- United States

- /

- Hotel and Resort REITs

- /

- NYSE:APLE

Apple Hospitality REIT (APLE): Assessing Valuation Following Dividend Recognition and Operational Upgrades

Reviewed by Kshitija Bhandaru

Apple Hospitality REIT (APLE) Draws Attention with Consistent Dividends and Operational Upgrades

If you're eyeing steady income in today’s unpredictable market, Apple Hospitality REIT (APLE) might already be on your radar. The company was just featured among the safest monthly dividend stocks, thanks to its unwavering $0.08 per share payout and recent operational fine-tuning, such as efficiency gains and a modernized hotel portfolio. These moves grab the attention of investors seeking both predictable cash flow and signals of strong management discipline.

APLE's story this year stands out for its stability, not fireworks. While the share price dipped just over 20% since January, the last three months have shown a modest rebound, trimming some losses as the market weighs management's cost-cutting and property refresh efforts. Alongside the recently reaffirmed dividend, these actions support a narrative of reliable performance amid a cooling broader REIT sector and rising interest in companies that can balance defensive income with operational growth initiatives.

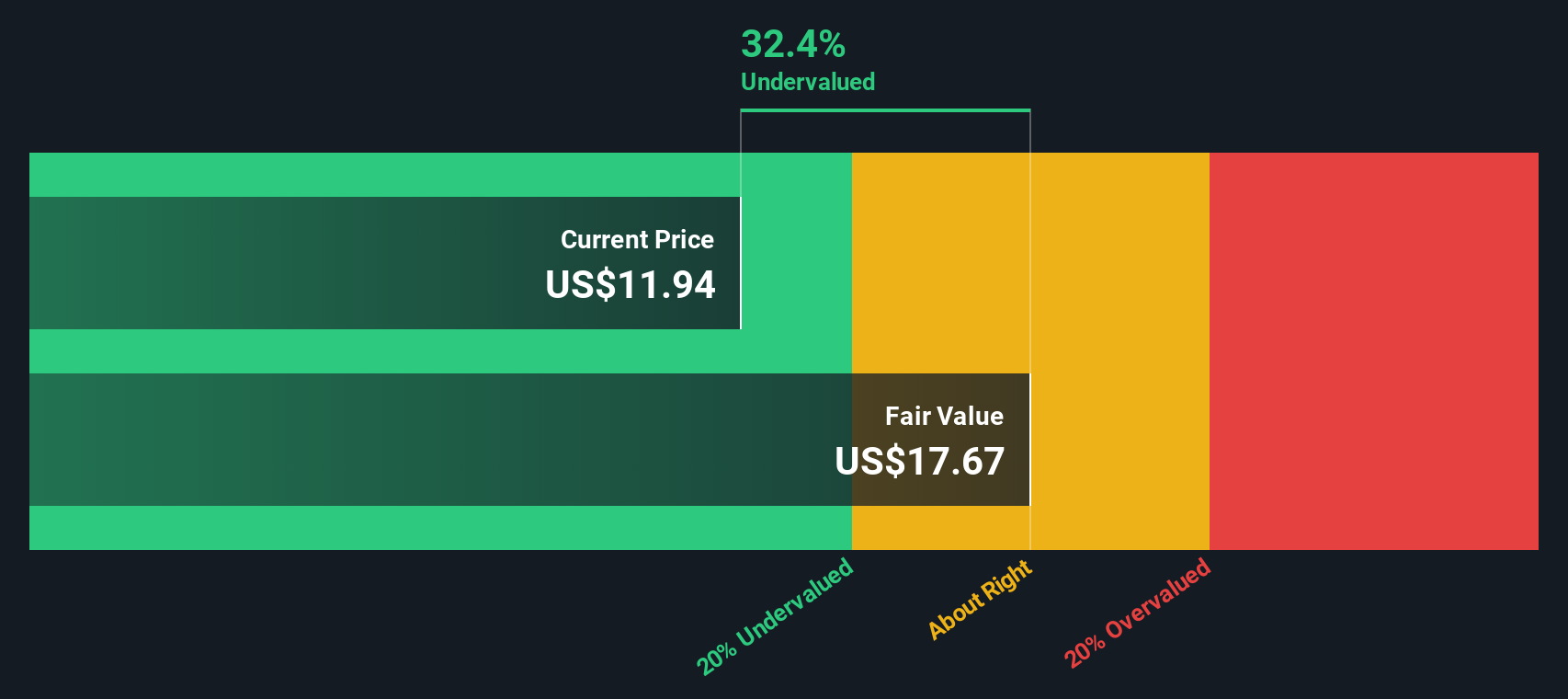

After a turbulent year and renewed interest in its strong yield, is Apple Hospitality REIT undervalued at these levels, or is the market already factoring in its future potential?

Most Popular Narrative: 11.5% Undervalued

According to the most widely-followed valuation narrative, Apple Hospitality REIT is considered to be undervalued by over 11% at the current share price, with analysts projecting moderate growth and operational resilience as key value drivers.

"The company's demonstrated ability to opportunistically acquire and cluster assets (such as the recent Tampa acquisition at a favorable cap rate and price below replacement cost), paired with strong execution on synergies and market positioning, suggests potential for enhanced long-term portfolio earnings and asset value growth. This contradicts expectations of sustained earnings decline."

Curious about the calculations powering this bullish valuation? The secret ingredient is a disciplined set of financial forecasts, spanning future earnings, revenue growth prospects, and the multiple applied to profits. What hidden assumptions do the analysts expect to play out, and how do these shape the potential upside from today's price? Unlock the full story for the details behind this surprising fair value call.

Result: Fair Value of $13.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent low hotel supply in key markets and effective asset management could support future gains. This challenges assumptions about ongoing earnings declines.

Find out about the key risks to this Apple Hospitality REIT narrative.Another View: Our DCF Model Backs Up the Story

Looking at Apple Hospitality REIT through the lens of our SWS DCF model, the results align with the earlier narrative and suggest the shares remain undervalued. Is the market still missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Apple Hospitality REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Apple Hospitality REIT Narrative

You’re invited to run the numbers in your own way and test your assumptions. A personalized view of APLE can be built in just minutes. Do it your way

A great starting point for your Apple Hospitality REIT research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t pass up new opportunities just because you haven’t seen them yet. Supercharge your watchlist by checking out fast-moving trends that could set you ahead of the curve.

- Spot companies capitalizing on the artificial intelligence boom by checking out the market’s most promising AI penny stocks.

- Chase attractive yields and strong income potential with our expertly curated selection of dividend stocks with yields > 3%.

- Unlock undervalued gems primed for growth with our undervalued stocks based on cash flows. These stocks might not stay under the radar for long.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APLE

Apple Hospitality REIT

Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded real estate investment trust (“REIT”) that owns one of the largest and most diverse portfolios of upscale, rooms-focused hotels in the United States.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives