- United States

- /

- Health Care REITs

- /

- NasdaqGS:SBRA

Sabra Health Care REIT (SBRA): Assessing Valuation Following Q3 Earnings Growth, Acquisitions, and Upgraded Guidance

Reviewed by Simply Wall St

Sabra Health Care REIT (SBRA) made headlines after releasing its third quarter earnings, marked by higher same-store managed senior housing Cash NOI, recent property acquisitions, and an increase to its earnings guidance for 2025.

See our latest analysis for Sabra Health Care REIT.

Sabra's latest quarterly update brought a wave of optimism, with a surge in managed senior housing Cash NOI, new acquisitions, and an earnings guidance upgrade all fueling investor confidence. After these announcements, Sabra’s share price jumped 7.9% over the past week and the stock is up more than 10% year-to-date, with momentum supported by a one-year total shareholder return of 4.45% and remarkable multi-year gains. This suggests that positive sentiment could be building as the company invests for future growth.

If Sabra’s steady dividend and renewed growth strategy have you curious, consider exploring what else stands out in the healthcare REIT and facility space. See the full list of possible opportunities with our See the full list for free..

With Sabra shares trending higher and analysts signaling optimism, the real question is whether there is still upside from here, or if the market has already priced in the company’s growth prospects for the coming year.

Most Popular Narrative: 9.5% Undervalued

With Sabra's narrative fair value set at $20.82, shares remain below this mark after a strong earnings-driven rally. The story behind this optimism centers on industry demand and portfolio strategy.

Persistent and accelerating demand for senior housing, assisted living, and memory care driven by the aging U.S. population, specifically the Baby Boomer cohort, continues to outpace new supply due to high barriers to development. This supports higher occupancy, rising rents, and long-term revenue and cash NOI growth across Sabra's property portfolio.

Want to peek under the hood of this bullish narrative? The calculation includes a powerful combination of revenue growth and margin moves, plus one especially bold assumption about future profitability. Curious what is driving over 9% upside? Click through to see exactly how these projections stack up.

Result: Fair Value of $20.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps with new operators or a sudden influx of new senior housing supply could quickly challenge Sabra's projected earnings momentum.

Find out about the key risks to this Sabra Health Care REIT narrative.

Another View: What About Price Ratios?

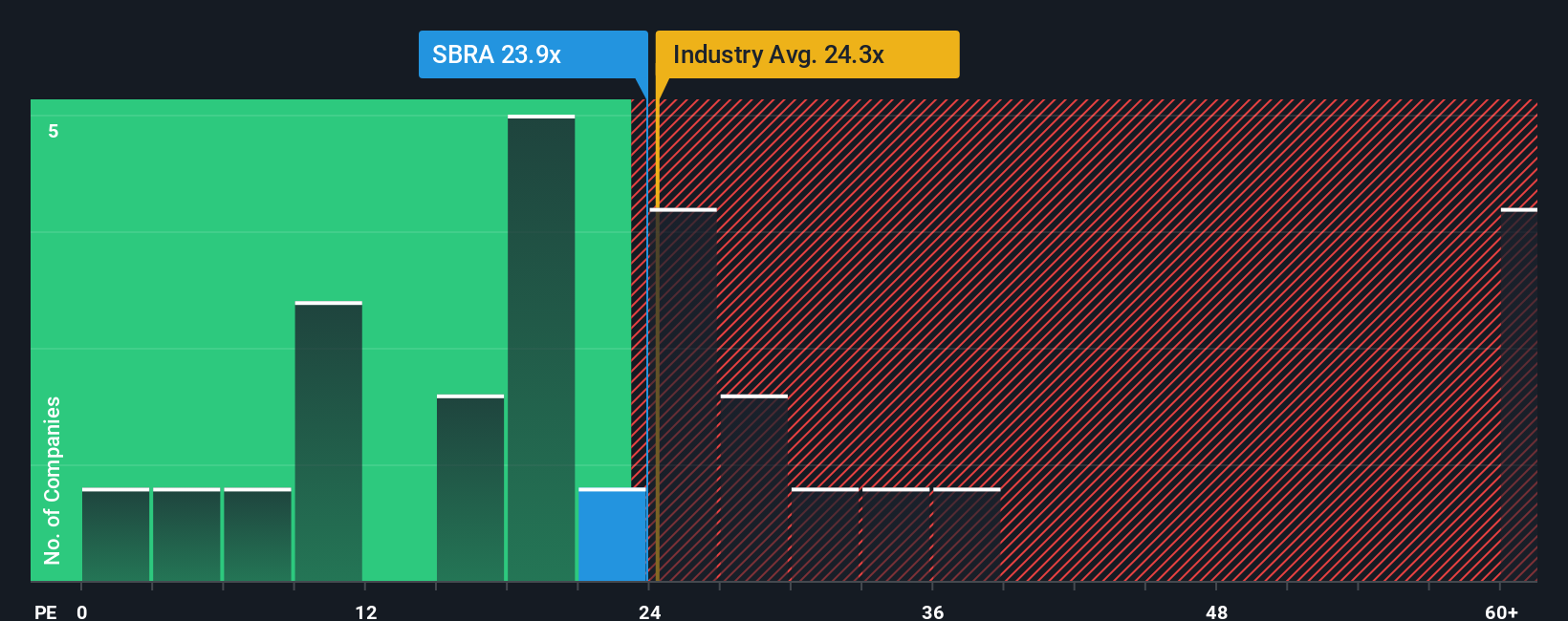

Looking at Sabra's valuation from a market multiple perspective, the company's price-to-earnings ratio stands at 25.8x. This is higher than the industry average of 24.2x, but still well below the average among its peers at 32.6x. Notably, it is trading at a meaningful discount to its fair ratio of 33.7x, suggesting room for the market to re-rate if momentum continues. But does this gap offer a real opportunity or simply highlight the risks if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sabra Health Care REIT Narrative

If you see things differently or want to dive deeper into the numbers, you can craft your own analysis and perspective on Sabra in just a few minutes. Do it your way

A great starting point for your Sabra Health Care REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Ideas?

Don’t leave your investment journey to chance. Unlock potential by searching for opportunities that others overlook, and seize your next smart move right now.

- Boost your income by targeting reliable payouts through these 17 dividend stocks with yields > 3% with yields above 3% and a track record of rewarding shareholders.

- Capitalize on breakthrough medical technology by checking out these 32 healthcare AI stocks, featuring companies harnessing artificial intelligence to transform healthcare.

- Tap into the high-return potential of early-stage businesses when you scan these 3586 penny stocks with strong financials for financially solid stocks that may be primed for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBRA

Sabra Health Care REIT

As of June 30, 2025, Sabra’s investment portfolio included 359 real estate properties held for investment (consisting of (i) 219 skilled nursing/transitional care facilities, (ii) 36 senior housing communities (“senior housing - leased”), (iii) 73 senior housing communities operated by third-party property managers pursuant to property management agreements (“senior housing - managed”), (iv) 16 behavioral health facilities and (v) 15 specialty hospitals and other facilities), 13 investments in loans receivable (consisting of three mortgage loans and 10 other loans), four preferred equity investments and two investments in unconsolidated joint ventures.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives