- United States

- /

- Retail REITs

- /

- NYSE:NNN

Did Record Acquisitions and Raised Outlook Just Shift NNN REIT's (NNN) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, NNN REIT, Inc. reported strong third-quarter 2025 results with revenue of US$230.16 million, exceeding prior-year levels, and raised its outlook for Core and Adjusted Funds From Operations per share following a record US$283 million in real estate acquisitions.

- Along with boosting its full-year acquisition and disposition volume expectations, NNN increased its quarterly dividend and highlighted robust liquidity, reinforcing confidence in operational growth despite a small dip in occupancy rates.

- We'll assess how the record-setting acquisition activity and higher guidance could shift NNN REIT's long-term investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

NNN REIT Investment Narrative Recap

To be a shareholder in NNN REIT, you need to believe that its focus on necessity-based retail properties and disciplined acquisitions will enable sustained revenue and dividend growth, even in a changing retail landscape. The recent record-breaking acquisitions and raised guidance strengthen the short-term catalyst of robust external growth, while the persistent risk of tenant bankruptcies and occupancy dips remains, though the latest report shows the impact on near-term outlook is limited.

Among recent announcements, NNN REIT’s guidance increase for acquisition volume and the resulting 3.4% dividend boost stand out. This move highlights the company’s strategy of leveraging portfolio expansion and stable cash flow to deliver consistent shareholder returns, reinforcing the growth catalyst driven by new property investments.

By contrast, investors should keep in mind the exposure to tenant financial health and the potential for higher vacancy rates if sector challenges persist…

Read the full narrative on NNN REIT (it's free!)

NNN REIT's narrative projects $1.0 billion revenue and $425.2 million earnings by 2028. This requires 4.6% yearly revenue growth and a $33.1 million earnings increase from $392.1 million today.

Uncover how NNN REIT's forecasts yield a $44.54 fair value, a 9% upside to its current price.

Exploring Other Perspectives

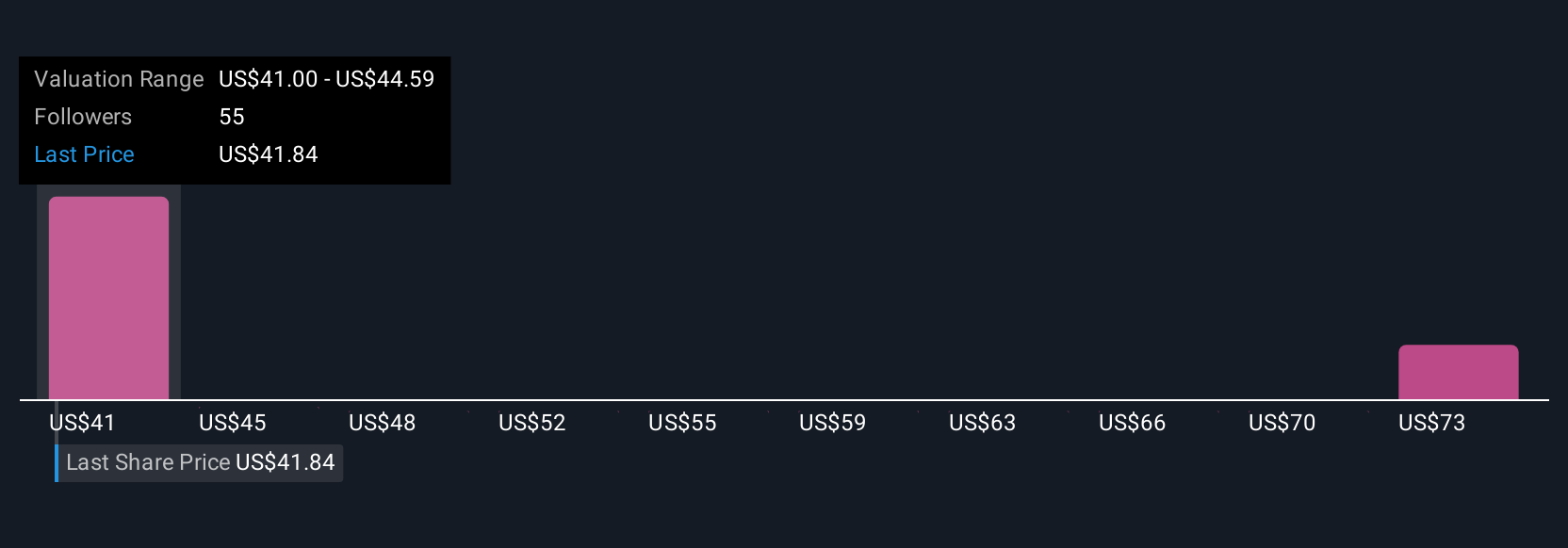

Four fair value estimates from the Simply Wall St Community span US$41 to US$73.07 per share. While expansion plans fuel optimism, tenant risk and occupancy pressure continue to shape sentiment and future performance.

Explore 4 other fair value estimates on NNN REIT - why the stock might be worth as much as 80% more than the current price!

Build Your Own NNN REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NNN REIT research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NNN REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NNN REIT's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NNN REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NNN

NNN REIT

NNN invests in high-quality properties subject generally to long-term, net leases with minimal ongoing capital expenditures.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives