- United States

- /

- Specialized REITs

- /

- NasdaqGS:PCH

PotlatchDeltic (PCH): Is There More Value Ahead After Recent Share Price Rebound?

Reviewed by Simply Wall St

See our latest analysis for PotlatchDeltic.

PotlatchDeltic’s share price has perked up after some recent softness, but overall momentum has cooled. A 3.45% year-to-date share price return and a five-year total shareholder return of 27.2% highlight the company’s mixed journey between short-term hesitation and longer-term gains.

If you’re keen to broaden your search beyond timberland, now’s a great moment to discover fast growing stocks with high insider ownership.

With shares still trading at a notable discount to analyst targets, but recent performance reflecting both hesitancy and growth, the key question is whether PotlatchDeltic is currently undervalued or if future gains are already reflected in the price.

Most Popular Narrative: 20.1% Undervalued

At $40.44 per share, PotlatchDeltic trades notably below the most widely followed narrative’s fair value estimate of $50.62. This significant gap highlights optimism around the company’s earnings potential and the possibility for future price appreciation.

*Heightened environmental focus and expanding opportunities in solar, carbon offsets, lithium, and other natural climate solutions are creating new, high-margin revenue streams that diversify earnings and bolster long-term margin expansion.*

What’s fueling this bullish price target? The narrative points to a combination of transformative growth strategies and profitability improvements. It also makes bold assumptions about the market and future business mix. Curious what projections underpin this valuation premium? Unlock the story behind these numbers before the next move.

Result: Fair Value of $50.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in US housing or higher operating costs in key timber regions could quickly challenge the bullish forecast for PotlatchDeltic’s shares.

Find out about the key risks to this PotlatchDeltic narrative.

Another View: What Do Multiples Say?

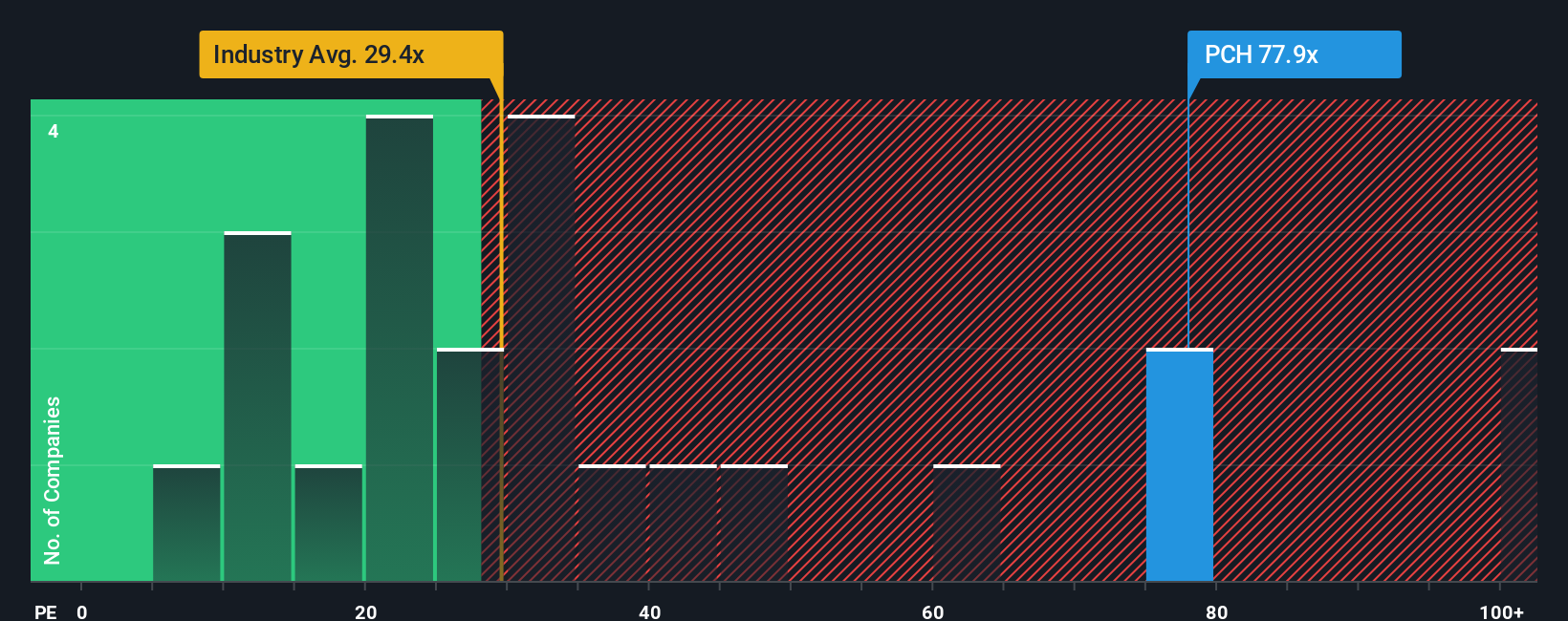

While the fair value estimate paints PotlatchDeltic as undervalued, the current price-to-earnings ratio of 48.7x actually runs higher than both peers (34.4x) and industry averages (25.7x). The fair ratio sits lower at 37.5x. This suggests the market might not be pricing in as much upside as the narrative suggests. Where will the consensus settle?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PotlatchDeltic Narrative

If these numbers and assumptions leave you unconvinced, take a fresh look at the data, challenge the consensus, and shape your own take in just a few minutes with Do it your way.

A great starting point for your PotlatchDeltic research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by when there are so many promising stocks out there. Your next winning investment could be just a click away.

- Capture tomorrow’s tech breakthroughs by checking out these 28 quantum computing stocks, perfect for spotting companies redefining the boundaries of computation.

- Boost your portfolio’s income stream as you scan these 17 dividend stocks with yields > 3% yielding over 3 percent, ideal for those who value steady cashflow.

- Uncover growth at a bargain by seeing which companies top these 861 undervalued stocks based on cash flows, so you never miss hidden value among overlooked winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCH

PotlatchDeltic

PotlatchDeltic Corporation (Nasdaq: PCH) is a leading Real Estate Investment Trust (REIT) with ownership of 2.1 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives