- United States

- /

- Specialty Stores

- /

- NasdaqGS:EYE

A Look at National Vision Holdings (EYE) Valuation After Raised Guidance and Improved Earnings

Reviewed by Simply Wall St

National Vision Holdings (EYE) just released better third-quarter earnings than last year, with increased revenue and a move from loss to profit. The company also raised its earnings guidance for the upcoming year.

See our latest analysis for National Vision Holdings.

The strong third-quarter results and upgraded earnings outlook have sparked some overdue momentum in National Vision Holdings' share price. After a standout 124% year-to-date share price return and more than doubling total shareholder returns in the past 12 months, the latest store expansion plans and persistent growth signals show renewed confidence from investors. However, longer-term holders are still waiting for a sustained comeback after deeper losses over the last three and five years.

If this turnaround story has you thinking about other stocks with rapidly shifting fortunes, now is a perfect time to explore fast growing stocks with high insider ownership.

But with shares rebounding sharply and trading near a 26 percent discount to analyst price targets, is National Vision Holdings now an undervalued growth story, or is the market accurately anticipating its next phase and leaving little room for upside?

Most Popular Narrative: 19% Undervalued

National Vision Holdings’ current share price trades well below the most popular narrative’s fair value estimate, with a sizeable upside gap to close. Investors are weighing the latest business catalysts and margin signals against the broader market’s wariness.

Ongoing premiumization of the frame assortment (increasing frames over $99 from 20% to 40% of mix) and new designer partnerships (e.g., Jimmy Choo, HUGO BOSS) are driving higher average tickets and validating the ability to move upmarket. This assortment evolution supports both near-term gross margin expansion and a longer-term shift in revenue mix.

Curious what bold financial bets went into that valuation? The narrative’s vision counts on a profit leap, fatter margins, and powerful earnings growth, leaving conventional forecasts looking tame. Only the full deep-dive reveals how aggressive these projections get.

Result: Fair Value of $29.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition from online eyewear brands and continued shortages of optometrists could challenge the company’s growth and put pressure on its profit margins.

Find out about the key risks to this National Vision Holdings narrative.

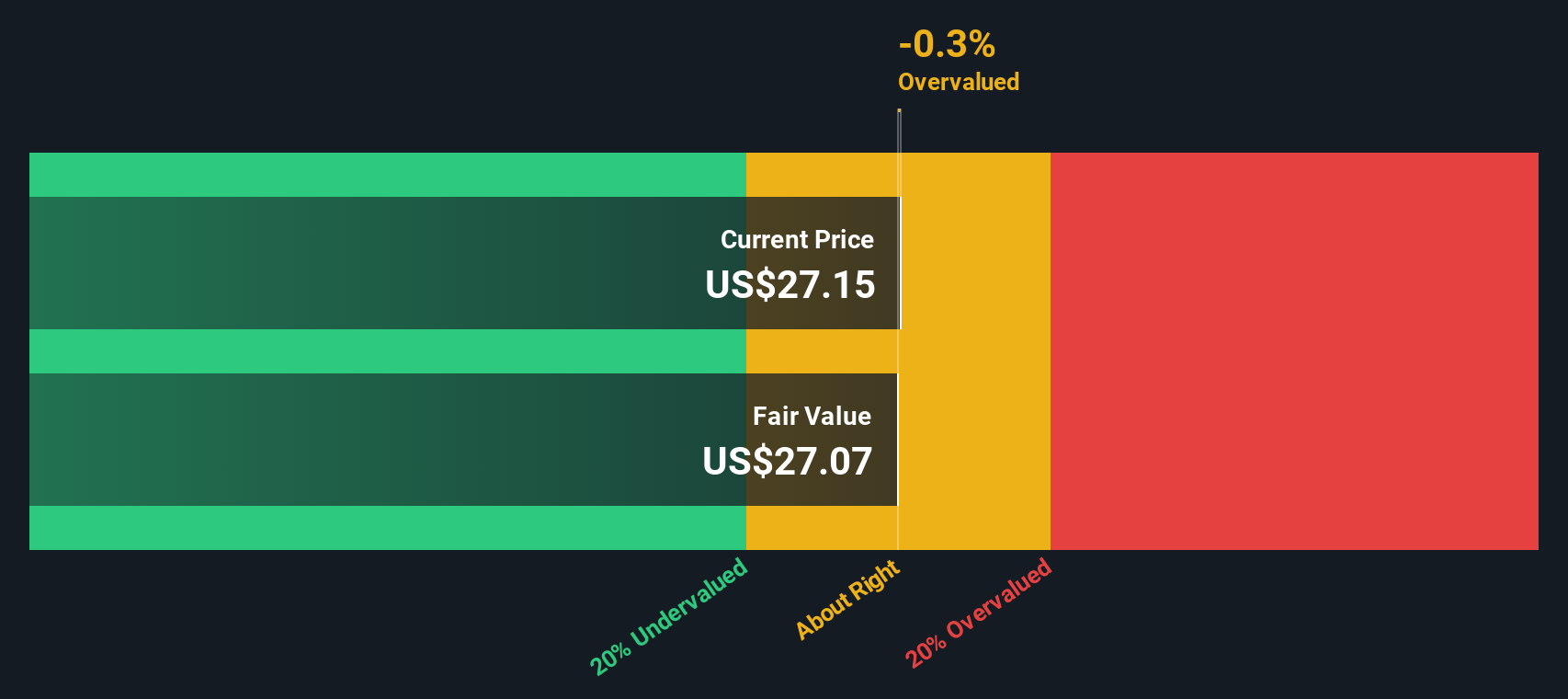

Another View: Discounted Cash Flow Shows a Different Story

While analyst and market-based valuations see National Vision Holdings as having room for upside, our DCF model presents a more cautious picture. The DCF suggests shares are trading above fair value, raising questions about whether expectations for future cash flows are too optimistic or if the market is overlooking hidden challenges.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Vision Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Vision Holdings Narrative

If you want to test your own assumptions or dig deeper into the numbers, you can shape your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding National Vision Holdings.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Your next portfolio win could be just a click away. Use the Simply Wall Street Screener to zero in on stocks with unique potential and strategies that suit your goals.

- Supercharge your search for overlooked opportunities by checking out these 3589 penny stocks with strong financials with impressive financial strength in today’s market.

- Start building smarter income streams by reviewing these 16 dividend stocks with yields > 3% offering yields above 3 percent and solid track records.

- Capitalize on the surge in artificial intelligence with these 25 AI penny stocks poised for growth within this game-changing sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Vision Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EYE

National Vision Holdings

Through its subsidiaries, operates as an optical retailer in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives