- United States

- /

- Office REITs

- /

- NYSE:SLG

SL Green Realty (SLG): Evaluating Valuation After Strong Q3 Earnings and New Acquisitions

Reviewed by Simply Wall St

SL Green Realty (SLG) just posted third-quarter earnings that outperformed expectations, highlighting the company’s progress on both financial and operational fronts. Recent acquisitions and upbeat leasing activity are fueling a more optimistic view for investors.

See our latest analysis for SL Green Realty.

SL Green Realty’s latest results and deal activity are set against a year of tough share price performance. The stock sits at $50.27, having notched a 30-day share price return of -14.9% and a total shareholder return of -34.8% over one year. That said, management’s upbeat tone, recent property acquisitions, and stronger leasing activity are all bright spots fueling hopes for a turnaround as momentum begins to rebuild.

If you’re looking to find the next growth story or a fresh opportunity, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

The question now facing investors is whether SL Green’s recent outperformance and revitalized prospects signal an undervalued opportunity, or if the stock’s fundamentals and future growth are already fully reflected in its current price.

Most Popular Narrative: 19% Undervalued

SL Green Realty’s fair value, according to the prevailing narrative, sits well above the last close of $50.27. This points to an opportunity for appreciation driven by recent upgrades in revenue forecasts and bullish assumptions about New York’s office market. The narrative relies on emerging growth drivers and optimism about portfolio moves as key ingredients behind this fair value.

Portfolio optimization and disciplined capital recycling, including strategic dispositions and realizing significant gains on debt and preferred equity investments, are strengthening liquidity. This sets the stage for new accretive investments and reduces interest expense to enhance future earnings growth.

Want to know how a blend of bold future margin assumptions and recent revenue upgrades is being used to justify this valuation? The narrative’s calculations hinge on financial projections that most office REITs can only dream of matching. Ready to see which surprising financial levers are baked into this fair value estimate? Dive into the details to see what’s really driving this story.

Result: Fair Value of $62.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and unpredictable asset sales could still challenge SL Green’s earnings trajectory and investor sentiment in the months ahead.

Find out about the key risks to this SL Green Realty narrative.

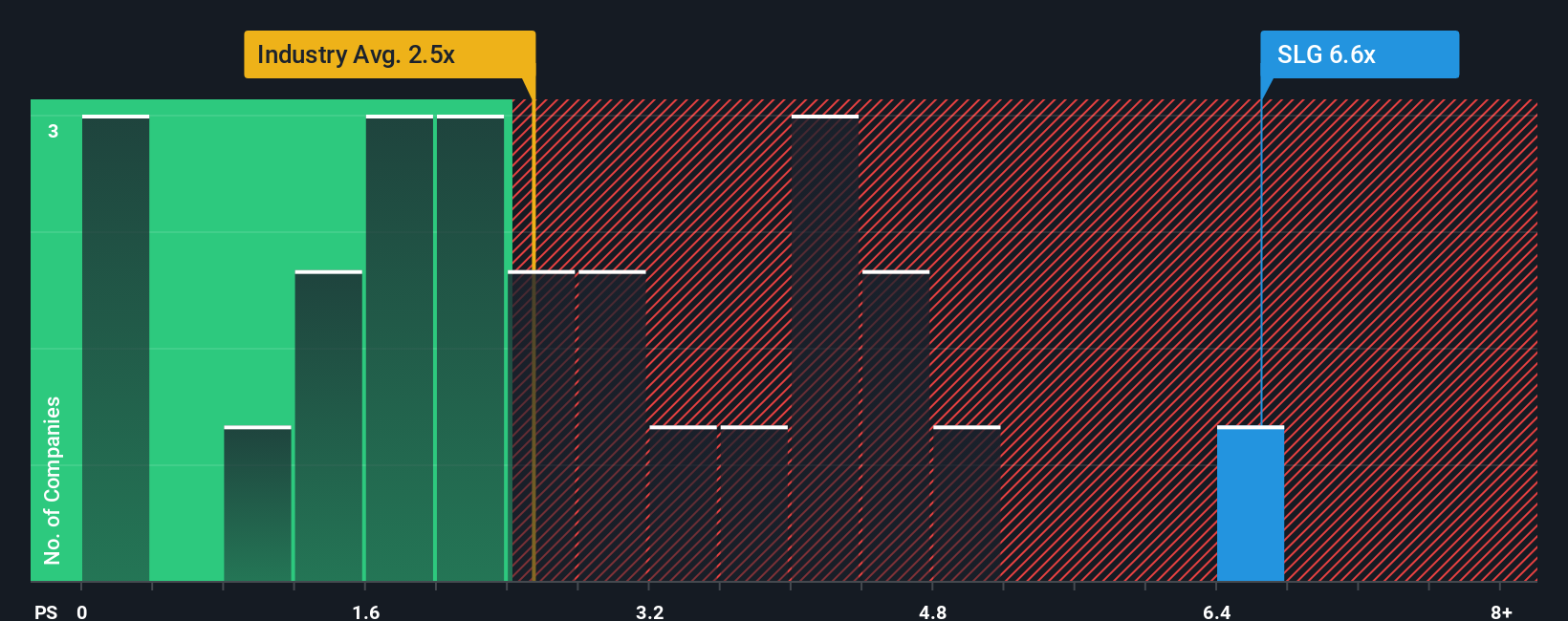

Another View: Market Multiples Tell a Different Story

While fair value narratives suggest SL Green Realty is undervalued, current market multiples throw up some caution flags. The company’s price-to-sales ratio stands at 5.4x, which is significantly higher than the US Office REITs industry average of 2.2x and the peer average of 4.3x. The fair ratio, at just 2.2x, hints the market could reprice lower if optimism fades. Are investors betting too much on a turnaround, or could premiums persist as the Manhattan story unfolds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SL Green Realty Narrative

If you see the numbers differently or want to dig into the details yourself, you can shape your own SL Green Realty outlook in just minutes, your way. Do it your way

A great starting point for your SL Green Realty research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready to Uncover More Smart Investment Opportunities?

There's a world of promising stocks waiting beyond SL Green Realty. Don’t let fresh market breakthroughs and tomorrow’s big winners slip through your fingers. Let the Simply Wall Street Screener guide your next moves.

- Jump into the hunt for strong income potential with these 17 dividend stocks with yields > 3%, offering healthy yields that could boost your returns beyond the market average.

- Capture the upside in emerging technology by checking out these 25 AI penny stocks, shaping everything from automation to real-world AI solutions.

- Tap into unrecognized gems by reviewing these 857 undervalued stocks based on cash flows that the market might be overlooking. This could give you a powerful edge on value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLG

SL Green Realty

SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing the value of Manhattan commercial properties.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives