- United States

- /

- Health Care REITs

- /

- NYSE:ARE

How Lowered Guidance and Major Write-Down Will Impact Alexandria Real Estate Equities (ARE) Investors

Reviewed by Sasha Jovanovic

- Alexandria Real Estate Equities recently lowered its 2025 earnings guidance, reported a US$323.9 million real estate impairment for the third quarter, and posted a quarterly net loss of US$232.75 million, alongside year-over-year declines in both sales and revenue.

- A sharp increase in real estate impairments compared to the prior year and the downward revision of earnings outlook signal ongoing challenges for Alexandria’s portfolio performance and valuation.

- We'll explore how the large real estate write-down impacts the company's investment narrative and long-term earnings trajectory.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Alexandria Real Estate Equities Investment Narrative Recap

To be a shareholder in Alexandria Real Estate Equities, you need to believe that the demand for specialized life science properties in top-tier innovation clusters will overcome short-term earnings volatility and sector disruptions. Recent impairments and lowered 2025 guidance shine a spotlight on short-term risks: specifically, pressure on occupancy rates, slowing leasing, and ongoing market value challenges, all of which remain the biggest obstacle to near-term earnings recovery.

The most relevant recent announcement is the third quarter’s US$323.9 million real estate impairment, which far exceeded the previous year’s write-down. This impairment, combined with a quarterly net loss and materially reduced sales and revenue, increases the urgency around asset valuation and questions around future profitability, the very issues driving both current volatility and concern for Alexandria’s longer-term growth narrative. In contrast to growing healthcare sector demand, investors need to carefully weigh...

Read the full narrative on Alexandria Real Estate Equities (it's free!)

Alexandria Real Estate Equities is projected to reach $3.2 billion in revenue and $288.1 million in earnings by 2028. This outlook assumes a 0.7% annual revenue decline and a $309.6 million improvement in earnings from the current $-21.5 million.

Uncover how Alexandria Real Estate Equities' forecasts yield a $96.07 fair value, a 73% upside to its current price.

Exploring Other Perspectives

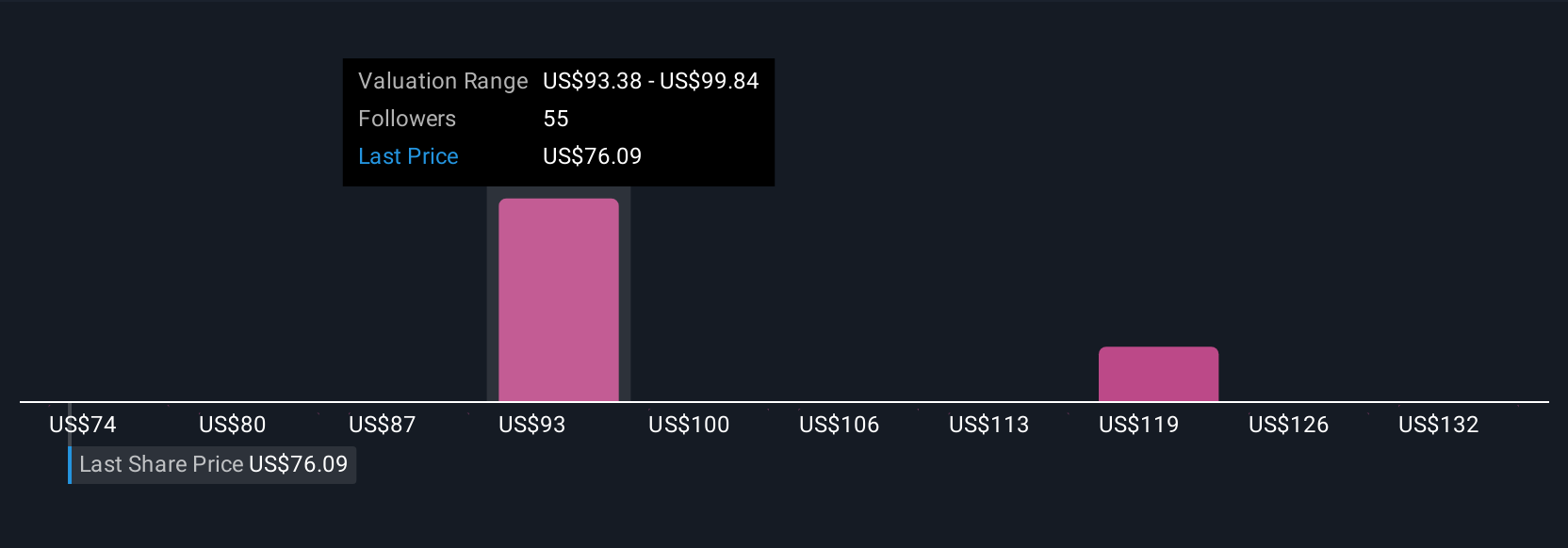

Simply Wall St Community members estimate Alexandria’s fair value from US$71 to US$136, reflecting nine differing views before the Q3 losses. Persistent pressure on occupancy and leasing velocity may keep investor opinions wide apart as portfolio performance bottoms out.

Explore 9 other fair value estimates on Alexandria Real Estate Equities - why the stock might be worth over 2x more than the current price!

Build Your Own Alexandria Real Estate Equities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alexandria Real Estate Equities research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alexandria Real Estate Equities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexandria Real Estate Equities' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives