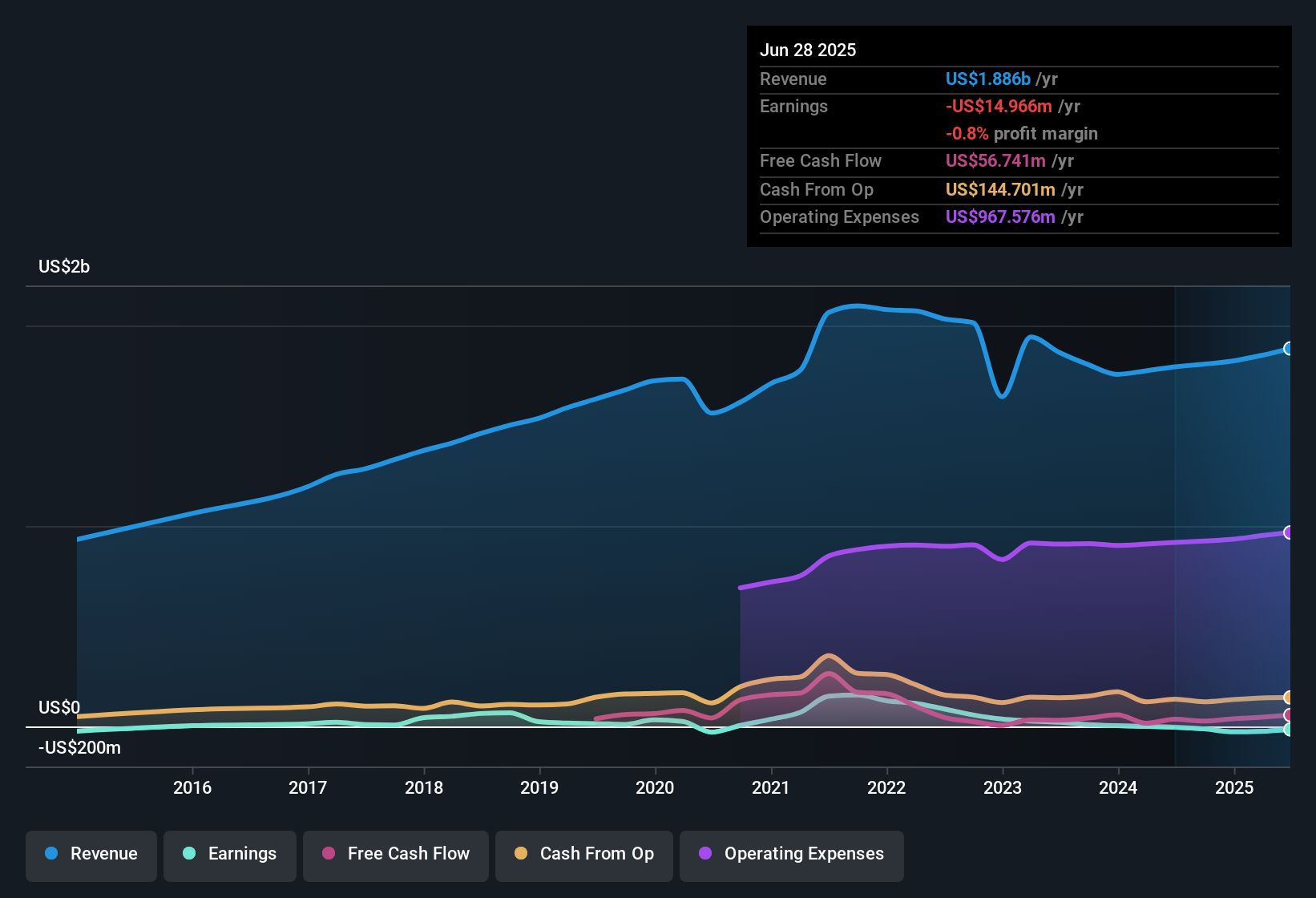

National Vision Holdings (EYE) has deepened its unprofitable streak, with losses compounding at a brisk 56.1% per year over the last five years and a net profit margin that remains in the red, showing no improvement in the past year. Despite the persistent losses, there is a bright spot: earnings are forecast to grow 20.57% annually, and the company is expected to reach profitability within three years, a turnaround rate that is ahead of most in the market. Revenue prospects are more muted, with a projected 4.8% annual growth, trailing the broader US market’s 10.5%, while shares currently trade at $24.7, a notable premium to the estimated fair value of $17.99.

See our full analysis for National Vision Holdings.Next up, we are putting these numbers head-to-head with the most widely held market narratives to see which convictions hold up and which may be up for debate.

See what the community is saying about National Vision Holdings

Managed Care Drives Revenue Upside

- Managed care comp growth has reached double digits, directly lifting revenue per transaction and helping to cushion the company’s overall top-line in a tough retail environment.

- Analysts’ consensus view highlights that:

- Expanded managed care customer base and vision insurance adoption are supporting more resilient patient volumes and boosting average ticket size.

- This trend backs the expectation for sustainable gross margin gains as more insured customers drive higher-value transactions.

Consensus narrative notes these catalysts are giving National Vision a leg up, but it will take more than just insurance-driven traffic to hit ambitious growth targets.

📊 Read the full National Vision Holdings Consensus Narrative.

Profitability Turnaround Hinges on Margins

- Profit margin is projected to swing from -0.8% today to 4.1% in three years, a dramatic shift that would turn National Vision to profitability substantially ahead of many similar retailers.

- According to analysts’ consensus view, the expected jump in margins is underpinned by:

- Ongoing investments in marketing, customer personalization, and premium frame assortments, such as expanding offerings over $99 and new designer partnerships, which are designed to grow both average ticket and overall earnings capacity.

- Strategic store fleet rationalization and use of remote exam technology are expected to further improve margins by driving operational efficiencies and expanding the doctor network.

Valuation Stands Out Versus Peers

- Shares are currently trading at a price-to-sales ratio of 1x compared to peers at 5.4x and the specialty retail industry at 0.4x, reflecting a mixed value story while the $24.70 share price holds a sizeable gap above the DCF fair value of $17.99 but remains 21% below the consensus analyst target of $29.80.

- Analysts’ consensus view points out:

- Believers in the price target are betting that National Vision’s revenue will reach $2.2 billion and earnings will rise to $89.4 million by 2028, putting the shares on a forward PE of 33.6x, well above the sector average.

- This optimistic scenario requires the company to both accelerate profit growth and command a premium multiple, a thesis facing tension from industry competition and macro risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for National Vision Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the figures in a unique way? In just a few minutes, you can build your own version of the story. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding National Vision Holdings.

See What Else Is Out There

National Vision faces inconsistent top-line growth and relies heavily on managed care trends. Its shares trade at a notable premium to calculated fair value.

If you want investments where price better reflects value and potential, uncover opportunities with these 848 undervalued stocks based on cash flows that could offer more compelling entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Vision Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EYE

National Vision Holdings

Through its subsidiaries, operates as an optical retailer in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives