- United States

- /

- Industrial REITs

- /

- NYSE:STAG

A Fresh Look at STAG Industrial (STAG) Valuation Following Q3 Growth and Expansion Moves

Reviewed by Simply Wall St

STAG Industrial (STAG) just posted growth in both revenue and net income for the third quarter, which reinforces confidence in its recent financial results. Management also discussed the increased pace of acquisitions and pointed to a more active expansion strategy.

See our latest analysis for STAG Industrial.

STAG Industrial’s recent acquisition momentum and upbeat quarterly results appear to have fueled a steady run in its shares, with a 7.1% share price return over the past month and an impressive 18.2% year-to-date. Looking at the bigger picture, long-term investors have seen a 53.6% total shareholder return over five years. This suggests that momentum is building as management executes on its growth strategy.

If STAG’s active approach has you considering broader opportunities, now might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares already reflecting strong gains and management signaling optimism about future deals, the key question now is whether STAG Industrial’s current price offers further upside or if the market has already priced in its growth prospects.

Most Popular Narrative: 2% Undervalued

STAG Industrial’s widely followed narrative pegs its fair value at $39.67 per share, slightly above the recent close of $39.00. This subtle upside is being driven by confidence in STAG’s operational execution and sector advantage, but the margin for error remains thin and makes pivotal financial assumptions even more important.

The company is expanding its development pipeline and acquisition activity at a time when average lease-up periods are lengthening and industrial supply in some markets, especially larger "big box" assets, is leading to elevated and persistent vacancies, raising the risk of future revenue shortfalls and net margin compression if supply-demand balance worsens.

Want to know which razor-thin margin is fueling that premium? The heart of this narrative is a bold call on shrinking profit margins and slowing revenue growth, yet the formula still lands on a price above where the market sits now. Ready to see which surprising forecasts and assumptions make that high bar possible? Don’t miss the key numbers and dramatic turning points that could decide STAG’s next move.

Result: Fair Value of $39.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing vacancies in key markets and a shift toward larger tenant preferences could disrupt growth and challenge STAG's long-term earnings momentum.

Find out about the key risks to this STAG Industrial narrative.

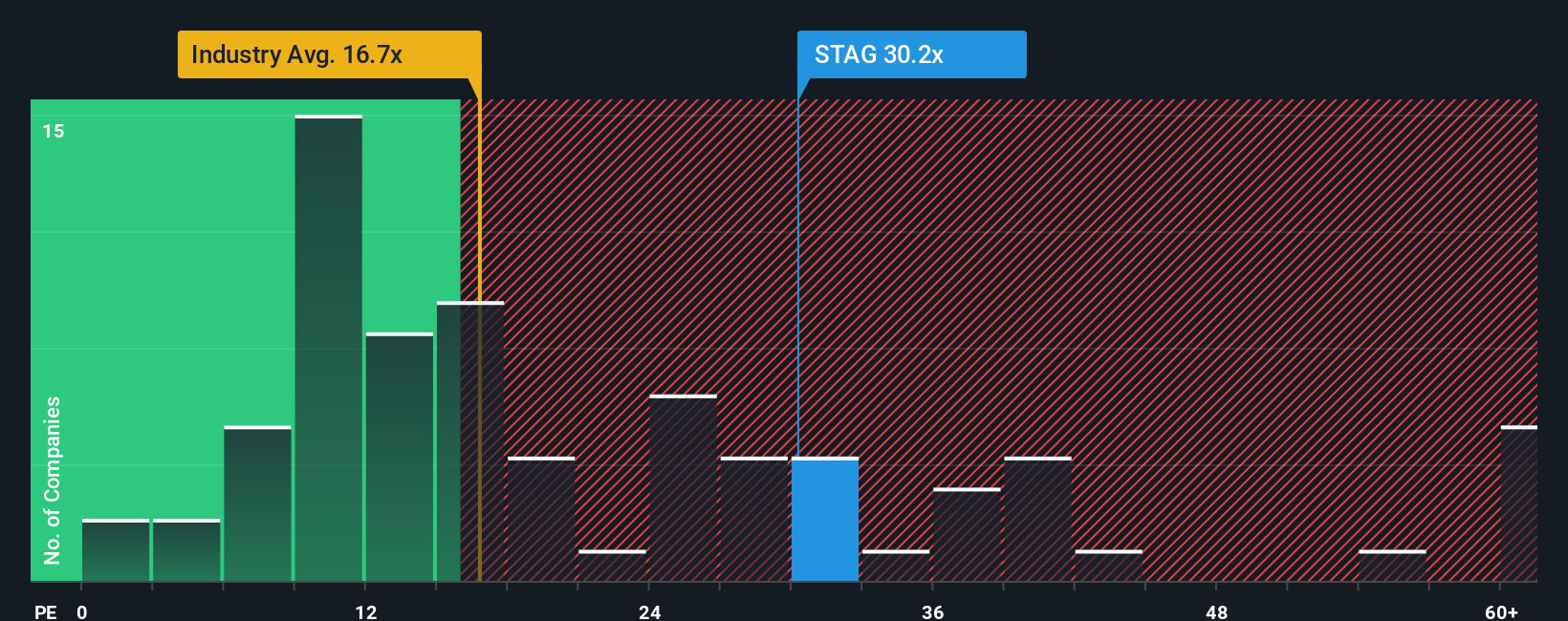

Another View: A Look at Market Multiples

While the fair value narrative suggests STAG Industrial has some upside, looking at its price-to-earnings ratio tells a different story. At 30.2x, STAG trades above both its peer average of 29.7x and the broader Global Industrial REITs group at 17.1x, and even slightly above its fair ratio of 29.4x. This signals that the market may already be pricing in a lot of optimism. Could that leave little room for further gains, or is there overlooked opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STAG Industrial Narrative

If you see things differently or want to dive into the details yourself, you can craft your own view in just a few minutes, your way. Do it your way.

A great starting point for your STAG Industrial research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. Expand your portfolio with fresh stocks handpicked for their standout potential. The right screen could unlock your next big winner.

- Boost your cash flow with reliable yields by tapping into these 16 dividend stocks with yields > 3% delivering income above the market average.

- Capitalize on tomorrow’s artificial intelligence breakthroughs by checking out these 24 AI penny stocks already making waves in next-generation technology.

- Capture undervalued gems and get ahead of the market by starting your search with these 876 undervalued stocks based on cash flows built on real cash flow insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STAG

STAG Industrial

A real estate investment trust focused on the acquisition, development, ownership, and operation of industrial properties throughout the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives