- United States

- /

- Specialized REITs

- /

- NYSE:VICI

Does VICI Properties Offer Real Value After Its Latest Resort Acquisitions in 2025?

Reviewed by Bailey Pemberton

- Wondering if VICI Properties stock is delivering real value or just gaming the market? Let’s dig into what might set it apart from other real estate investments.

- The stock recently edged up 1.2% over the past week but is still down 2.0% for the last 30 days. This hints at shifting sentiment and a possible turning point in perceived risk or growth potential.

- Recent headlines have pointed to VICI Properties’ continued expansion in the gaming and hospitality sectors, including the acquisition of high-profile resort assets and long-term lease agreements with top casino operators. These moves have cemented its role as a leading player in experiential real estate, fueling both optimism and questions around future growth.

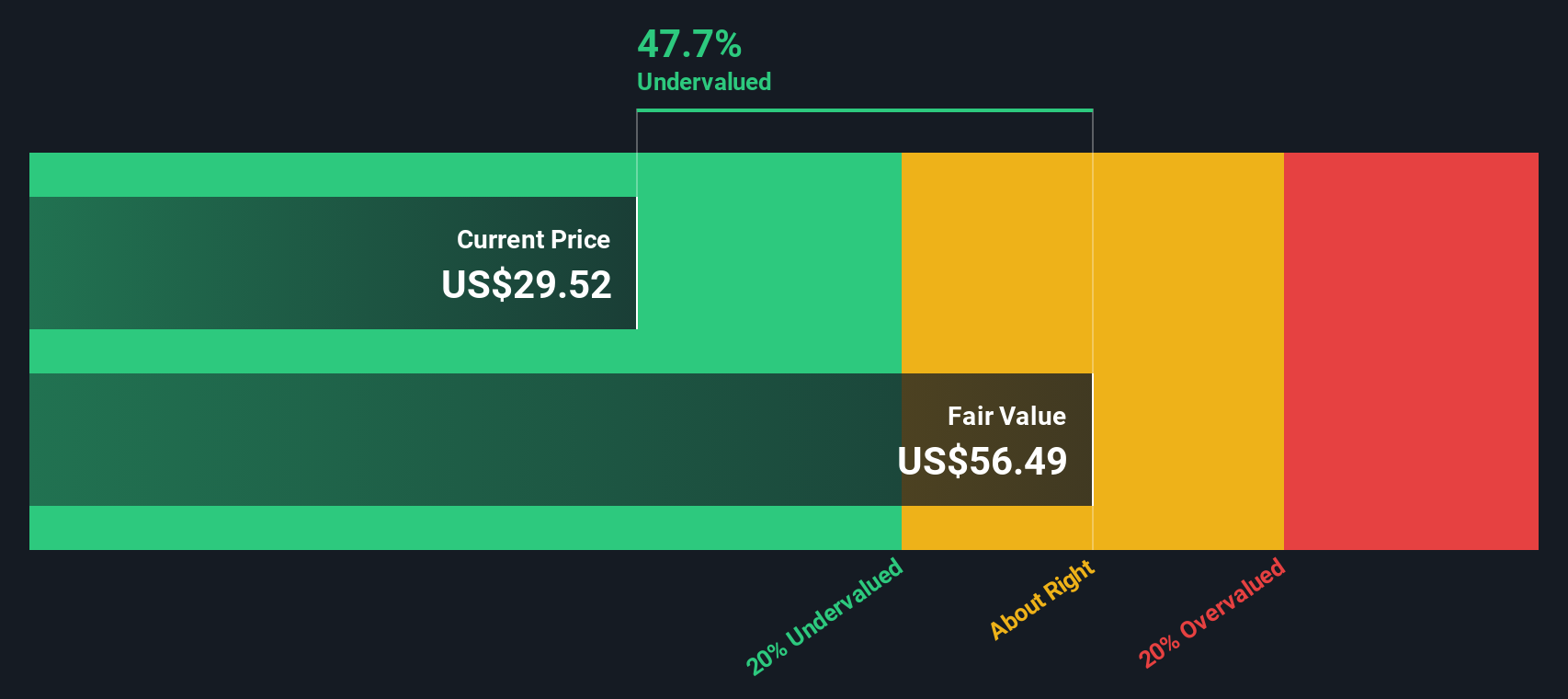

- The company has scored a perfect 6/6 on our valuation checks, suggesting it may be noticeably undervalued right now. We’ll look closely at the different ways to analyze this stock’s value. Stick with us until the end to discover an approach that goes beyond just the numbers.

Approach 1: VICI Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future adjusted funds from operations, then discounting those expected cash flows back to their worth today. For VICI Properties, this method relies on estimates of future free cash flow (FCF) and applies a two-stage approach. Analyst projections are used for the initial period, with extrapolations for growth in the longer term.

Currently, VICI Properties is generating free cash flow of about $2.37 billion. Analyst forecasts suggest steady growth, with FCF expected to reach nearly $2.98 billion by the end of 2028. Beyond the five-year analyst forecast window, projections continue as estimated by Simply Wall St, resulting in FCF of around $3.97 billion by 2035. All cash flows are calculated in US dollars for consistency.

Based on this DCF model, the estimated intrinsic value of a VICI Properties share is $55.15. Compared to the current share price, this implies the stock is trading at a substantial 45.0% discount to its underlying value. In other words, the model indicates that the market may be undervaluing VICI Properties based on its cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests VICI Properties is undervalued by 45.0%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

Approach 2: VICI Properties Price vs Earnings

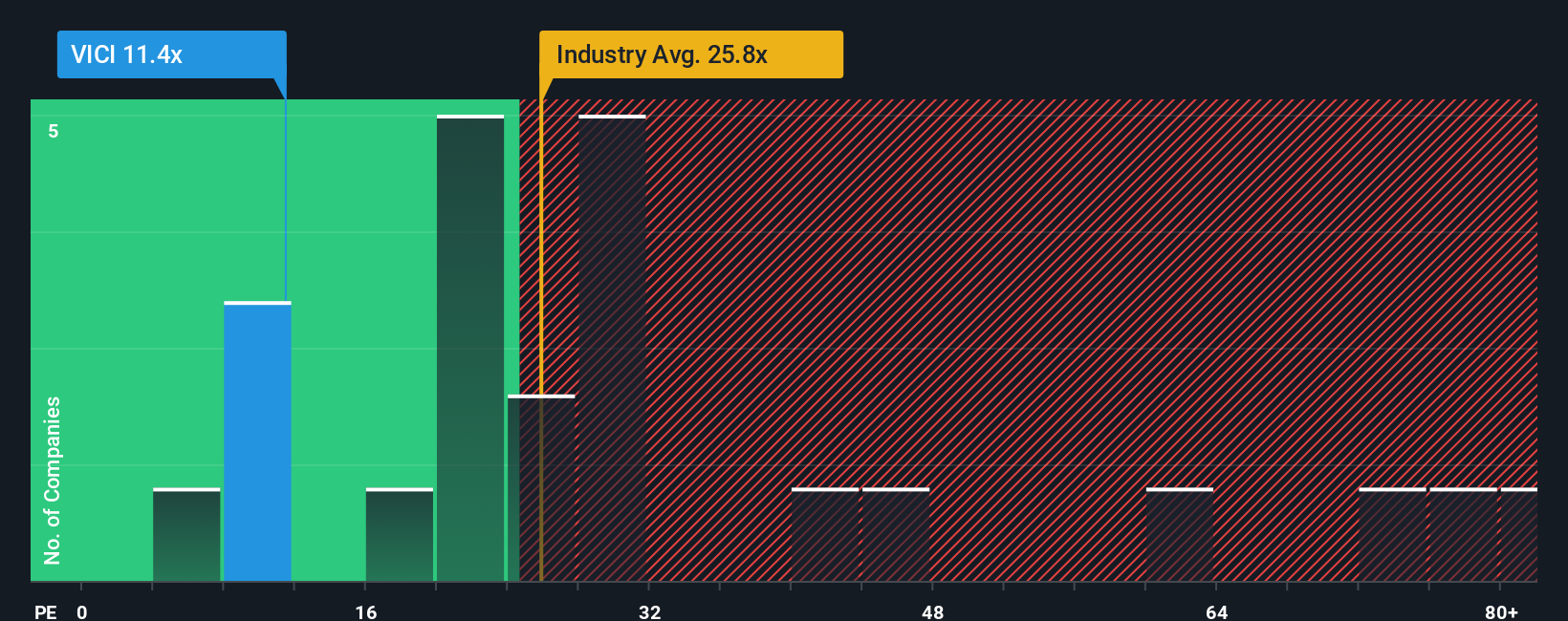

The Price-to-Earnings (PE) ratio is a commonly used metric for valuing profitable companies because it captures the market’s expectations of a company’s future earnings power. For companies generating solid profits like VICI Properties, the PE ratio helps investors quickly compare valuation across businesses, factoring in how much they are paying for each dollar of earnings.

It is important to note that a "normal" or "fair" PE ratio is not the same for every company. Higher growth prospects and lower risk generally justify a higher PE because investors are willing to pay more for future earnings, while companies with lower growth or higher risks trade at lower multiples.

VICI Properties currently trades on a PE ratio of 11.6x, which is noticeably lower than the industry average of 17.0x and well below the peer average of 22.9x for specialized REITs. This initially signals a possible bargain. However, looking deeper, the Simply Wall St Fair Ratio for VICI Properties is calculated at 32.2x. The Fair Ratio is Simply Wall St’s proprietary estimate of what the company’s PE should be, based on earnings growth, profit margins, risk profile, market cap, and its competitive landscape.

Relying solely on peer or industry averages can be misleading, as these do not account for the qualities unique to VICI Properties, such as steady earnings growth, its large size, and resilient business model. The Fair Ratio reflects these factors directly, giving a more tailored view of value.

Comparing the Fair Ratio of 32.2x to VICI Properties’ actual PE of 11.6x, the stock appears significantly undervalued on this measure alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your VICI Properties Narrative

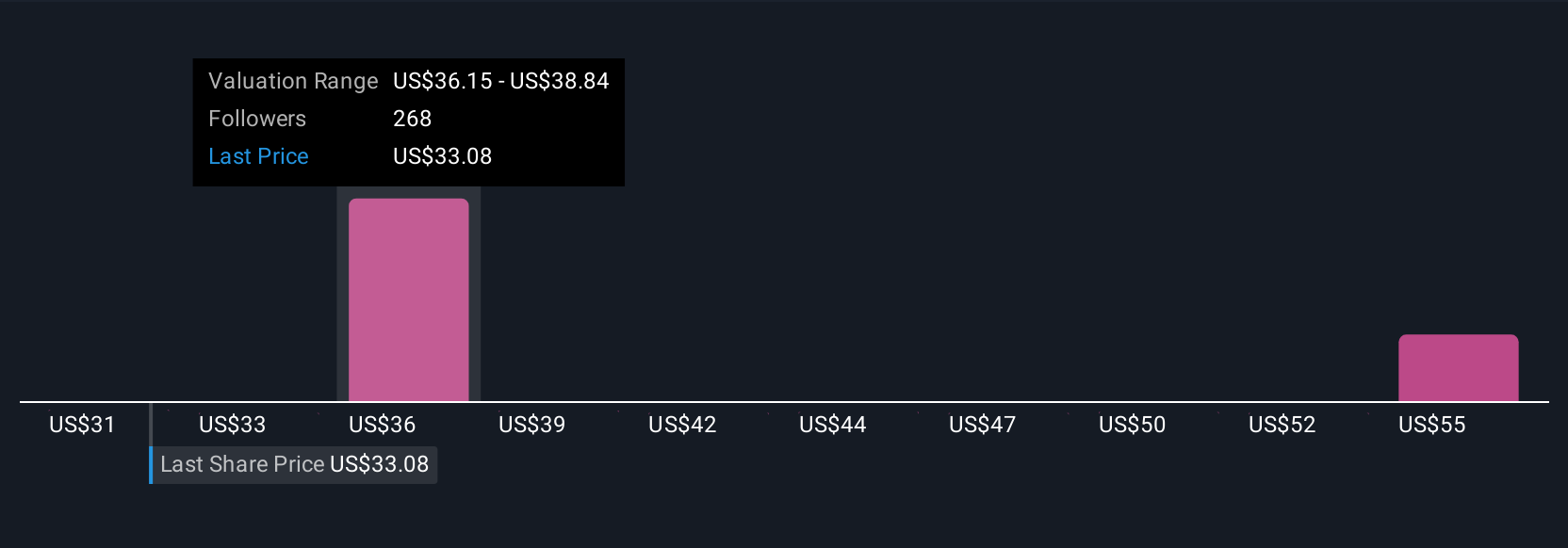

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company, where you connect your assumptions about its future, such as revenue and margins, with a clear financial forecast and your estimate of fair value. This is all grounded in your unique perspective. This approach puts the "why" behind the numbers front and center, making investment analysis not just about ratios but about how you see VICI Properties evolving.

Available right on Simply Wall St’s Community page, Narratives let millions of investors define and share their outlooks for VICI Properties or any other company in a simple, accessible way. They empower you to make confident decisions by benchmarking your own Fair Value against the current Price. Whenever news breaks, earnings are released, or forecasts shift, your Narrative automatically updates so your analysis stays relevant.

For instance, some VICI Properties investors are optimistic and see a long runway for earnings growth, setting fair values as high as $44.00 based on expected expansion in experiential assets. Others are more cautious, highlighting industry risks or slower growth, with fair values closer to $34.00. Narratives make it easy to see these diverse viewpoints at a glance, helping you make smarter, story-driven investment decisions.

Do you think there's more to the story for VICI Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives