- United States

- /

- Specialized REITs

- /

- NasdaqGS:GLPI

How Strong Earnings and a Major Project Could Shape GLPI’s Long-Term Income Stability

Reviewed by Sasha Jovanovic

- Gaming and Leisure Properties, Inc. reported its third quarter 2025 results, posting higher sales, revenue, and net income compared to the prior year, while also announcing plans to acquire and fund the real estate for the upcoming Live! Casino and Hotel Virginia project.

- This dual announcement highlights the company’s ongoing growth through both robust financial performance and involvement in major gaming and hospitality developments.

- We’ll explore how Gaming and Leisure Properties’ recent earnings strength may impact its long-term outlook and income stability narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Gaming and Leisure Properties Investment Narrative Recap

To own Gaming and Leisure Properties, investors need confidence in stable rental income from physical casino real estate, despite modest sector growth, and the company's ability to drive returns through new developments and lease agreements. The latest earnings beat and Virginia acquisition boost visibility on near-term revenue streams, but do not fundamentally shift the concern over tenant concentration risk, especially with major exposure to Bally's. The news offers incremental support, though the main catalyst remains successful project execution and lease-up, while macroeconomic and tenant credit risks persist.

The Virginia Live! Casino and Hotel announcement underlines GLPI's continued push into high-profile, multi-use casino destinations. Given capital already targeted to other developments with tenant and construction-specific risks, this project adds to ongoing commitments that investors should continue to track for progress and discipline around capital deployment.

But contrary to the focus on new ventures, investors should also be aware of...

Read the full narrative on Gaming and Leisure Properties (it's free!)

Gaming and Leisure Properties' outlook anticipates $2.0 billion in revenue and $1.1 billion in earnings by 2028. This is based on a projected 9.0% annual revenue growth rate and a $382 million increase in earnings from the current $717.9 million.

Uncover how Gaming and Leisure Properties' forecasts yield a $54.07 fair value, a 20% upside to its current price.

Exploring Other Perspectives

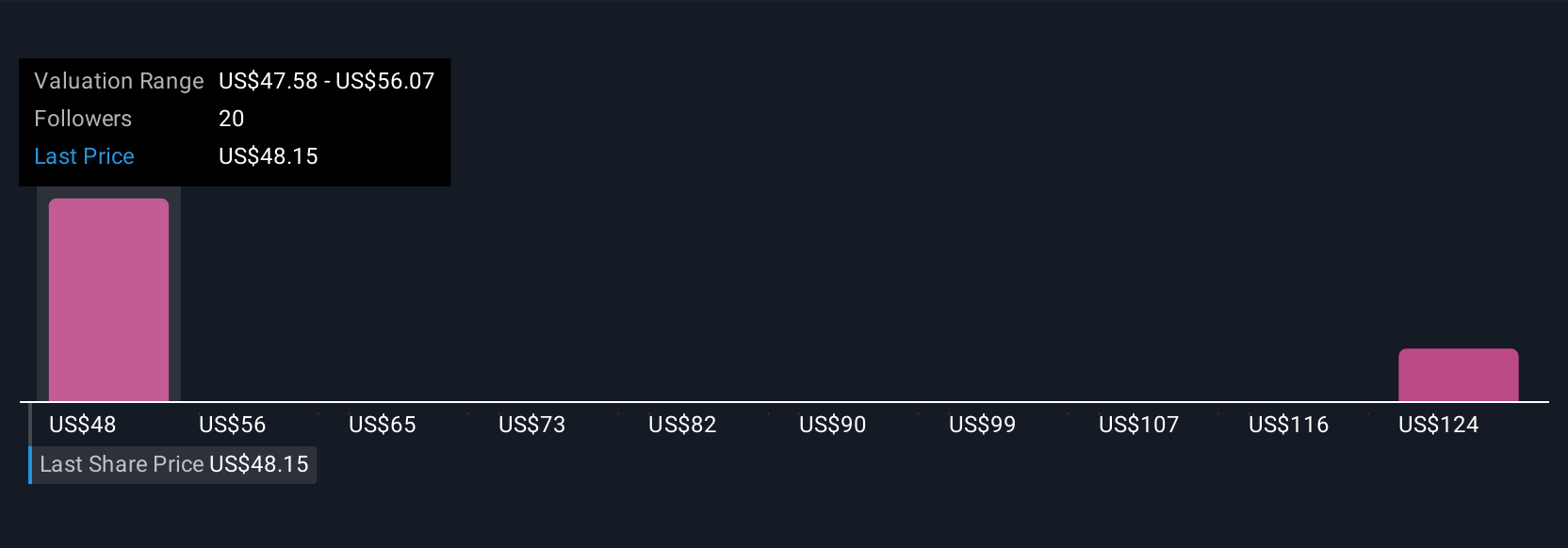

Simply Wall St Community members set fair values for GLPI between US$47.58 and US$120.96 based on three independent estimates. Even with diverse targets, exposure to tenant risk and concentrated capital projects are pivotal factors that could sway future performance, so be sure to consider varying viewpoints.

Explore 3 other fair value estimates on Gaming and Leisure Properties - why the stock might be worth over 2x more than the current price!

Build Your Own Gaming and Leisure Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gaming and Leisure Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gaming and Leisure Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gaming and Leisure Properties' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLPI

Gaming and Leisure Properties

GLPI is engaged in the business of acquiring, financing, and owning real estate property to be leased to gaming operators in triple-net lease arrangements, pursuant to which the tenant is responsible for all facility maintenance, insurance required in connection with the leased properties and the business conducted on the leased properties, including coverage of the landlord's interests taxes levied on or with respect to the leased properties and all utilities and other services necessary or appropriate for the leased properties and the business conducted on the leased properties.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives