- United States

- /

- Office REITs

- /

- NYSE:VNO

Profit Rebound and Manhattan Leasing Momentum Might Change The Case For Investing In Vornado Realty Trust (VNO)

Reviewed by Sasha Jovanovic

- Vornado Realty Trust recently reported its third-quarter 2025 results, achieving a turnaround with net income of US$27.12 million compared to a net loss a year earlier, supported by revenue of US$453.7 million and key gains from property transactions including a master lease with New York University.

- Investor interest was further fueled by Vornado's strong leasing activity in Manhattan, acquisition and redevelopment plans for 623 Fifth Avenue, and expectations for increased Penn District occupancy and robust rent growth.

- We’ll explore how Vornado’s improved profitability and leasing momentum in premium Manhattan offices could shape its future investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Vornado Realty Trust Investment Narrative Recap

To be a shareholder in Vornado Realty Trust, you likely need to believe that premium Manhattan offices will sustain strong tenant demand and pricing power as the Penn District redevelopment and high-profile leases come online. The recent return to profitability was aided by one-off gains but did not meaningfully change the core short-term catalyst: rising Manhattan occupancy and robust rent growth. The biggest risk remains the earnings impact of ongoing property sales and redevelopment, which may limit near-term growth even as longer-term prospects improve.

Among Vornado’s recent announcements, its acquisition and redevelopment plans for 623 Fifth Avenue stand out. This initiative is closely related to Manhattan’s premium office momentum, an area that is central to both Vornado's growth catalysts and investor optimism around higher occupancy and rental rates.

Yet, in contrast, investors should be aware that near-term earnings could remain muted as major redevelopments shift revenue timing and...

Read the full narrative on Vornado Realty Trust (it's free!)

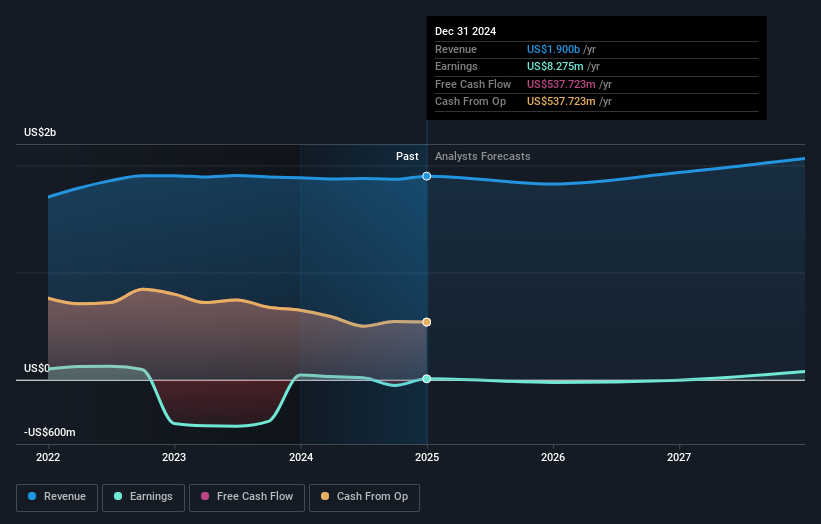

Vornado Realty Trust's outlook points to $2.1 billion in revenue and $21.9 million in earnings by 2028. Achieving this implies a 3.0% annual revenue growth rate, but a significant decrease in earnings, down $790.8 million from the current $812.7 million.

Uncover how Vornado Realty Trust's forecasts yield a $39.80 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s two fair value estimates for Vornado Realty Trust range from US$39.80 to US$42.03. These views precede the recent earnings turnaround but highlight how investor conviction about Manhattan rent growth continues to shape performance expectations, see how your own assumptions compare to theirs.

Explore 2 other fair value estimates on Vornado Realty Trust - why the stock might be worth as much as 13% more than the current price!

Build Your Own Vornado Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vornado Realty Trust research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Vornado Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vornado Realty Trust's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNO

Vornado Realty Trust

Vornado Realty Trust (“Vornado”) is a fully-integrated real estate investment trust (“REIT”) and conducts its business through, and substantially all of its interests in properties are held by, Vornado Realty L.P.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives