- United States

- /

- Specialized REITs

- /

- NYSEAM:PW

I Ran A Stock Scan For Earnings Growth And Power REIT (NYSEMKT:PW) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Power REIT (NYSEMKT:PW), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Power REIT

Power REIT's Improving Profits

In the last three years Power REIT's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Power REIT's EPS shot from US$0.33 to US$0.68, over the last year. Year on year growth of 107% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Power REIT's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. The good news is that Power REIT is growing revenues, and EBIT margins improved by 8.6 percentage points to 75%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

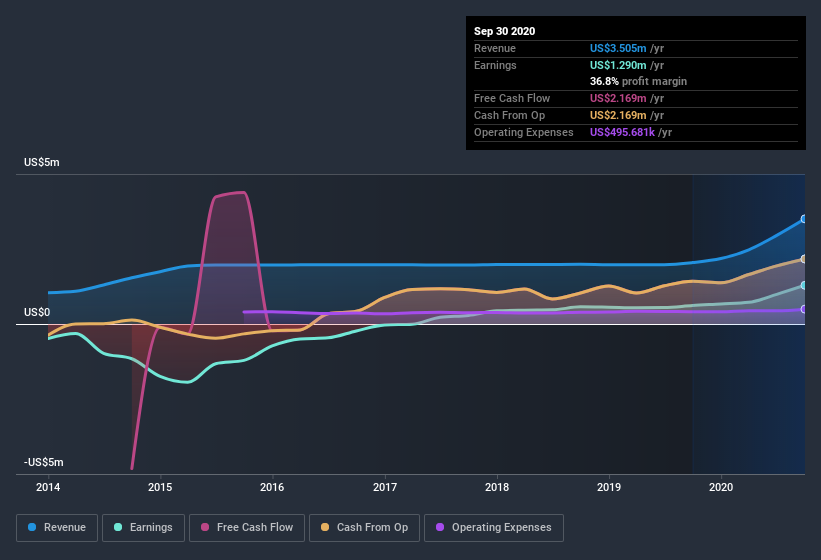

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Power REIT isn't a huge company, given its market capitalization of US$57m. That makes it extra important to check on its balance sheet strength.

Are Power REIT Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Power REIT shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that David Lesser, the Chairman of the company, paid US$7.4k for shares at around US$9.25 each.

The good news, alongside the insider buying, for Power REIT bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$17m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 30% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Power REIT To Your Watchlist?

Power REIT's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Power REIT deserves timely attention. Before you take the next step you should know about the 5 warning signs for Power REIT (1 doesn't sit too well with us!) that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Power REIT, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Power REIT or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:PW

Power REIT

Power REIT (ticker: PW) is a real-estate investment trust (REIT) that owns real estate related to properties for Controlled Environment Agriculture (greenhouses), Renewable Energy and Transportation.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives