- United States

- /

- Specialized REITs

- /

- NYSE:WY

A Look at Weyerhaeuser’s (WY) Valuation After Strong Q3 Earnings Growth

Reviewed by Simply Wall St

Weyerhaeuser (WY) just posted third-quarter earnings that showcase a strong rebound from a year ago. Net income and earnings per share both more than doubled for the period. Investors are watching closely to gauge what is behind this momentum.

See our latest analysis for Weyerhaeuser.

Weyerhaeuser’s recent buyback activity and strong earnings have not reversed the drift in its stock price, with a 1-year total shareholder return of -25.5% and shares now trading at $23.08. The momentum has cooled over the past year, reflecting cautious investor sentiment even after the company’s notable operational improvements.

If you’re curious about what other companies are demonstrating resilience and growth, now is a great opportunity to broaden your investing universe and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets even after a strong quarter, the central question is whether Weyerhaeuser is currently undervalued or if the market has already adjusted for future growth. Could this be a buying opportunity?

Most Popular Narrative: 25.7% Undervalued

With Weyerhaeuser’s fair value pegged at $31.08, substantially above its last close at $23.08, the popular narrative suggests room for considerable upside. Industry watchers are zeroing in on enterprise changes and forward earnings power as key drivers.

The carbon capture and sequestration (CCS) agreement with Occidental Petroleum represents a growth opportunity in Weyerhaeuser's Natural Climate Solutions business, likely boosting future earnings. Ongoing construction of the EWP facility in Arkansas and return to normal operations at the Montana facility will drive increased production, positively impacting revenue and net margins.

Curious what backs that bullish price target? Find out the bold assumptions on future earnings, margin expansion, and industry catalysts that power this storyline. There’s more driving this valuation than most investors realize. Dive in to uncover the hidden levers that analysts are betting on.

Result: Fair Value of $31.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, external pressures such as a ban on US log imports by China and ongoing macroeconomic uncertainty could limit Weyerhaeuser’s recovery despite these bullish forecasts.

Find out about the key risks to this Weyerhaeuser narrative.

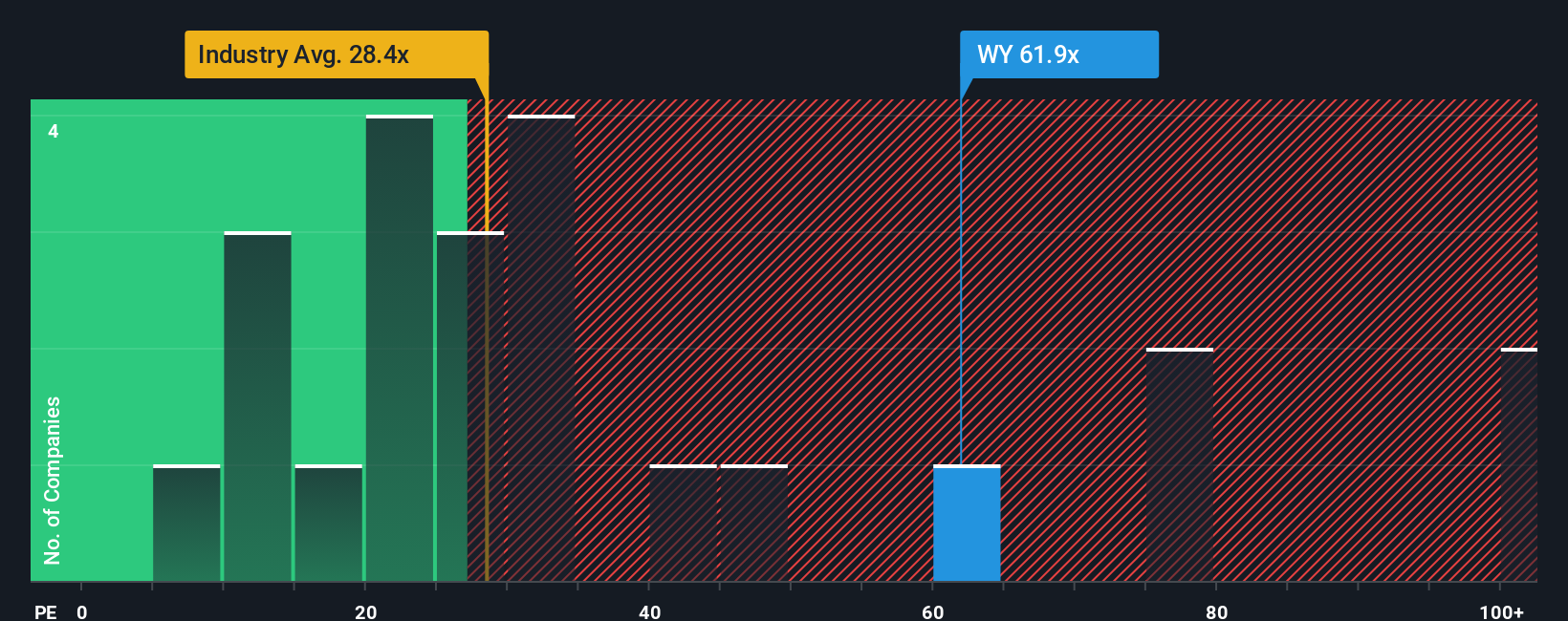

Another View: Multiples and Market Comparisons

Looking from another angle, Weyerhaeuser’s current price-to-earnings ratio sits at 50.3x, which is sharply higher than both its own fair ratio of 47.2x and the peer group average of 28.2x. This significant premium suggests the market may be pricing in a lot of optimism, increasing valuation risk. Is there a good reason to justify paying up, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Weyerhaeuser Narrative

If the prevailing story doesn’t quite fit your perspective or you want to dig deeper, the tools are here to help you build your own analysis in just a few clicks, so why not Do it your way

A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Opportunities?

Don’t wait for the next big winner to pass you by. Expand your stock portfolio by tapping into powerful investment ideas the pros are tracking right now.

- Capture greater income potential by reviewing these 16 dividend stocks with yields > 3% offering yields above 3% for committed long-term investors.

- Supercharge your portfolio’s tech exposure with these 25 AI penny stocks that are harnessing artificial intelligence to revolutionize core industries.

- Protect your capital and identify market mispricing through these 874 undervalued stocks based on cash flows chosen for their attractive cash flow valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900 and today owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives