- United States

- /

- Office REITs

- /

- NYSE:KRC

Kilroy Realty (KRC): Assessing Valuation After a 10% Share Price Rally

Reviewed by Simply Wall St

Kilroy Realty (KRC) shares have moved higher over the past month, gaining about 10%. Investors are keeping an eye on how the company is navigating the shifting office real estate market as well as current economic headwinds.

See our latest analysis for Kilroy Realty.

Kilroy Realty's 1-year total shareholder return of 11.5% shows the stock has delivered solid gains, especially given its nearly 10% increase in share price over the last month. The momentum suggests investor confidence is rebounding as the company navigates lingering uncertainties in the office real estate market.

If you’re eyeing what’s next in the market, this is a perfect moment to expand your perspective and discover fast growing stocks with high insider ownership

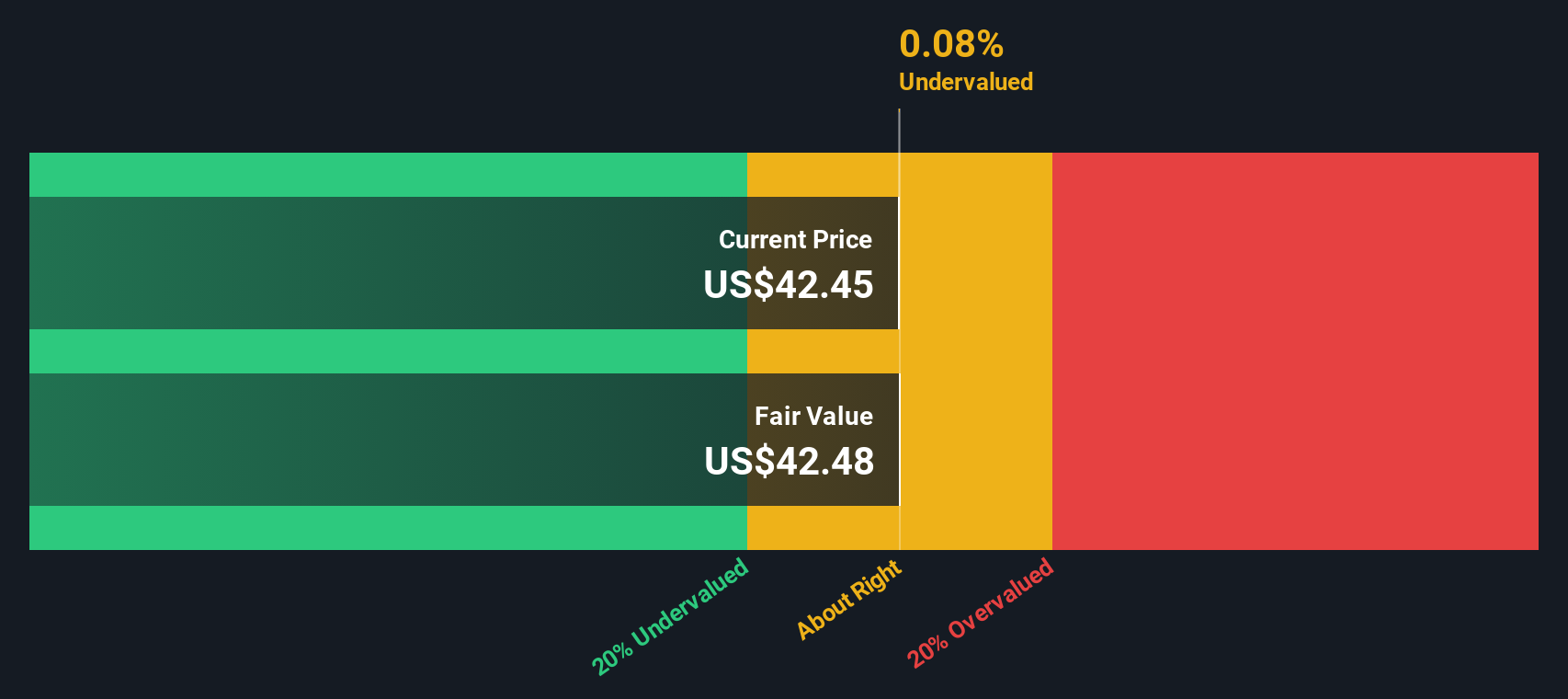

With shares rallying and solid shareholder returns, the real question now is whether Kilroy Realty is still trading at a discount or if the recent gains mean markets have already priced in the company’s prospects. Could there be more upside ahead, or is the opportunity fading?

Most Popular Narrative: 3.5% Overvalued

According to the most popular narrative, Kilroy Realty's fair value estimate sits just below its last close price of $43.48. With analyst consensus pointing to a slight overvaluation, investors are weighing whether recent gains can be sustained as market pressures mount.

The need for ongoing significant ESG investments to keep buildings compliant with tenant and investor sustainability demands may strain capital expenditures. Failure to keep up could risk reputation and occupancy, while maintaining compliance may weigh on net margins.

Want to know how ambitious bets on sustainability and dramatic margin shifts shape this valuation? The narrative hinges on projections that just might surprise you. Curious what moves the needle on this price target? Explore the full narrative to unveil the numbers driving this story.

Result: Fair Value of $42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a quicker than expected rebound in San Francisco’s leasing activity or strong demand from AI and biotech tenants could spark a more optimistic outlook.

Find out about the key risks to this Kilroy Realty narrative.

Another View: What Does the SWS DCF Model Say?

While the market multiple approach points to a slight overvaluation, our DCF model suggests a different story. The SWS DCF fair value estimate is $47.47, which is 8.4% above Kilroy Realty’s recent share price. Could this signal hidden upside, or is the market pricing in risks not captured by the cash flow model?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kilroy Realty Narrative

If you want to take a closer look or think you see the story differently, you can dig into the details and craft your perspective in just a few minutes. Do it your way

A great starting point for your Kilroy Realty research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to boost your investing edge even further, don’t stop at Kilroy Realty. Uncover fresh opportunities simply by using the right tools, as these unique screens could help you spot tomorrow’s winners before the crowd does.

- Snap up potential growth plays early and find hidden gems among these 3585 penny stocks with strong financials with robust fundamentals and momentum on their side.

- Capture the AI revolution before it becomes mainstream by checking out these 25 AI penny stocks, which includes tech leaders powering the next wave of innovation.

- Maximize your passive income strategy by tapping into these 16 dividend stocks with yields > 3% offering attractive yields and consistent payout histories above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kilroy Realty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRC

Kilroy Realty

Kilroy is a leading U.S. landlord and developer, with operations in San Diego, Los Angeles, the San Francisco Bay Area, Seattle, and Austin.

6 star dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives