- United States

- /

- Office REITs

- /

- NYSE:BXP

BXP (BXP) Valuation: Is There Untapped Value After a 5% Pullback?

Reviewed by Simply Wall St

BXP (BXP) shares have seen some movement over the past month, with the stock declining around 5%. Investors are weighing recent financial results and broader real estate market trends as they consider the company’s outlook.

See our latest analysis for BXP.

While BXP’s recent 30-day share price return of -5% has caught attention, it comes on the heels of a 90-day rally of nearly 11%. This suggests that momentum has cooled but isn’t entirely spent. Over the past year, investors have experienced a -10.7% total shareholder return. However, the stock still boasts a positive three-year total shareholder return, reflecting long-term resilience despite near-term challenges.

If you’re looking for fresh opportunities as the real estate outlook shifts, you might want to broaden your horizons and discover fast growing stocks with high insider ownership

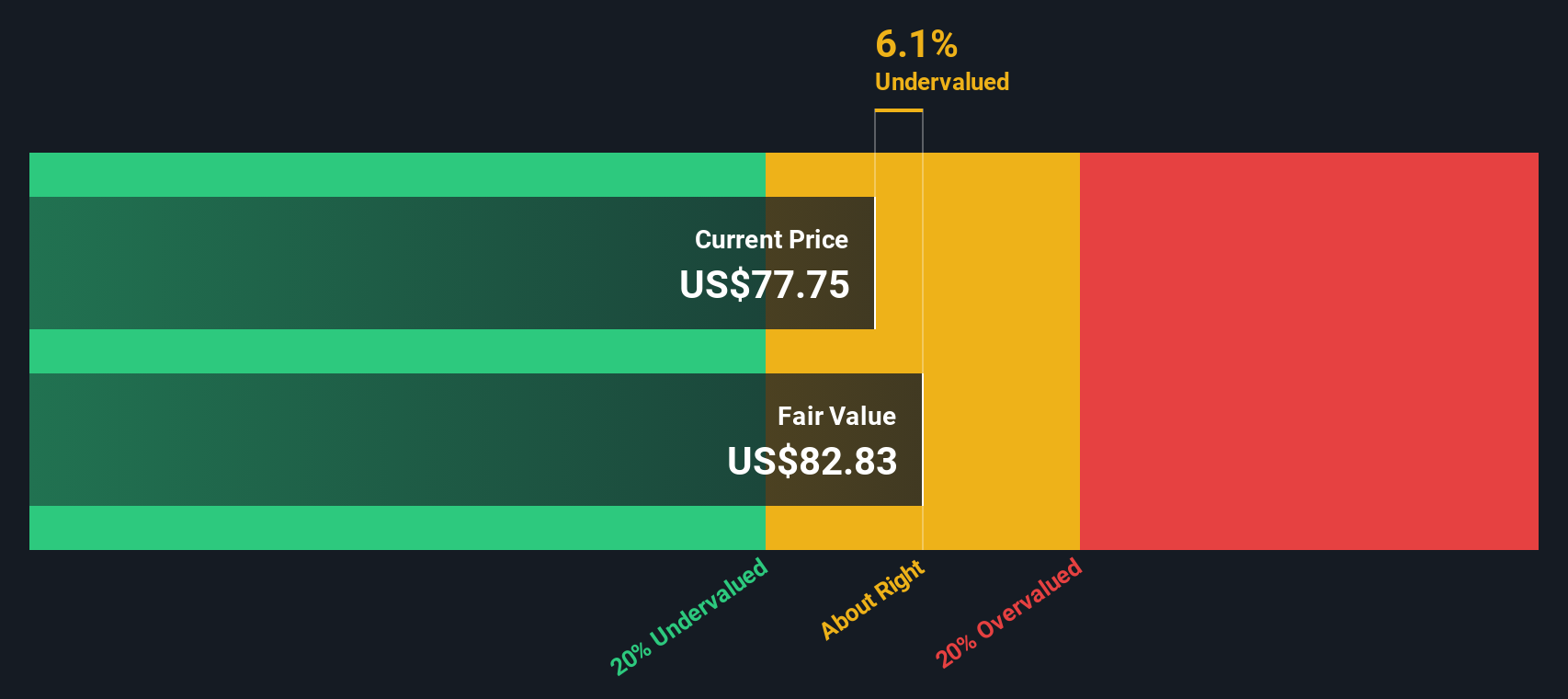

With shares trading at a discount compared to analyst targets and recent growth in annual revenue and net income, the big question remains: is BXP currently undervalued, or is the market already factoring in its potential for future gains?

Most Popular Narrative: 11.8% Undervalued

With BXP’s last close at $70.10 and the narrative’s fair value sitting at $79.50, the current market price is notably lower than what the most widely followed narrative suggests. This sets the stage for debate around whether investor caution or analyst expectations will ultimately define the next leg.

“Analysts are assuming BXP's revenue will grow by 2.5% annually over the next 3 years. Analysts assume that profit margins will increase from 0.1% today to 10.0% in 3 years time.”

BXP’s bullish fair value is not just about optimism. The narrative hinges on a dramatic turnaround in profitability, baked into ambitious future projections. Want to know which aggressive shift is powering the price target and why consensus thinks a high multiple is justified? Tap in to see these numbers, as they may surprise you.

Result: Fair Value of $79.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining occupancy rates and sluggish leasing activity could quickly undermine the upbeat outlook and put pressure on BXP’s future earnings growth.

Find out about the key risks to this BXP narrative.

Another View: Discounted Cash Flow Perspective

Looking through the lens of our SWS DCF model, BXP appears undervalued, with a fair value estimate of $90.28 per share compared to its recent trading price. This provides a more optimistic perspective than price-based multiples. Could this indicate deeper value beneath market caution?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BXP Narrative

If you want to dig deeper, you can review the numbers yourself and build a new story based on your own observations in just a few minutes. Do it your way

A great starting point for your BXP research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait on the sidelines while fresh trends are taking shape. Act now and tap into powerful opportunities across innovative markets, rewarding dividends, and next-generation AI leaders.

- Boost your portfolio’s income potential by tapping into these 17 dividend stocks with yields > 3% that earn yields above 3% and stand out for consistent payouts.

- Ride the artificial intelligence wave with these 25 AI penny stocks that are making headlines for pioneering real-world applications and bold growth plans.

- Capitalize on undervalued gems by checking out these 862 undervalued stocks based on cash flows that the market may be overlooking but show strong fundamentals and solid cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BXP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXP

BXP

BXP, Inc. (NYSE: BXP) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives