- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Does the Recent Data Center Expansion Signal Opportunity for Digital Realty Trust?

Reviewed by Bailey Pemberton

- Wondering if Digital Realty Trust is actually a bargain, or if you would be overpaying in today’s market? You are not alone, and the answer might be more nuanced than it first appears.

- The stock has dropped 1.4% over the past week and 3.9% in the last month, and is currently down 4.9% for the year. Its three-year return stands at an impressive 72.4%.

- Recent headlines have focused on the growing demand for data centers, with Digital Realty Trust expanding its global footprint to meet surging AI and cloud infrastructure needs. Investors are watching closely as new partnerships and acquisitions could shift the risk and reward profile for the company.

- On our valuation checks, Digital Realty Trust currently scores just 2 out of 6, suggesting there may be better opportunities elsewhere. However, a deep dive into different valuation approaches is next, with a look at an even smarter way to judge a stock’s worth coming at the end.

Digital Realty Trust scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Digital Realty Trust Discounted Cash Flow (DCF) Analysis

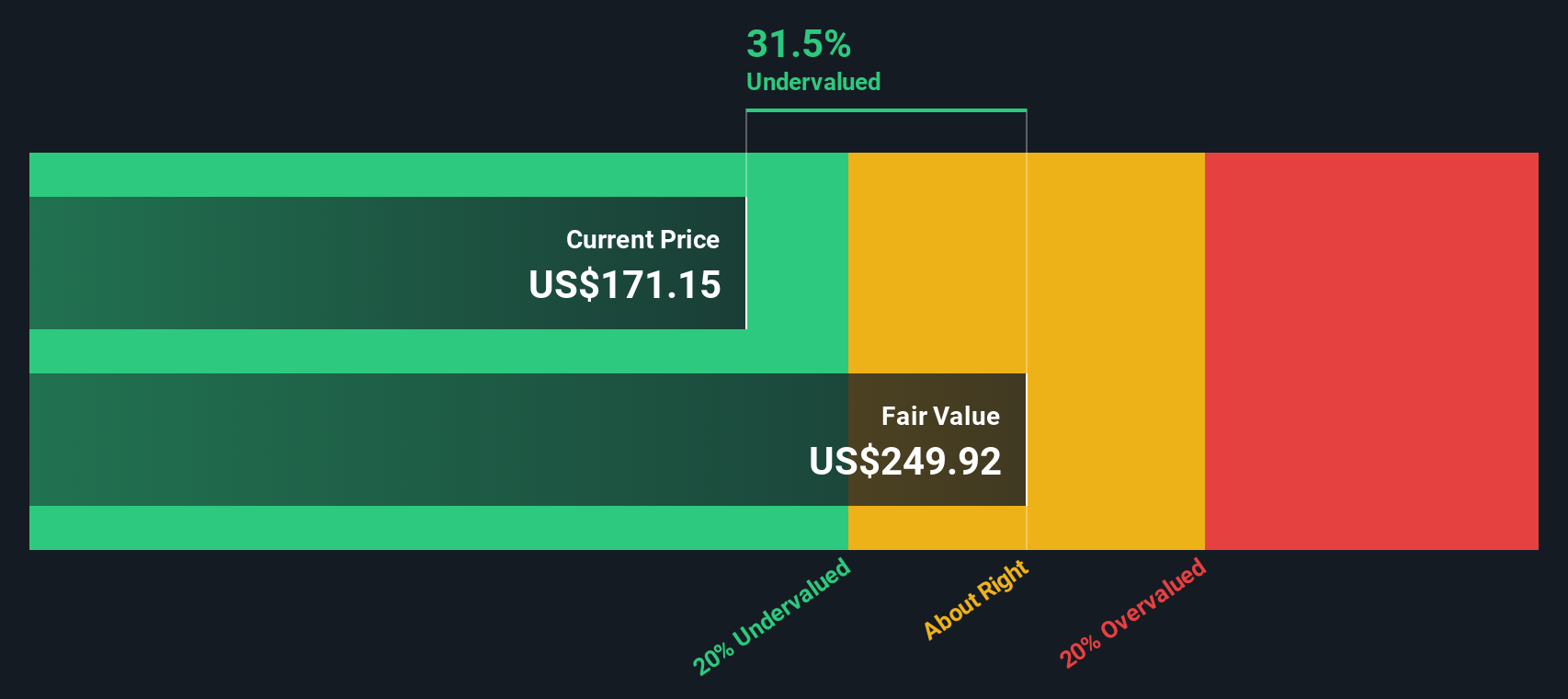

The Discounted Cash Flow (DCF) model projects Digital Realty Trust's future cash flows by extrapolating its adjusted funds from operations, then discounts those cash flows back to their value today. This gives investors a sense of what the business might be worth, based on the money it is expected to generate over time.

Currently, Digital Realty Trust is generating $2.02 Billion in Free Cash Flow. Analysts estimate this number will grow steadily, reaching $3.70 Billion by 2029. These first five years rely on analyst estimates, while Simply Wall St extrapolates further out using consistent growth rates. By 2035, projections show Free Cash Flow approaching $5.33 Billion, all figures in USD.

According to the DCF model, the intrinsic value per share for Digital Realty Trust is $237.72. This value is about 29.2% higher than the current share price, suggesting the stock may be significantly undervalued in the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Digital Realty Trust is undervalued by 29.2%. Track this in your watchlist or portfolio, or discover 861 more undervalued stocks based on cash flows.

Approach 2: Digital Realty Trust Price vs Earnings

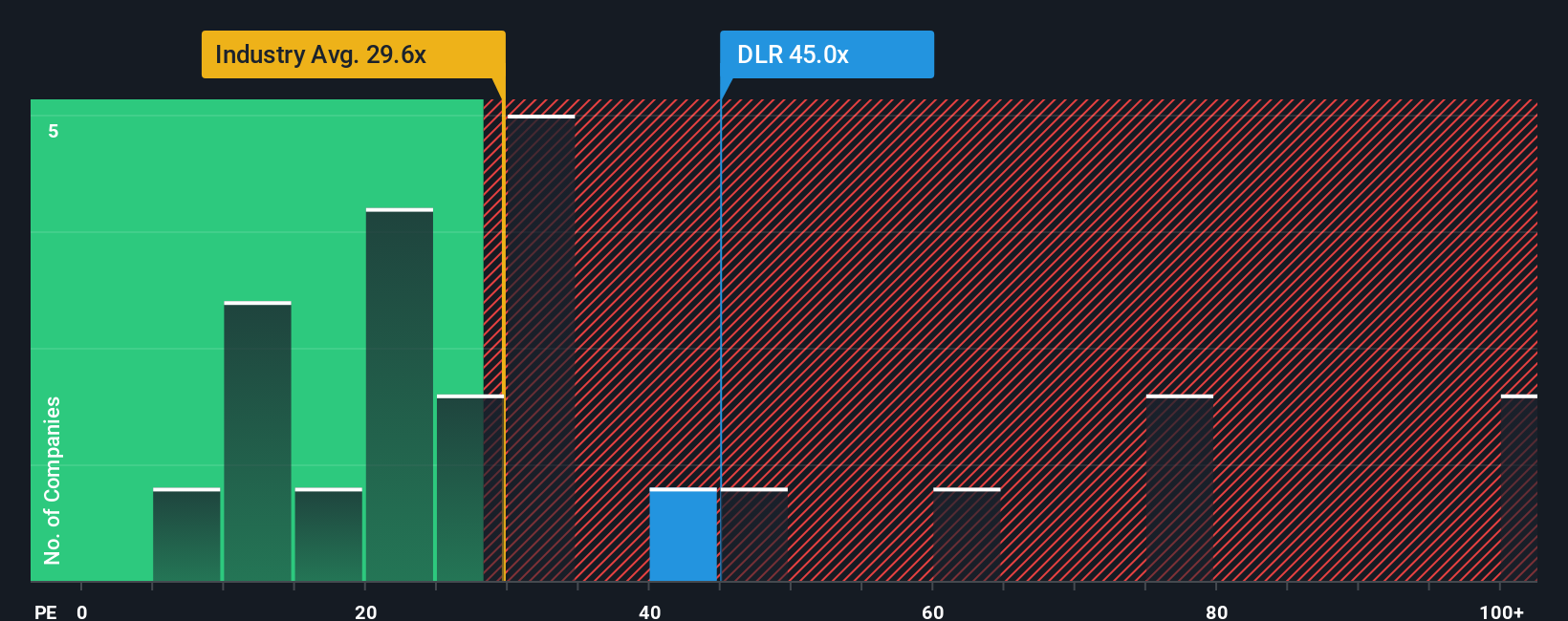

The Price-to-Earnings (PE) ratio is one of the most commonly used metrics for valuing profitable companies like Digital Realty Trust, as it directly relates the company’s share price to its annual earnings. This figure is especially helpful for comparing growth prospects across similar businesses.

Growth expectations and company risk are central to determining what makes a “normal” or “fair” PE ratio. Fast-growing companies or those with stable earnings can command higher PE ratios. Companies facing greater uncertainty typically trade at lower multiples.

Currently, Digital Realty Trust trades at a PE ratio of 42.56x. This is substantially above the industry average of 17.05x for Specialized REITs, and also higher than the peer average of 35.83x. While these comparisons offer some context, they do not fully capture the unique qualities of the business.

Simply Wall St’s proprietary "Fair Ratio" aims to improve comparability by incorporating factors such as earnings growth, profit margins, market capitalization, risk, and industry dynamics. For Digital Realty Trust, the Fair Ratio is calculated at 27.85x, which is more tailored to the company’s profile than a simple peer or industry average.

Comparing Digital Realty Trust’s current 42.56x PE to its Fair Ratio of 27.85x suggests the stock is trading at a premium to what would be expected based on company-specific fundamentals. In other words, investors are paying significantly more than the business’s underlying performance and risk profile might justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Digital Realty Trust Narrative

Earlier we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple framework to connect your perspective on a company, your story about its growth drivers, risks, and future potential, with your own financial forecast and fair value estimate.

Narratives help bring investing to life by allowing you to anchor the numbers to a real-world context. This makes it easier to decide when to buy or sell based on the difference between Fair Value and the current Price. On Simply Wall St’s Community page, millions of investors use Narratives to track and compare these stories. All are updated automatically as new data or news comes in, so your perspective can stay current without any extra effort.

For example, some investors building a Digital Realty Trust Narrative might project strong AI-driven demand and see a fair value above $220. Others expecting rising competition and margin pressure estimate a much lower fair value near $110. Narratives let you easily see these competing perspectives alongside your own, helping you make smarter, more personal investment decisions.

For Digital Realty Trust, we’ll make it easy for you with previews of two leading Digital Realty Trust Narratives:

🐂 Digital Realty Trust Bull Case

Fair Value: $197.70

Undervalued by approximately 14.8%

Revenue Growth Rate: 13.16%

- Analysts see strong demand for data centers and successful strategic expansions driving future revenue growth, supported by robust leasing and new funds for investment.

- Profitability could be enhanced through sustainability initiatives and fixed-escalator lease renewals. New developments in growth markets also create additional opportunities.

- Risks include rapid expansion potentially outpacing demand, rising interest rates impacting profitability, and competitive pressures. Consensus forecasts a 13.3% upside from current prices.

🐻 Digital Realty Trust Bear Case

Fair Value: $110.45

Overvalued by approximately 52%

Revenue Growth Rate: 7%

- Digital Realty is positioned to benefit from AI and cloud-driven demand growth, with international expansion and service optimization offering additional tailwinds.

- The stock faces headwinds from rising interest rates, intense competition (both from REIT peers and hyperscalers), and potential risks of overbuilding in the sector.

- Valuation is seen as fair to slightly undervalued at current prices. However, execution missteps, elevated debt levels, or supply outpacing demand could quickly shift the outlook.

Do you think there's more to the story for Digital Realty Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives