- United States

- /

- Retail REITs

- /

- NYSE:ALX

Assessing Alexander’s (ALX) Valuation Following Upgraded Earnings Outlook and Strong 2024 Performance

Reviewed by Simply Wall St

Alexander's (ALX) has caught investor attention following a renewed bump in its consensus earnings outlook. This shift comes as the company outpaces sector and industry peers despite recent dips in year-over-year quarterly results.

See our latest analysis for Alexander's.

This positive run comes after a steady dividend announcement and earnings results that, while down from last year, have not reduced investor optimism. Alexander’s share price has climbed 18.1% year-to-date and its total return over the last five years stands at 22.4%. This suggests that momentum is building as confidence in the company’s future outlook continues to grow.

If you’re curious what other opportunities investors are finding in today’s market, consider broadening your search and discover fast growing stocks with high insider ownership

With shares rallying and analyst estimates on the rise, investors are left to wonder whether Alexander's is still undervalued given its recent run, or if the market has already priced in all of its anticipated growth.

Price-to-Earnings of 32.3x: Is it justified?

Alexander's is currently trading at a price-to-earnings (P/E) ratio of 32.3x, notably higher than both the US Retail REITs industry average of 26.7x and the peer average of 18.1x. This premium suggests that investors may be paying more for its current earnings, possibly due to expectations of future stability or unique qualities not found in its peers.

The price-to-earnings ratio measures how much investors are willing to pay today for a dollar of the company’s earnings. For a REIT like Alexander’s, this metric is particularly important because it can indicate whether the market expects higher future profit growth, greater stability, or other sector-specific benefits.

At 32.3x earnings, Alexander's stands out as expensive in this space, especially since its profit margins are down compared to last year and its earnings have declined over both the short and medium term. Additionally, the current ratio significantly exceeds the estimated fair price-to-earnings ratio of 23.4x, which highlights how stretched current investor expectations might be.

Explore the SWS fair ratio for Alexander's

Result: Price-to-Earnings of 32.3x (OVERVALUED)

However, weaker annual net income growth and a current share price that is above analyst targets could signal vulnerability if investor optimism wanes.

Find out about the key risks to this Alexander's narrative.

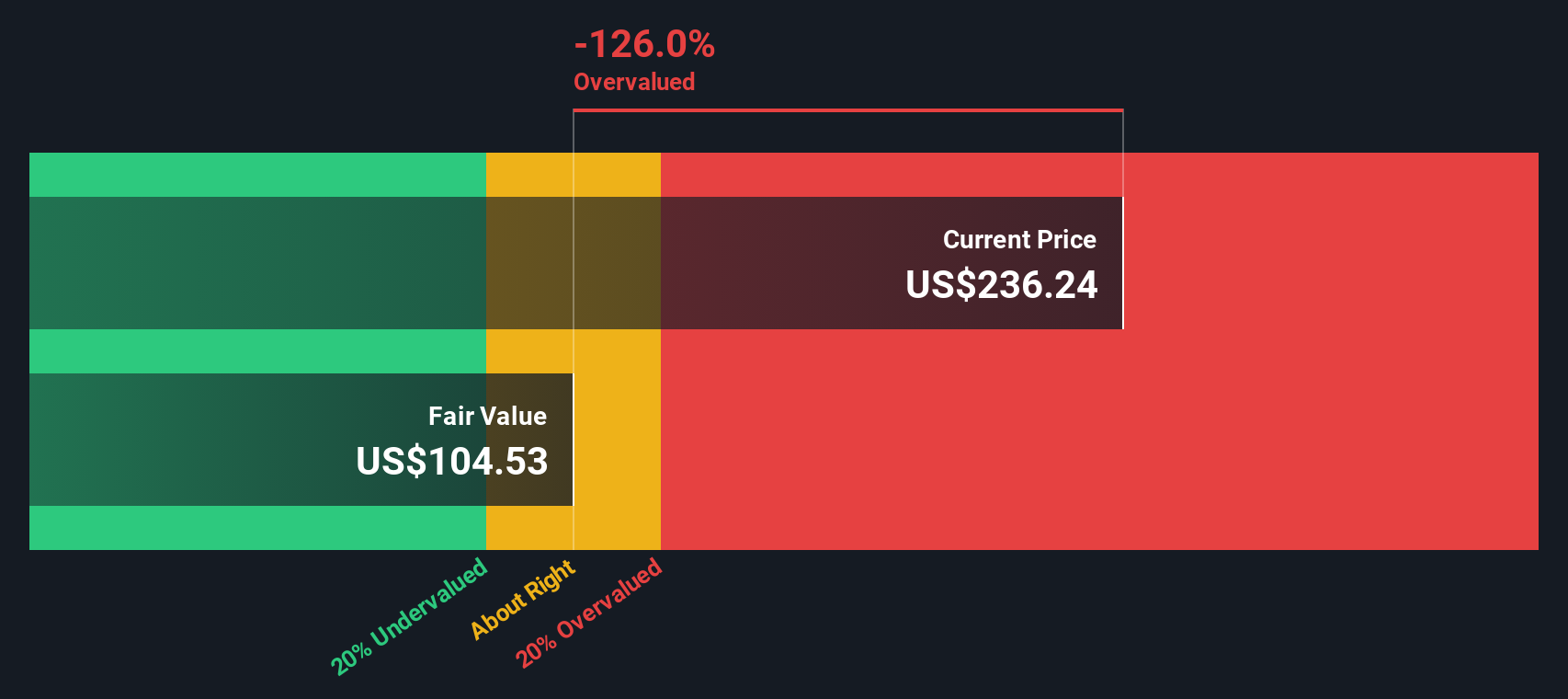

Another View: SWS DCF Model Suggests Overvaluation

Looking through the lens of our DCF model, a different picture emerges. The SWS DCF model estimates Alexander’s fair value at $149.78, which is well below the current price of $231.75. This suggests the stock could be significantly overvalued if cash flows play out as forecast, introducing another layer of valuation risk for investors. How might the market reconcile these two outlooks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alexander's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alexander's Narrative

If you have a different perspective or want to dig deeper into the numbers, you can easily craft your own analysis in just a few minutes, and Do it your way.

A great starting point for your Alexander's research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't wait on the sidelines; supercharge your watchlist with unique stock opportunities picked for their disruptive potential and strong fundamentals. If you want an edge, try these handpicked themes:

- Boost your income potential by scanning for reliable yields in these 16 dividend stocks with yields > 3% with impressive rates above 3%.

- Uncover growth trends in healthcare by targeting innovation in these 32 healthcare AI stocks making a real impact on patient outcomes and medical advancement.

- Get ahead of the curve in tomorrow’s economy with these 82 cryptocurrency and blockchain stocks taking the lead in digital finance and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALX

Alexander's

Alexander’s, Inc. is a real estate investment trust (REIT) engaged in leasing, managing, developing and redeveloping properties.

Average dividend payer with low risk.

Market Insights

Community Narratives